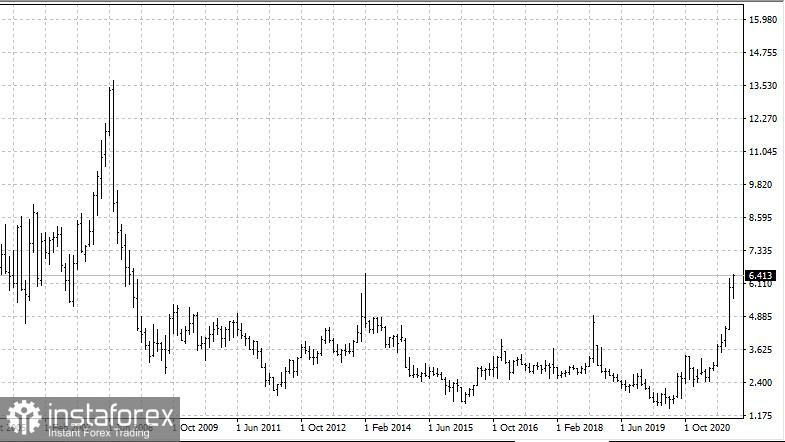

NG (natural gas), monthly chart

Europe's gas crisis: What is going on?

Gas prices have hit all-time records.The last few weeks they have surged to $1,000- $1,200 per thousand cubic meters. That's extremely high. Notably, Yanukovych's government in Ukraine was overthrown by the Maidan in February 2013 mainly due to the economic crisis. Besides, the crisis was caused by a sharp rise in gas prices, though they were about $400 per thousand cubic meters. The difference is evident as compared with the current EU prices of $1,100 per thousand cubic meters. The gas price hike has already resulted in a jump in the UK energy prices, for example, up to 4-5 times (!). Rising gas and electricity prices, combined with increasing oil prices, leads to a surge in commodities such as transport and basic goods. Inflation will rise, the ECB will have to raise the rate. Moreover, increasing cost of credit and decline in consumer demand due to the forced increase in costs of housing services and utilities will stop growth.

So what is going on?

The versions are listed below, the information is considered to be unofficial. In contrast to previous years, Gazprom allegedly almost does not pump gas over the contracted current volumes. Let me explain. It is obvious that there is a spike in Gazprom's domestic consumption in winter. Besides, winters in central Russia are cold, and there is a huge gas demand for heating. In summer, Gazprom has more volumes of gas supplies, so it pumps more gas than it does under current contracts. This extra gas usually goes to gas storage facilities, particularly there are huge capacities for gas injection in Germany.

Why did Gazprom change its policy? It aimed to speed up the launch of Nord Stream-2. The certification process in the EU is dragging on. Notably, there are a lot of debates concerning Nord Stream-2. At the same time, Gazprom has additional capacities to increase gas injection without launching Nord Stream-2. It means a limited gas supply to push through the launch of Nord Stream-2. Gas traders observe this situation and raise prices. Consequently, they are $1,000-$1,200 per barrel.

There are still some complicated points. Earlier there were many debates over the US exerting pressure on Gazprom and hindering Nord Stream-2 launch to take advantage of delivering its own liquefied gas. The question is, where is American LNG? Europe's gas prices bring super profits to LNG sellers. Besides, there was a strange report from China. The US is supposedly restricting its gas supply to China. Is the US facing a gas shortage? It is possible.

What is going on?

Notably, after the Fukushima nuclear disaster in Japan, the EU began to close nuclear power plants, including Germany (although I think it was not a wise decision. In Germany, unlike Japan, there is no tsunami or earthquake, and German discipline obviously makes the probability of a Chernobyl-type disaster in 1986 very low.) This fact has dramatically increased the demand for gas in Germany and Europe and dependence on gas supplies respectively.

Consequently, a so-called mild (so far mild, until cold winter) gas war broke out. Is it a way to put pressure on the new German government? Possibly.

Besides, there is the opposite effect. Why, for example, does OPEC try to prevent abnormally high oil prices above $100/barrel? Commodity prices are increasing, profits are rising. However, this is strategically ineffective. A rise of oil prices above $100 triggers ways for alternatives - green energy, electric cars, switch to gas.The same situation is with gas. Extremely high Gazprom's gas prices increase financing of green energy, a return to nuclear power is possible. Other ways include search for new suppliers, that is the reason for LNG appearance on the EU market. Looking ahead, Gazprom's market share in the EU will decrease. I believe Gazprom should not rejoice at extremely high gas prices in Europe at the moment.