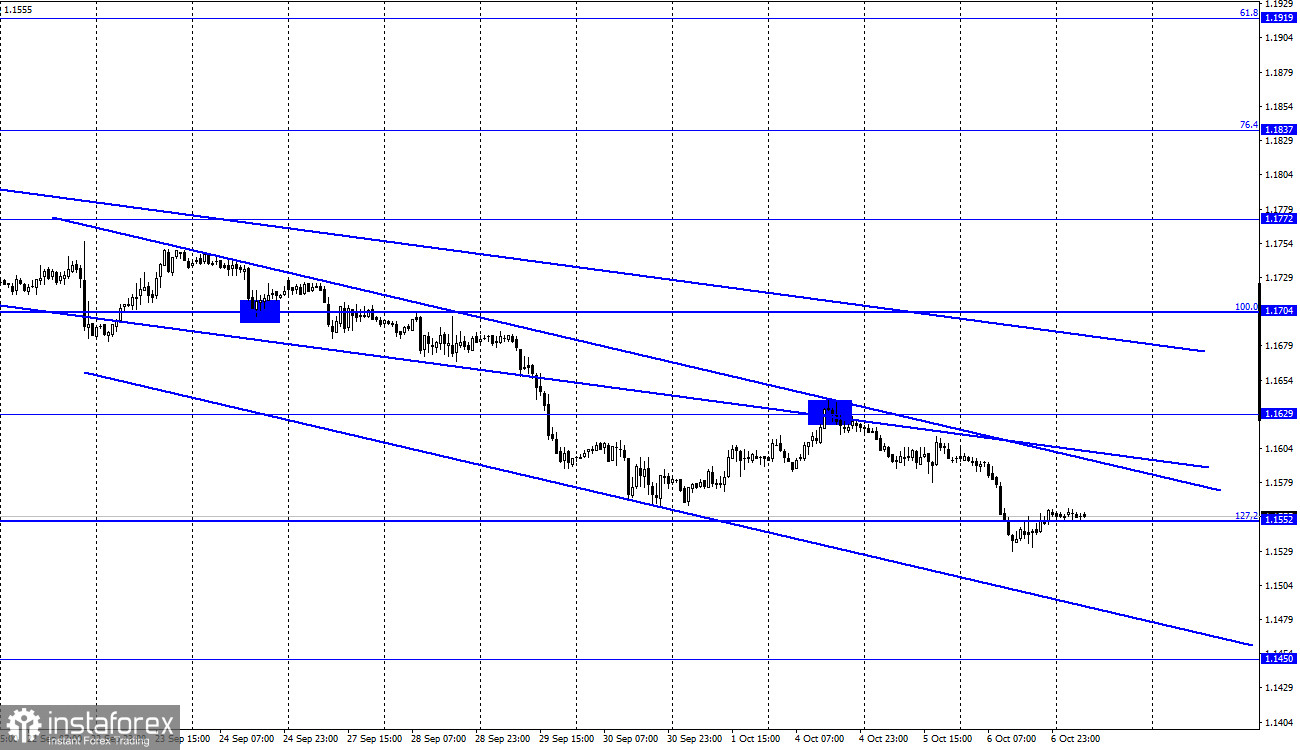

EUR/USD – 1H.

The EUR/USD pair resumed the process of falling yesterday and closed under the corrective level of 127.2% (1.1552). However, already this morning, a reverse closure was performed above this level. It should be noted that both of these closures were quite weak and uncertain. Also, in addition to the first downward trend corridor, a second corridor was formed. Therefore, now two corridors characterize the current mood of traders as "bearish." As a result, a new closing under the corrective level of 127.2% will work to continue the fall of quotes in the direction of 1.1450. If you look at the calendar of economic events of yesterday and its results, then everything looks very logical. The ADP report showed an increase in September by 568 thousand employees, although the increase was only 340 thousand in August. But August was a very weak month for both ADP and Nonfarm Payrolls. In September, the state of the US labor market began to improve again.

