Gold's rebound from last week's two-month low is encouraging as both Main Street investors and Wall Street analysts expect prices to rise this week.

Despite the fact that bullish sentiment is growing, some analysts note that the market still faces fundamental obstacles in the form of rising interest rates, the upward trend of the US dollar, and general apathy among universal investors.

Christopher Vecchio, a Senior Market Strategist at DailyFX.com, said that the current credit problems with Evergrande and the problems with the debt ceiling in the US may continue to support prices.

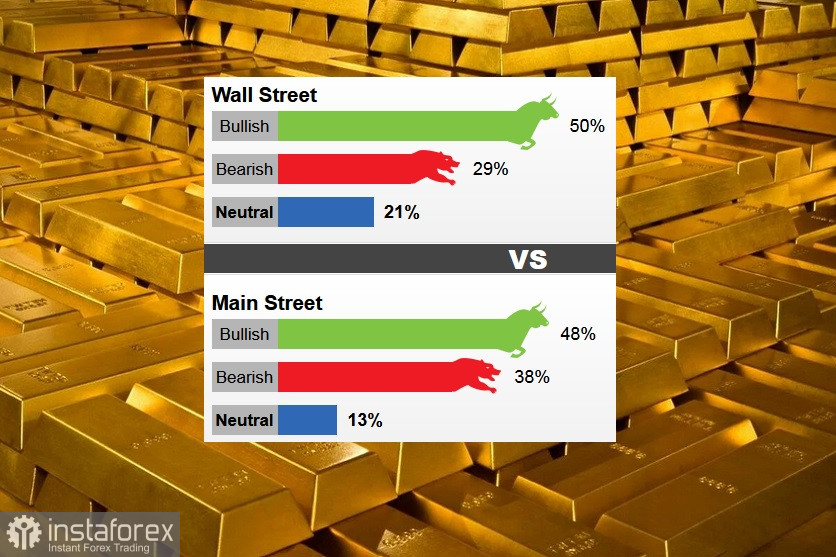

Last week, 14 Wall Street analysts took part in the gold survey. Seven participants, or 50%, voted for the price increase, while four analysts, or 29%, voted for a price fall this week. The remaining three analysts, or 21%, rated gold neutrally.

889 votes were cast in the Main Street online polls. Of these, 430 respondents, or 48%, expected an increase in gold prices, another 340, or 38%, voted for a reduction, and 119 voters, or 13%, were neutral.

The recent selling pressure on gold was the result of a stronger dollar and higher yields on US debt instruments.

Another factor that attracts the attention of the investment community is the potential crisis that will arise if Congress and the Senate fail to pass legislation to raise the debt ceiling by October 18. Last week, the House of Representatives and the Senate approved a temporary measure to fund the government until December. However, they have not developed any legislation regulating the current debt limit, because of which the United States could not make payments on its debt.

The future direction of gold will be largely based on the Fed's future monetary policy. The recent interest rate forecast, which was published by the Federal Reserve on the "dot chart" of FOMC meetings, suggests that the normalization process with an increase in interest rates from almost 0% to 3% will be implemented over the next three years. The Federal Reserve's statement and Jerome Powell's press conference also showed that they will begin the process of reducing asset purchases as early as November of this year.

Analysts and investors still do not know how fast the reduction process is going. It is believed that they will reduce the purchase of US debt instruments and securities on a monthly basis. Thus, it will take about a year before the cessation of sales leads to the cessation of asset purchases.