To open long positions on GBP/USD, you need:

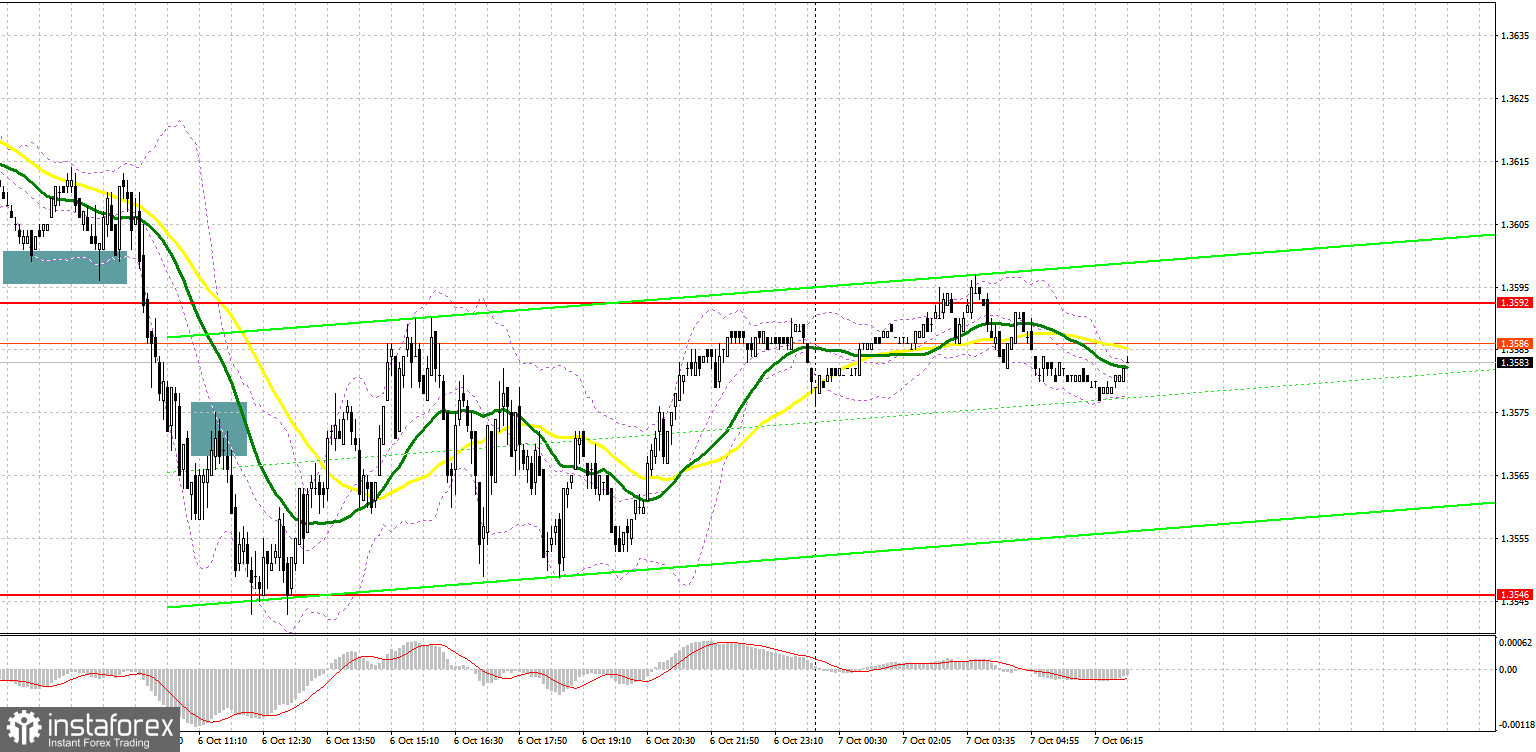

Yesterday, the British pound fell as demand for the US dollar returned amid fears of greater global inflationary pressures and continued political uncertainty in the US. Let's take a look at the 5-minute chart and break down yesterday's entry points. There were several interesting signals to enter the market in the first half of the day. The first false breakouts of the 1.3601 level resulted in forming an excellent entry point into long positions in continuation of the upward correction of the pound. However, it never resulted in a sharp rise for the pair. Back in the morning forecast, I said that if the pound does not actively rise from the level of 1.3601, it is best to refuse to buy. Some time later, a breakdown of 1.3601 and a sharp drop in GBP/USD occurred with a breakthrough of support at 1.3569. An update of this level from the bottom up formed a signal to open short positions, which plunged the pound by another 35 points. In the second half of the day, we didn't reach the levels I indicated, so I didn't get any signals to enter the market.