Thus, traders are now waiting for a positive Nonfarm Payrolls report. But more on that below. For now, let's return to the ADP report, which turned out to be stronger than market expectations. That's just the growth of the dollar that happened in the European session. Moreover, in the American session, the dollar fell a little. What happens? Did the Europeans buy the dollar before the ADP report, and did the Americans ignore this rather important report? Judging by the pair's movement schedule, everything is exactly like that. But we are already interested in the Nonfarm Payrolls report, which will be released on Friday. And there may be problems with this report. If the ADP forecast was about 400 thousand and it was quite easily interrupted by the actual value, then according to the Nonfarm report, the forecast is almost 500 thousand, and it will be quite difficult to interrupt it. Even a value of 450 thousand (after August - 235) will be perceived by traders as negative. Thus, Nonfarm will need to try very hard not to disappoint dollar bulls, and the dollar itself will need to continue the growth process.

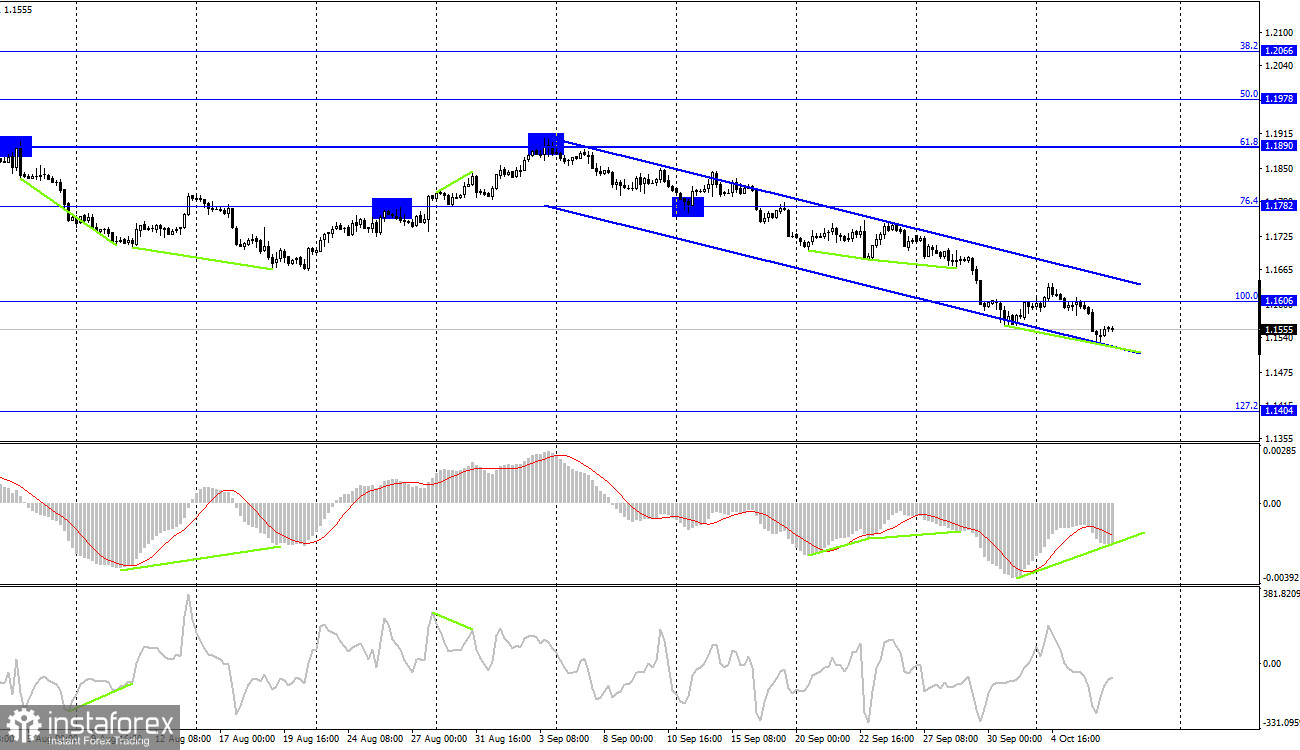

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed a new close under the corrective level of 100.0% (1.1606). Thus, the process of falling can be continued in the direction of the next Fibo level of 127.2% (1.1404). Maturing divergences are not observed in any indicator today. The pair's quotes continue to be in a downward trend corridor, which indicates the preservation of the "bearish" mood among traders. A "bullish" divergence is also brewing, which allows us to count on a small growth.

