To open long positions on EURUSD, you need:

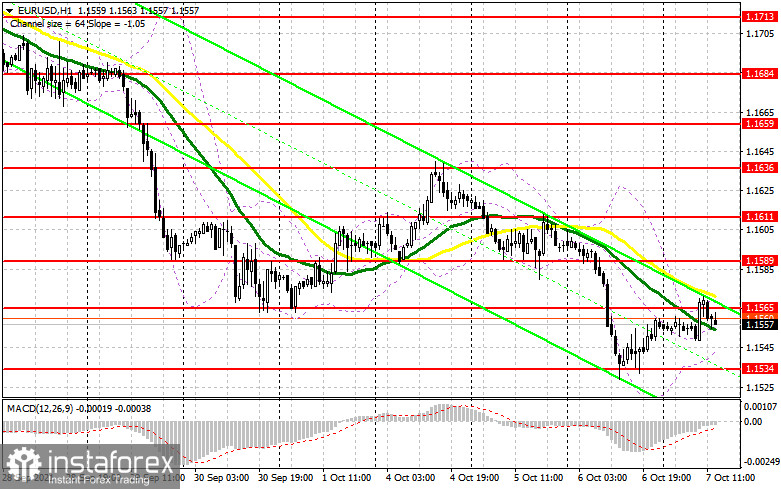

In my morning forecast, I paid attention to the 1.1565 level and recommended making decisions from it. Let's look at the 5-minute chart and figure out what happened. An unsuccessful attempt to break and consolidate above the level of 1.1565 led to the formation of a signal to open short positions, which continued to operate at the time of writing the forecast. While trading will be conducted below 1.1565, we can count on a larger euro movement down. There were no other signals to enter the market in the first half of the day. From a technical point of view, nothing has changed for the second half of the day, as the volatility of the trading instrument leaves much to be desired.

In the afternoon, data on the number of initial applications for unemployment benefits will be released, and the European Central Bank representatives will speak. Therefore, as for euro purchases, a very important task today will be to protect the support of 1.1534, to which the pair can collapse very quickly during the American session. Only the formation of a false breakdown there will lead to a signal to open long positions in the hope of restoring EUR/USD to the resistance area of 1.1665, which has not yet been able to get above. Data on the US labor market may slightly weaken the grip of buyers of the US dollar, which will lead to an upward correction of the pair. If the bulls manage to gain a foothold above 1.1565, then only a reverse test of this level from top to bottom will form signals to buy the euro in hopes of recovering to the maximum of 1.1589. A more distant target will be the 1.1611 area, where I recommend fixing the profits. In the scenario of the absence of bull activity at 1.1534, and the pressure on the euro will remain quite serious this week, I advise you to postpone long positions to the next weekly low of 1.1510. It is possible to open long positions immediately for a rebound only in the area of 1.1482 and 1.1454 supports and then counting on an upward correction of 15-20 points within a day.

To open short positions on EURUSD, you need:

Euro sellers continue to control the market, clearly proving their presence above the resistance of 1.1565 in the first half of the day. All of them are aimed at the next monthly lows, to which the way can be opened already in the afternoon. A very important task remains to protect the resistance of 1.1565, which is now occupied by the moving averages playing on the sellers' side. Only the next formation of a false breakdown there in the afternoon will return pressure on the pair, which will push it to the intermediate support of 1.1534. A breakthrough of this level with its reverse test from the bottom up will form a new entry point into short positions to reduce EUR/USD already to the area of 1.1510 and 1.1482, where I recommend fixing the profits. A longer-term goal will be a minimum of 1.1454. However, this is under the worst-case scenarios, which will already be associated with political problems in the United States and an increase in the debt limit. In the scenario of the absence of sellers at the level of 1.1565, it is best to postpone sales until the test of a larger resistance of 1.1589 or open short positions immediately for a rebound based on a downward correction of 15-20 points from the new high of 1.1611.

The COT report (Commitment of Traders) for September 28 recorded a sharp increase in short and long positions. However, the first turned out to be more, which led to a reduction in the net position. The fact that the United States of America is currently going through difficult political times has kept the demand for the US dollar all last week and put pressure on risky assets. The prospect of changes in the monetary policy of the Federal Reserve System also allowed traders to build up long positions on the dollar without much difficulty, as many investors expect the Central Bank to begin reducing the bond purchase program closer to the end of this year. An important report on the number of people employed in the US non-agricultural sector will be released this week. It will shed light on the further actions of the Central Bank since a lot now depends on labor market indicators. Demand for risky assets will remain limited due to the high probability of another wave of the spread of coronavirus and its new Delta strain. Last week, the President of the European Central Bank said a lot that she would continue to adhere to a wait-and-see position and maintain a stimulating policy at current levels. However, the observed surge in inflationary pressure in the 4th quarter of this year may spoil the regulator's plans. The COT report indicates that long non-commercial positions increased from 189,406 to the level of 195,043, while short non-commercial positions jumped quite seriously - from the level of 177,311 to the level of 194,171. At the end of the week, the total non-commercial net position dropped from the level of 12,095 to the level of 872. The weekly closing price also fell to 1.1695 from 1.1726.

Signals of indicators:

Moving averages

Trading is conducted around 30 and 50 daily moving averages, which indicates the lateral nature of the market.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.1565 will lead to a new wave of euro growth. A break of the lower limit of the indicator in the area of 1.1545 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.