Euro and pound rallied on Monday, finally ignoring all the political problems in the US, which created a lot of problems for bullish traders last week.

The impending US default, with no political party signaling its willingness to abandon its principles to benefit the economy and reduce damage, clearly shows a tough struggle for power.

Senate Democratic leader Chuck Schumer is set to hold another meeting to raise the national debt limit, but his Republican counterpart, Mitch McConnell, once again expressed his opposition over it. Schumer almost demanded yesterday that senators should vote and raise the debt ceiling by the end of this week, warning that if they do not meet the deadline, they would have to stay in session all weekend and work until the scheduled week-long break, which is due to start on October 11. Coincidence or not, it is on October 18 that the Treasury will run out of money, according to Secretary Janet Yellen.

As such, US President Joe Biden plans to speak today to sway the stance of senators over the debt ceiling. Mitch McConnell wrote to him yesterday that he should put pressure on the Democrats in order for them to raise the national debt limit on their own. "Bipartisanship is not a light switch that Speaker Pelosi and Leader Schumer may flip on to borrow money and flip off to spend it," McConnell said. "For two and a half months, we have simply warned that since your party wishes to govern alone, it must handle the debt limit alone as well," he added.

Democrats have everything they need to make such a decision, but they still call for a bipartisan deal on this issue because if they do it alone, Republicans may use it to provoke political struggle in the future.

In any case, Morgan Stanley analysts predict that if no decision is made by next week, Treasury bills maturing in late October would "quickly" fall in value, as will US stocks.

On a different note, the Congressional Budget Office recently reported that interest payments over the next three years may remain very low relative to the size of the economy. This is because the long-term contraction in borrowing outweighs the debt taken by the government to support the economy during the 2008 financial crisis and pandemic. Reversing this trend will require Treasury yields averaging about 2.5% across all maturities. Last August, the average was below 1.6%, the lowest in more than two decades. And even after a sharp jump last month, 10-year Treasuries remained trading around 1.5%, the lowest rate by historical standards.

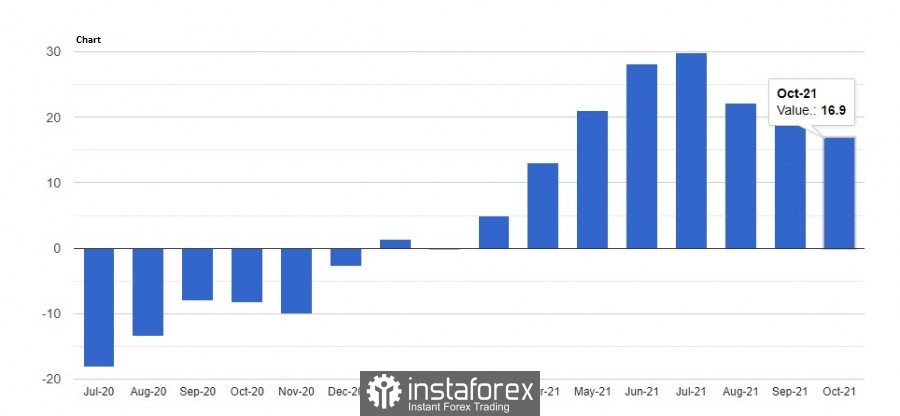

In the Euro area, Sentix reported that investor confidence fell again in October, posting decline for three consecutive months. The index went down to 16.9 points, from 19.6 points in September.

Not only has the current assessment worsened, but expectations dropped as well. The current situation index fell from 30.8 points to 26.3 points, while the expectations index slipped from 9.0 points to 8.0 points. But Sentix said this does not pose a serious threat to economic recovery, as after all the disappointing figures were from Germany only.

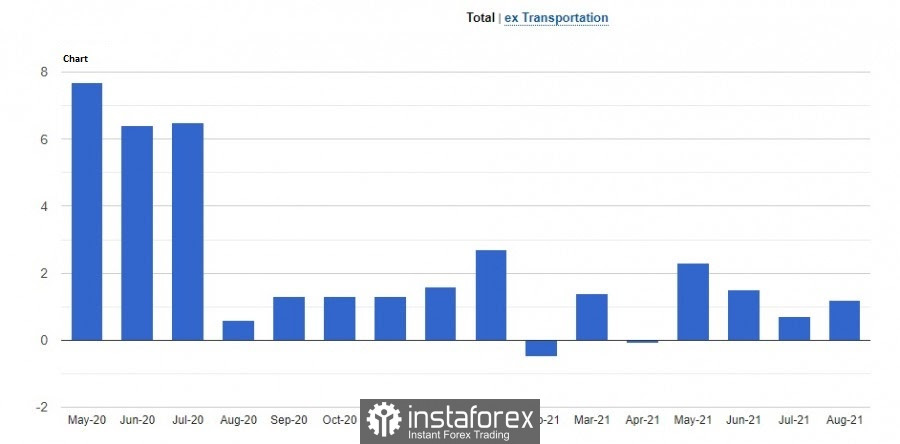

Going back to the US, the Department of Commerce released data yesterday that indicated that new orders jumped more than expected in August. It rose by 1.2%, after climbing 0.7% in July. Orders for durable goods jumped 1.8% at once.

Talking about EUR / USD, bullish traders managed to push the quote above 1.1640, so their task now is to protect this support level. Further increase will bring the price to 1.1670 and to the 17th figure, while a drop below will lead to a plunge to 1.1600 and 1.1565.

GBP

Pound continues to actively recover its positions, heading towards 1.3625. This is surprising because UK is currently facing a serious supply chain problem that is driving up prices across the economy. The government, however, seems unafraid, as it continues to make plans to turn the crisis into good news for UK workers. For example, the shortage of personnel in the field of cargo transportation, agriculture and meat processing led to the government dispatching soldiers to intervene in all these matters. But the catch is that companies are forced to offer higher wages, which threatens inflation growth at the expense of increased consumer spending. Expected inflation growth this year, according to the Bank of England, is above 4%.

Yesterday, there was a conference of the ruling Conservative Party, where Prime Minister Boris Johnson and Finance Minister Rishi Sunak tried to explain that growing household spending is the main task of the government and should be looked at from a positive side. "I don't think that in the future anyone is planning to re-face the supply chain problems that we see today," Sunak said. But according to Boris Johnson, high-paying jobs are part of the UK's post-Brexit transition from a low-wage economy to a higher one.

But the problem is that a sharp rise in wages without a corresponding increase in productivity is far from positive for an economy. It may provoke a sharp jump in unit labor costs, all while reducing real income. It may also lead to stagflation or hinder the Bank of England from raising rates and tapering programs.

Going back to GBP/USD, a lot currently depends on 1.3640 because a break through it will lead to a further jump to 1.3675 and 1.3760. Meanwhile, a drop below the level could result in a plunge to 1.3570, and then to 1.3530 and 1.3490.