Yesterday, the pound continued its upward correction, albeit at a more modest pace than on Friday. This is despite the growth in oil prices and persisting extremely high gas prices. Apparently, the market is already somewhat tired of the continuous negativity associated with the energy crisis in Europe, at least when you look at the pound.

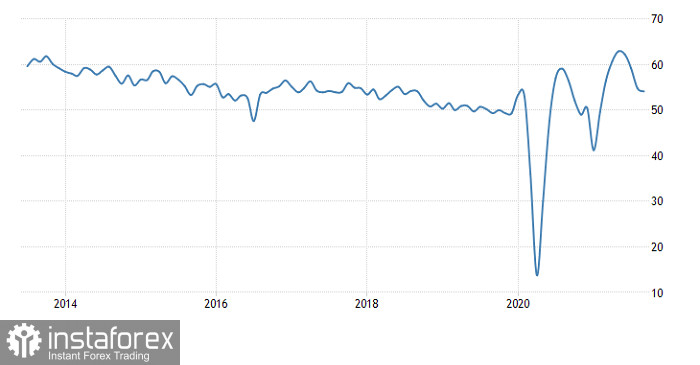

Moreover, OPEC+ has decided to increase oil production, and the supply of energy will increase sooner or later, which will inevitably lead to a decrease in cost. The main driving force for the pound is excessively oversold. Its growth may well continue today since the correction is clearly far from over, although business activity indices in the UK should decline. It is worth noting that the index of business activity in the service sector may drop from 55.0 points to 54.6 points, while the composite index may also do so from 54.8 points to 54.1 points. The final data is likely to coincide with the preliminary estimates that the market has already taken into account.

Composite PMI (UK):

The Euro currency has been growing for almost the entire day yesterday. Moreover, the growth turned out to be quite impressive. However, the movement turned in the opposite direction a couple of hours after the opening of the US trading session, and as a result, the currency lost most of its gains. The energy crisis, which everyone is already used to, still has a strong impact on it. After all, it is not the UK energy companies that declare bankruptcy, but EU ones. Europe does not have to rely too much on Nord Stream 2, since only its test trials began yesterday. It is quite obvious that this procedure will take a lot of time. And although the correction for the most part suggests itself, the single European currency will have to slightly wait. It's all about macroeconomic statistics.

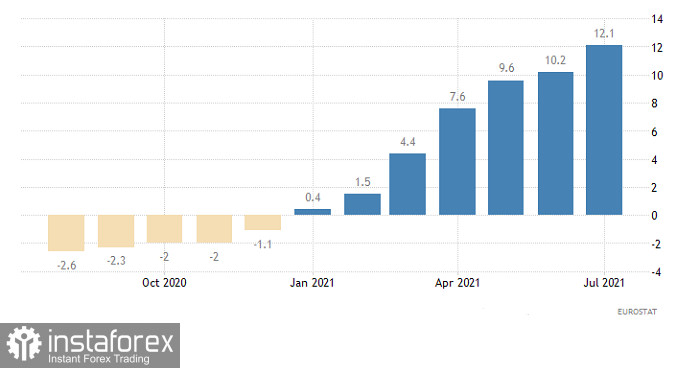

However, the final data on business activity indices have nothing to do with it. They should coincide with the preliminary estimate, which showed a decrease in the index of business activity in the service sector from 59.0 points to 56.3 points, and the composite from 59.0 points to 56.1 points. It's all about the producer price index, which should rise from 12.1% to 13.7%. Considering that producer prices are a leading indicator of inflation, their growth indicates a further rise in consumer prices. This is despite the fact that Europe's inflation continues to grow faster than expected. Unlike the Fed or even the Bank of England, the ECB has not yet made any statements regarding the possibility of monetary tightening. In this case, the growth in inflation is causing more and more fears.

Producer Price Index (Europe):

As for the United States, PMIs are also expected to decline. In particular, the index of business activity in the service sector should decline from 55.1 points to 54.4 points. The composite business activity index is expected also from 55.4 points to 54.5 points. But just like the UK and the EU, we are talking about the final data, which should coincide with the preliminary estimate. Therefore, market participants do not learn anything new. The producer price index in Europe will come to the fore, which will prevent the euro from carrying out a correctional movement.

