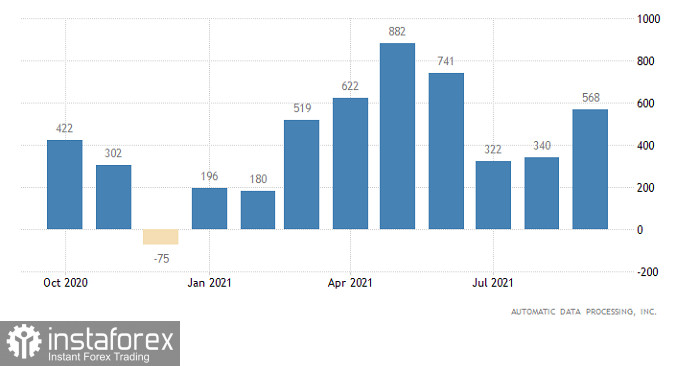

The European single currency behaved unusually yesterday. An increase of 568K in the US employment did not have any effect on the market. The actual results beat the market expectation of a 428K rise. However, even if the data came in line with the forecast, this would already be a significant increase. Indeed, the unemployment rate has almost reached the Federal Reserve's target. It means that the US jobs market is now in a state of equilibrium. For the market to remain stable, employment should climb by slightly more than 200K per month. All this indicates that the unemployment rate will continue to decline. Consequently, there will be nothing preventing the US Fed from starting tapering. Indeed, such a sharp rise in employment should have boosted the greenback. However, it did not happen. The fact is that the US dollar had been bullish before the publication of the report. It grew based on expectations.

United States ADP Employment Change:

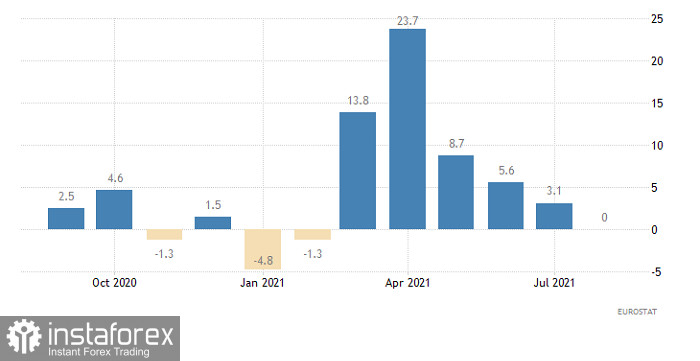

There were enough reasons for a bearish euro yesterday. It is about retail sales that stood unchanged from a year earlier, following a 3.1% rise in the previous month and missing market expectations of a 0.6% growth. At the same time, retail sales rose by 0.3% from a month earlier, missing market expectations of a 1% increase.

Eurozone retail sales:

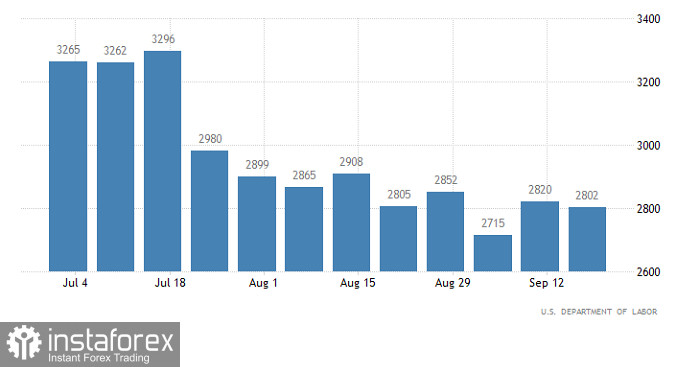

The only important report scheduled for release today will be US weekly jobless claims. Nevertheless, this data is unlikely to somehow influence the market. Initial jobless claims are estimated to drop by 14K, and continuing claims by 12K, showing an insignificant change from the previous period. On Friday, the US Labor Department will publish its closely-watched report. Ahead of such an important event, investors are likely to be very cautious. For that reason, the market is expected to move in a sideways trend.