News calendar for the USA and the European Union:

EU - ECB report from the monetary policy meeting (11:30 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

On October 7, the calendars of economic events of the European Union and the United States are almost empty, and they do not contain important records. Both entries that appear in it have no chance of traders reacting to them. The information background will be very weak today.

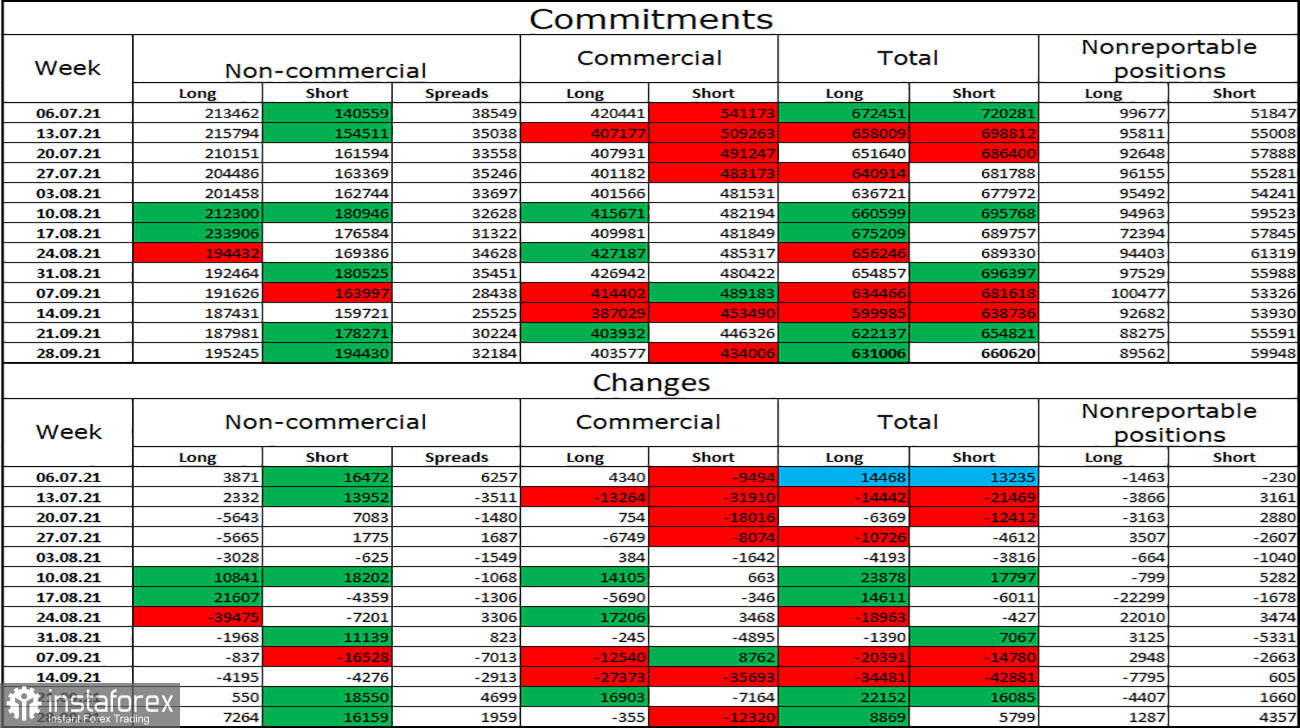

COT (Commitments of Traders) report:

The latest COT report showed that the mood of the "Non-commercial" category of traders changed very much during the reporting week. Speculators opened 7,264 long contracts on the euro and 16,159 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 195 thousand, and the total number of short contracts - to 194 thousand. Over the past few months, the "non-commercial" category of traders has tended to get rid of long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. This process continues now, and the European currency, meanwhile, continues to fall slightly. Thus, the actions of speculators affect the behavior of the pair at this time. The fall may continue.

Forecast for EUR/USD and recommendations to traders:

I recommended new pair purchases when rebounding from the level of 127.2% (1.1552) on the hourly chart with a target of 1.1629, but this did not happen. I recommend new sales if a new consolidation is made under the corrective level of 127.2% (1.1552) on the hourly chart with a target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.