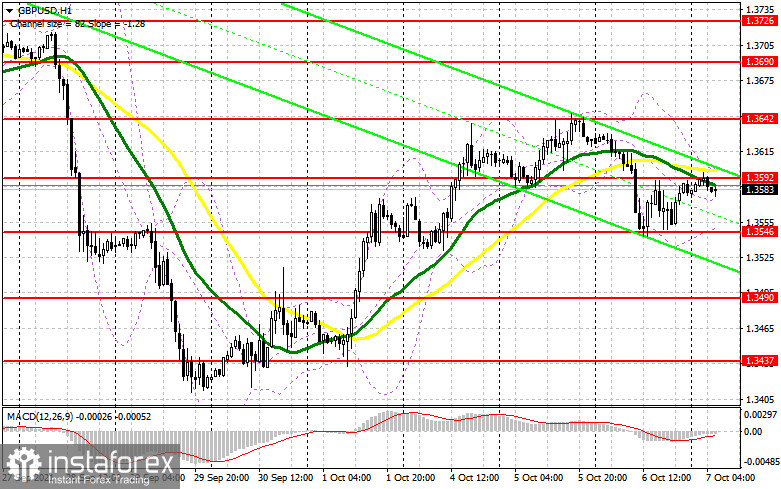

There are no important fundamental statistics for the UK today and many traders will be preparing for tomorrow's important US labor market data. For this reason, the bulls have every chance of building an upward correction. All they need now is to rise above resistance 1.3592. Only such a scenario will help compensate for the losses that were observed yesterday morning. A breakthrough and reverse test of 1.3592 from top to bottom will form a signal to buy GBP/USD, which will push the pair towards 1.3642. A test of this area will be evidence of a return to the bull market. Its breakdown will open a direct road to resistance at 1.3690, where I recommend taking profits. If the pressure on GBP/USD persists in the first half of the day, I advise you not to rush into long positions. An important task for the bulls is to protect support at 1.3546, which formed at the end of yesterday. Only a false breakout there will form a good entry point into long positions. Otherwise, the best buying scenario would be a test of the next support at 1.3490, but even there it is best to wait for a false breakout to form. I advise you to watch long positions of GBP/USD immediately for a rebound only from a low like 1.3437, counting on an upward correction of 25-30 points within the day.

To open short positions on GBP/USD, you need:

The bears managed to do the most that was required of them yesterday: they achieved a breakdown of quite important support and managed to maintain control over this level until the end of the day. Today the bears' task will consist of the same protection at 1.3592. Forming a false breakout at this level will result in creating a new signal to open short positions in continuation of the downward correction observed yesterday throughout the day. The next task for the bears is to regain control over the new support level at 1.3546. A breakthrough of this area and its reverse test from the bottom up will form a signal to open short positions in hopes of a decline in the pair to 1.3490. The breakdown of this range also forms another entry point into short positions with the goal of breaking the bulls' stop orders and a sharper fall to the low of 1.3437, where I recommend taking profits. If the pound recovers and there is no one willing to sell at 1.3592, only a false breakout in the area of the next resistance at 1.3642 will be a signal to open short positions in GBP/USD. I recommend selling the pound immediately on a rebound from a larger resistance at 1.3690, or even higher - from a high of 1.3726, counting on the pair's rebound down by 20-25 points within the day.

The Commitment of Traders (COT) report for September 28 revealed both a sharp rise in short ones and an increase in those who bet on the pound's succeeding growth. The British pound has been falling for almost the entire week amid the fuel crisis that has flared up. Supply chain problems have led to disruptions in the supply of fuel to gas stations, and an acute shortage of drivers has prompted British Prime Minister Boris Johnson to engage the military. The corresponding reaction of the buyers of risky assets followed immediately and the pound fell against the US dollar. Strong data on the growth of the UK economy in the second quarter of this year, which was revised upward, did not help the pound much, however, perhaps due to them, the pressure on the pair slightly decreased, and traders recalled the Bank of England's statements on monetary policy about the fact that decisions to change it can be made as early as November this year. The only problem that stands in the way of the bulls is the US Federal Reserve, which, although not going to raise interest rates, is also on the path of tightening monetary policy. I have repeatedly advised to buy the pound in case of significant corrections. This happened last week as well. After a sharp decline, traders seized the moment and bought it back at attractive prices. The COT report indicated that long non-commercial positions rose from 51,910 to 57,923, while short non-commercials jumped from 52,128 to 55,959, leading to a partial build-up of bulls' advantage over bears. As a result, the non-commercial net position regained its positive value and increased from -218 to 1964. The closing price of GBP/USD increased to 1.3700 against 1.3662 by the end of the week.

Indicator signals:

Moving averages

Trading is carried out below 30 and 50 moving averages, which indicates the possibility of the continuation of the pound's downward correction.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.3595 will lead to a new wave of growth of the pound. Surpassing the lower boundary at 1.3555 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.