To open long positions on EURUSD, you need:

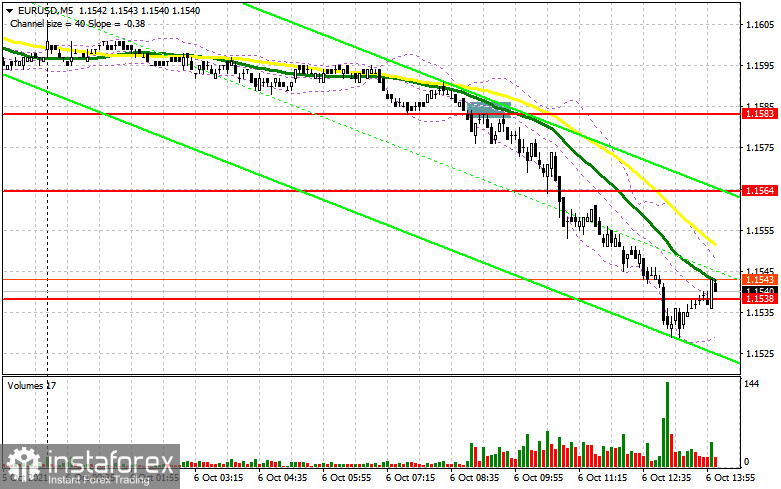

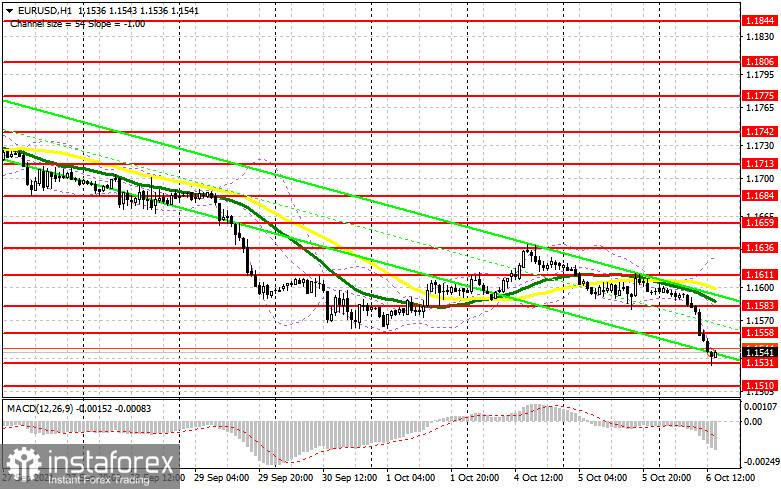

In my morning forecast, I paid attention to the 1.1583 level and recommended making decisions from it. Let's look at the 5-minute chart and figure out what happened. Pressure on the euro has returned after a sharp rise in US bond yields due to fears of excessive inflationary pressure expected this fall. The breakthrough and consolidation below the support of 1.1583 led to the formation of an entry point into short positions and then to a rapid fall of EUR/USD to the area of 1.1564. After a short pause, a breakdown of this range took place and a further decline of the pair to a minimum of 1.1538. It is unlikely that euro buyers will be able to offer something in the afternoon when reports from ADP on the state of the American labor market are expected. Good data on the growth of new jobs will only lead to another wave of EUR/USD decline. The Fed representatives are also expected to speak, who may more actively raise the issue of inflation policy in the United States. It is necessary to try to bring the resistance of 1.1558 back under control in the afternoon. Only a test of this area from top to bottom forms a signal to open long positions in the hope of restoring the euro to the level of 1.1683. Its breakthrough with a similar consolidation forms an additional entry point into purchases, which will lead EUR/USD to new local levels: 1.1611 and 1.1636, where I recommend fixing the profits. While maintaining pressure on the pair and strong data on the American economy, and most likely this scenario awaits us, since we should not forget about the problem of the US debt ceiling, long positions can be opened if another false breakdown is formed around 1.1531. It was there that the pair's fall was stopped in the first half of the day. In the scenario of the absence of bull activity, I advise buying EUR/USD immediately for a rebound only after the first test of 1.1510, or even lower - from the level of 1.1482, counting on a bounce up by 15-20 points inside the day.

To open short positions on EURUSD, you need:

Bears are in control of the situation, and everything points to the resumption of the bear market without the slightest hope of an upward correction. Even at the lows of 1.1531, no people are willing to buy the euro. In the case of an upward correction of the pair in the afternoon after the release of reports on the US economy, only the formation of a false breakdown in the area of 1.1558 will give an excellent entry point into sales to reduce to the intermediate support of 1.1531, which the bears failed to break below in the first half of the day. Only a repeat test with a breakthrough and an update of 1.1531 from the bottom up will increase the pressure on the pair and open the way to the lows: 1.1510 and 1.1482, where I recommend fixing the profits. Strong data on the US labor market should help in the implementation of such a scenario. With the growth of the pair and the absence of bear activity in the area of 1.1558 during the American session today, I advise you to open short positions only after the formation of a false breakdown in the area of 1.1583, in the area of which there are moving averages playing on the side of the bears. It is best to sell EUR/USD immediately for a rebound only after testing a new local resistance of 1.1611, counting on 15-20 points downward correction.

The COT report (Commitment of Traders) for September 28 recorded a sharp increase in short and long positions. However, the former turned out to be more, which led to a reduction in the net position. The fact that the United States of America is currently going through difficult political times has kept the demand for the US dollar all last week and put pressure on risky assets. The prospect of changes in the monetary policy of the Federal Reserve System also allowed traders to build up long positions on the dollar without much difficulty, as many investors expect the central bank to begin reducing the bond purchase program closer to the end of this year. An important report on the number of people employed in the US non-agricultural sector will be released this week, which will shed light on the further actions of the central bank since a lot now depends on labor market indicators. Demand for risky assets will remain limited due to the high probability of another wave of coronavirus spread and its new Delta strain. Last week, the President of the European Central Bank said a lot that she would continue to adhere to a wait-and-see position and maintain a stimulating policy at current levels. However, the observed surge in inflationary pressure in the 4th quarter of this year may spoil the regulator's plans. The COT report indicates that long non-commercial positions increased from 189,406 to the level of 195,043, while short non-commercial positions jumped quite seriously - from the level of 177,311 to the level of 194,171. At the end of the week, the total non-commercial net position dropped from the level of 12,095 to the level of 872. The weekly closing price also fell to 1.1695 from 1.1726.

Signals of indicators:

Moving averages

Trading is below 30 and 50 daily moving averages, which indicates the resumption of the bear market.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the pair grows, the average border of the indicator in the area of 1.1583 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.