United States Continuing Jobless Claims:

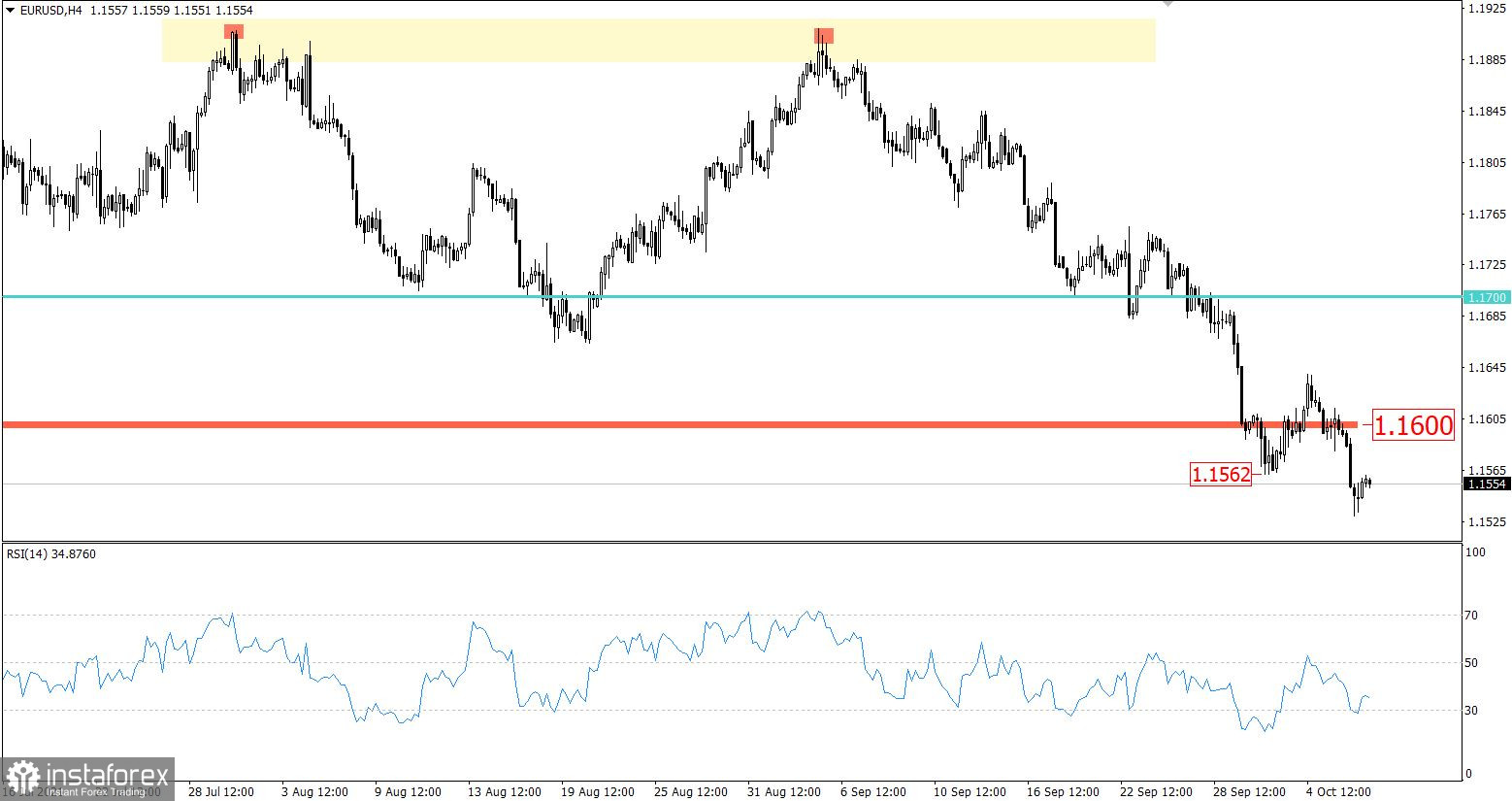

The downward trend in EUR/USD resumed after a short-term rebound. An increase in the volume of short positions occurred from the support level of 1.1640. As a result, the price broke the swing low of 1.1562 as of September 30.

The RSI approached 30 on the H4 chart but failed to consolidate below the line, indicating that the euro has not acquired an overbought status yet.

The lack of a full correction reflects an increase in bearish sentiment.

Outlook:

The market remains bearish. An increase in the volume of short positions is expected at the moment the quote consolidates below 1.1562. If so, the price is expected to go down to 1.1420.

In case of a rebound from the current levels, the quote may head towards 1.1600.

In terms of complex indicator analysis, technical indicators are signaling to sell the pair for short-term, mid-term, and intraday trading due to the continuation of the downward trend.