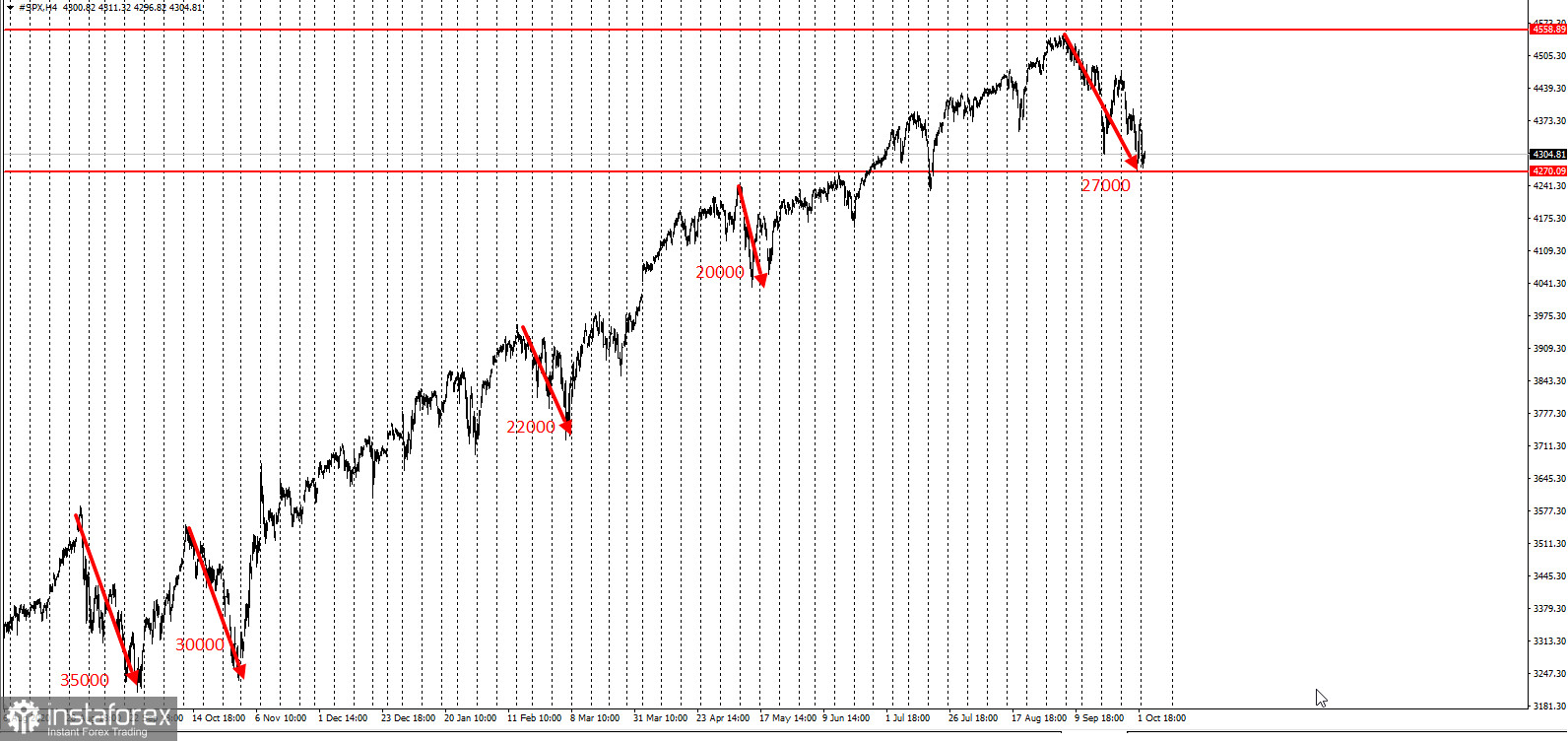

The S&P 500 has been declining for five consecutive weeks already. This creates problems to institutional investors, but delights speculators.

Objectively speaking, after the 2020 crisis, the benchmark index has not pulled back by more than 35,000 pips from its peaks.

This means that now is a good idea to set up buy limits in order to buy out the correction.

Investors can place a long grid of buy limits from 4270, with an increment of 1,000 pips. The S&P500 is a trending instrument that reflects the profitability of the 500 largest American companies, so it is good to trade against corrections. This will surely provoke a strong growth in quotations.

The analysis is based on the grid trading method.

Good luck and have a nice day!