Composite PMI (United States):

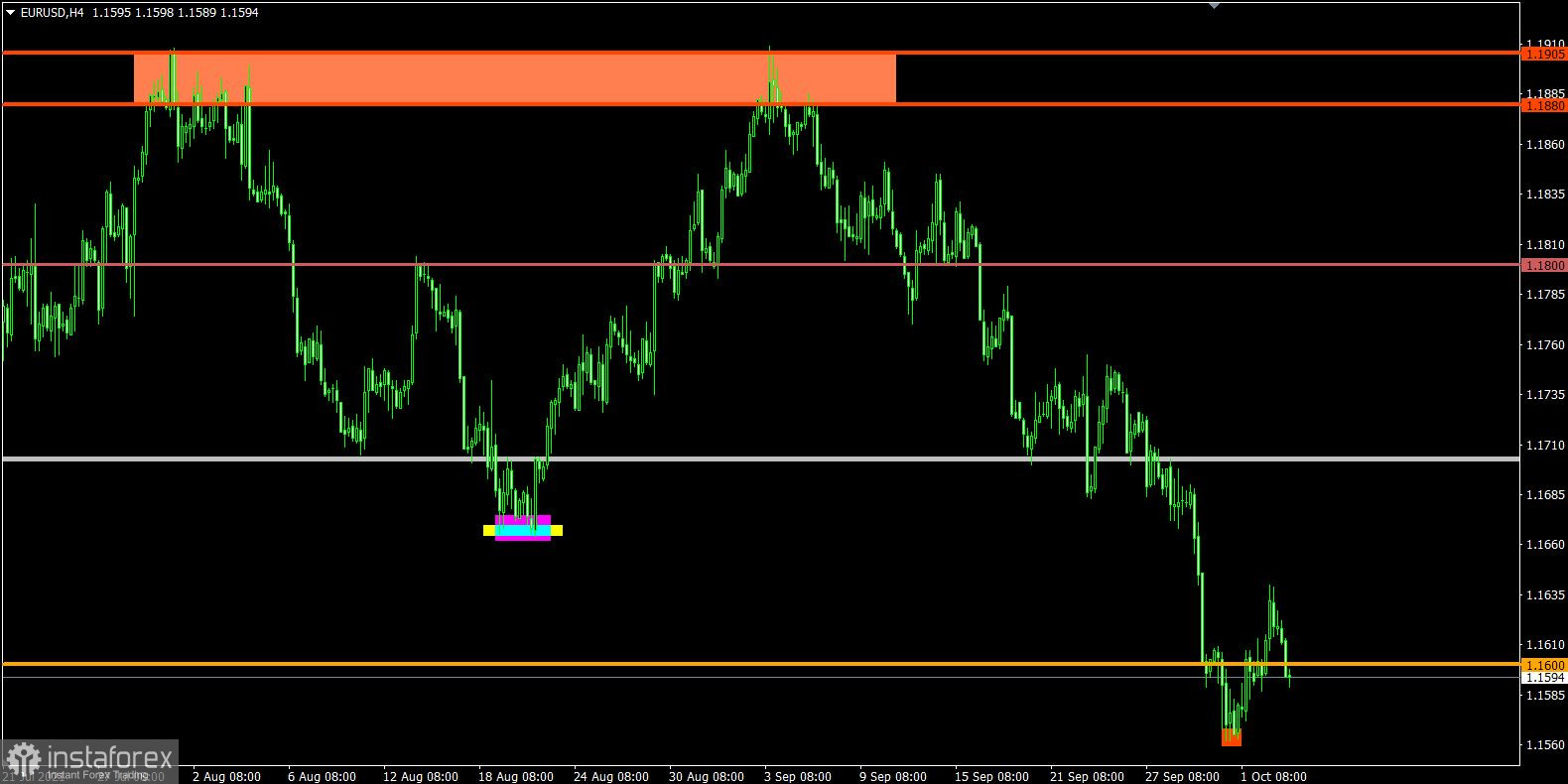

The EUR/USD pair returned below the level of 1.1600 after a slight pullback, increasing the sellers' chance of resuming the downward cycle. In this situation, stable price retention below the level of 1.1600 will eventually lead to reaching the local low of 1.1562. Otherwise, the pullback may be replaced by a full-size correction.

The GBP/USD pair managed to restore the rate of the pound by more than 220 points during the correction, while the overbought status did not appear on the market. The resistance level is 1.3640, relative to which stagnation has arisen. In order to prolong the corrective move, the quote needs to stay above the level of 1.3645. This will open the way towards 1.3700. An alternative scenario will arise if the price is kept below 1.3560.