Long positions in EUR/USD:

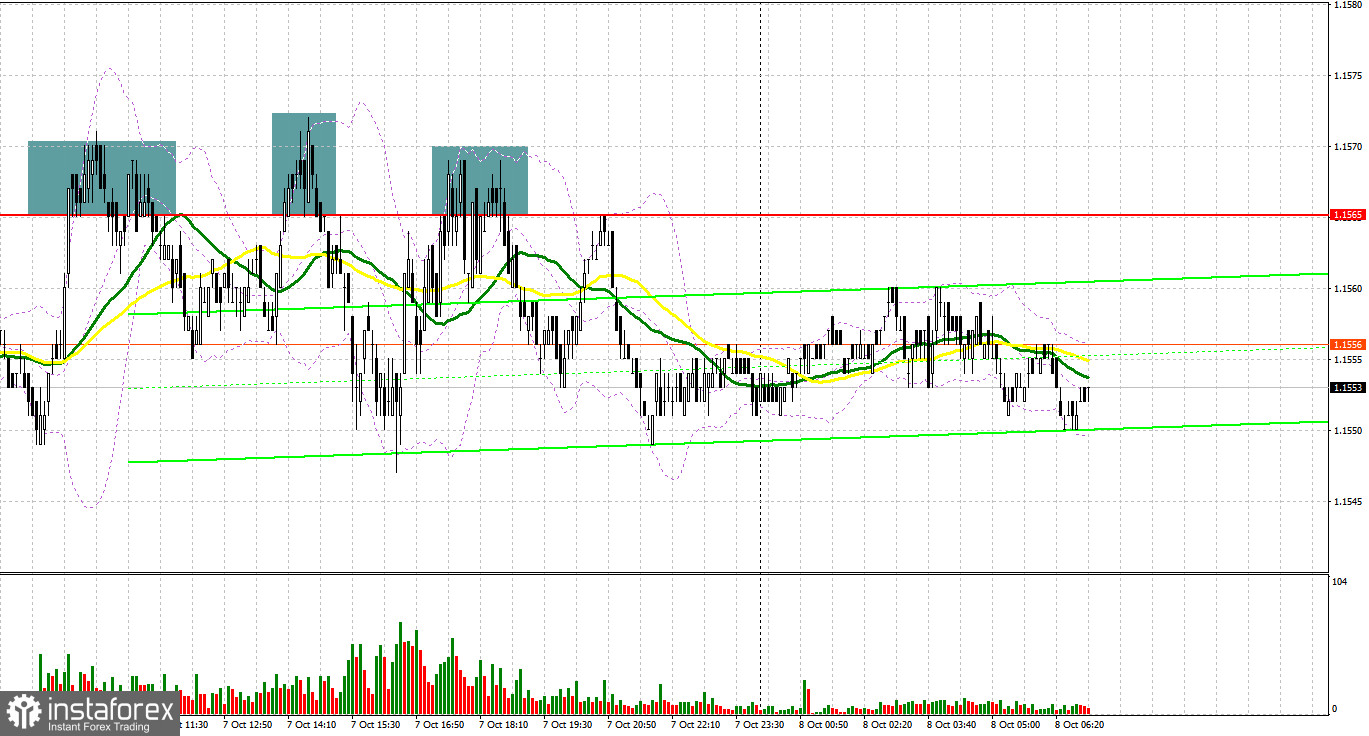

Yesterday, the pair was trading in a narrow sideways channel, ignoring almost all the macroeconomic statistics in the eurozone and the US. On the M5 chart, a false breakout and consolidation above 1.1565 gave a sell signal. Bears tried to push the price down several times. However, all their attempts were unsuccessful. In the second half of the day, a buy signal from the level of 1.1565 was generated. It did not cause a significant fall in price. In terms of technical analysis, nothing has changed. Today, the market will focus solely on the NFP report.

Short positions in EUR/USD:

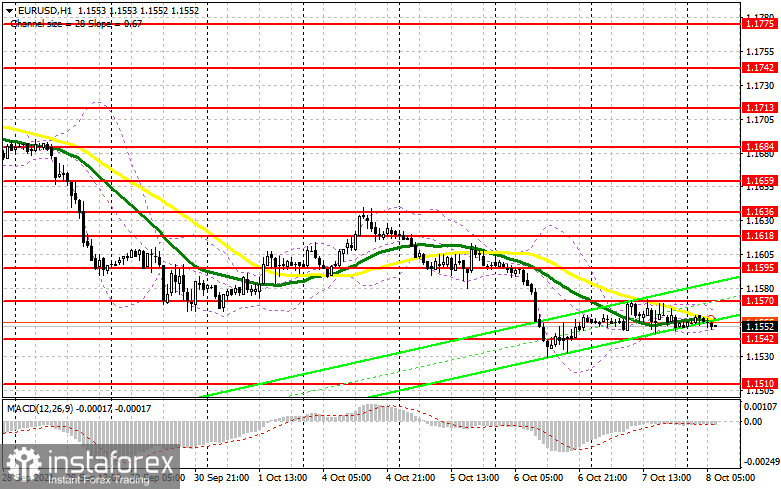

Bears continue to control the market and are aiming for new monthly lows. Their main task today remains to protect the resistance level of 1.1570. All bulls' attempts to consolidate above this barrier yesterday failed. Only a false breakout at this level in the first half of the day will resume pressure on the pair and push it to the intermediate support level of 1.1542. In case of a breakout and a test of this level bottom/top, as well as strong NFP results, a new short entry point will form with targets at 1.1510 and 1.1482, where it is wise to lock in profits. A further target is seen at the low of 1.1454 but the quote is likely to go to this mark only in the worst-case scenario related to political issues in the US. If there is no bearish activity at 1.1570, it will be wise to open short positions only when the quote tests the resistance level of 1.1595 or on a bounce, allowing a 15-20 pips bearish correction from the low of 1.1618.

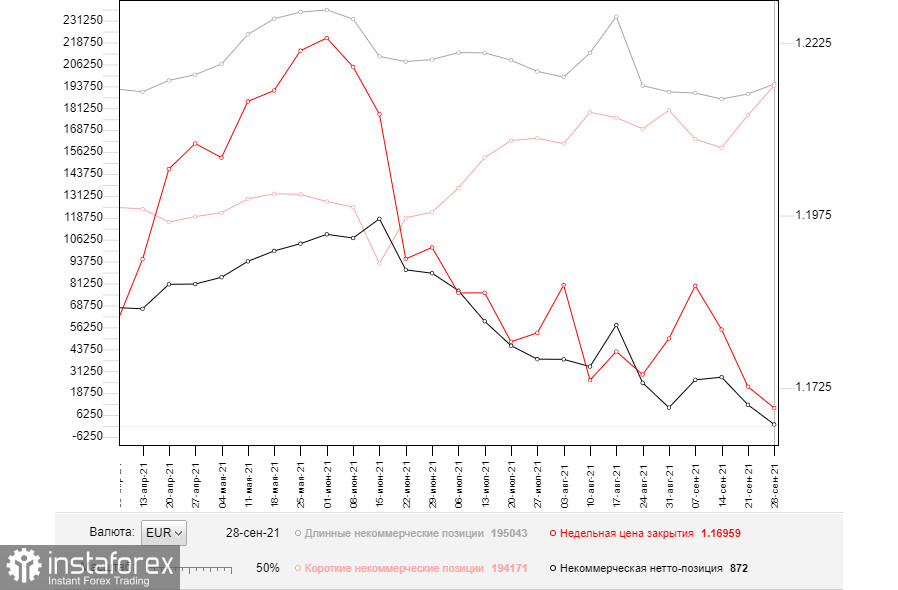

Commitment of Traders report:

The COT report as of September 28 logged a sharp increase in both short and long positions. At the same time, market participants opened more short positions than long ones, which, in turn, led to a decrease in the net position. Demand for the US dollar and pressure on risk assets were high during the previous week because the United States was currently going through tough times. The possibility of tapering by the Federal Reserve in November allows traders to raise the number of long positions in USD. Many investors expect the regulator to start reducing bond purchases by the end of this year. The Nonfarm Payrolls report is likely to throw light on the central bank's future actions. A lot now depends on the labor market performance. Demand for risk assets is expected to be limited due to the likelihood of another coronavirus wave and the spread of its Delta variant. In the previous week, the ECB's president spoke a lot about the regulator's intention to maintain the economic stimulus program at current levels. However, mounting inflationary pressure in Q4 2021 may ruin the regulator's plans. Based on the COT report, the number of long non-commercial positions increased to 195,043 from 189,406, while short non-commercial positions spiked to 194,171 versus 177,311. At the end of the week, the total non-commercial net position tumbled to 872 from 12,095. The weekly closing price also dropped to 1.1695 from 1.1726.

Indicator signals:

Moving averages

Trading is carried out near 30- and 50-period MAs, reflecting uncertainty in the market ahead of important macroeconomic statistics.

Important! The period and prices of moving averages are viewed by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands

Volatility has dropped sharply, which gives no signals to enter the market.

Indicators:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- The total non-commercial net position is the difference between short and long positions of non-commercial traders.