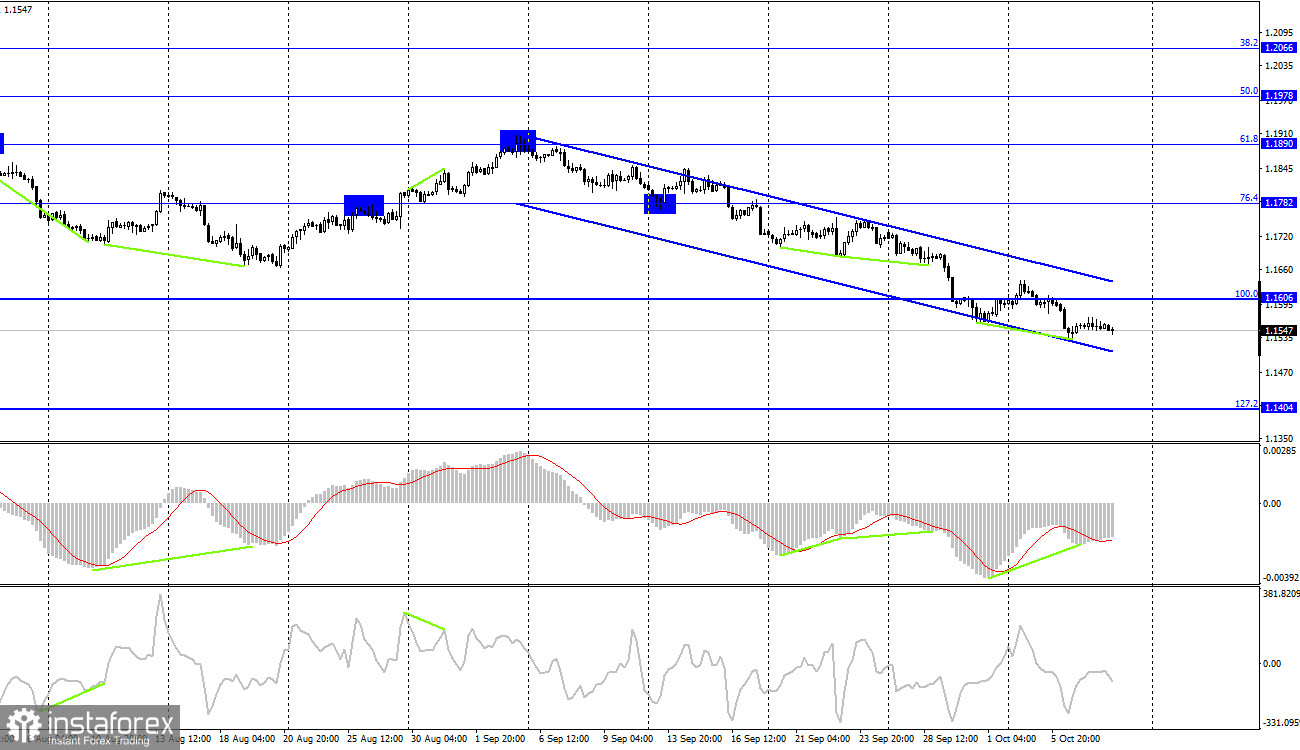

EUR/USD – 1H.

The EUR/USD pair moved exclusively horizontally yesterday, along the level of 127.2% (1.1552). Thus, no changes can be made to the graphic picture after a day, and no new conclusions can be drawn. Yesterday was unique in its way, as the pair traded in a side corridor about 20 points wide. I don't even remember the last time it happened. Thus, given the lack of traders in the market, it wasn't easy to count on something interesting. The same applies to the information background. The ECB's monetary policy report was released in the European Union, and what information did it give to traders? The document said all about the same inflation, its "temporary growth," and that everything would get better in a few months and inflation would begin to decline. The report also said that in the next few months, the volumes of the PEPP program are likely to be slightly reduced, and most members of the ECB monetary committee believe that the economy still needs a soft monetary policy. And what does it all mean? It means that the ECB will start curtailing stimulus at about the same time as the Fed. Is it intentional? Most likely, yes. Let me remind you that the QE and PEPP programs are nothing more than filling the economy with liquidity by purchasing bonds from the open market. And all the money coming into the economy is printed. Thus, there may be a skew between the EU and US economies if one central bank reduces the stimulus program earlier or faster. Therefore, I believe that the Fed and the ECB will begin to simultaneously curtail incentives to harm the euro/dollar exchange rate as little as possible. Recently, analysts have expressed great fears that the world is on the verge of a new financial crisis, which may be caused by an excessive increase in public debt of almost half of the countries on Earth. The national debt in the USA, the EU, and the UK has grown significantly. Those countries interest us the most.

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes closed under the corrective level of 100.0% (1.1606). Thus, the process of falling can be continued in the direction of the next Fibo level of 127.2% (1.1404). Bullish divergence allows us to count on some growth of the pair. However, it is already clear that growth has not begun. Most likely, the fall in quotes will be resumed. Closing above the downward trend corridor will allow us to count on a change in the mood of traders to "bullish" and the pair's growth in the direction of the corrective level of 76.4% (1.1782).

News calendar for the USA and the European Union:

US - Treasury Secretary Janet Yellen will deliver a speech (12:05 UTC).

EU - ECB President Christine Lagarde will deliver a speech (12:10 UTC).

US - unemployment rate (12:30 UTC).

US - change in the number of people employed in the non-agricultural sector (12:30 UTC).

US - change in the average hourly wage (12:30 UTC).

On October 8, the calendars of economic events of the European Union and the United States are full of very important records. The most important event is the Nonfarm Payrolls report in the USA. Lagarde and Yellen's speeches may also be very interesting. The information background may be strong today.

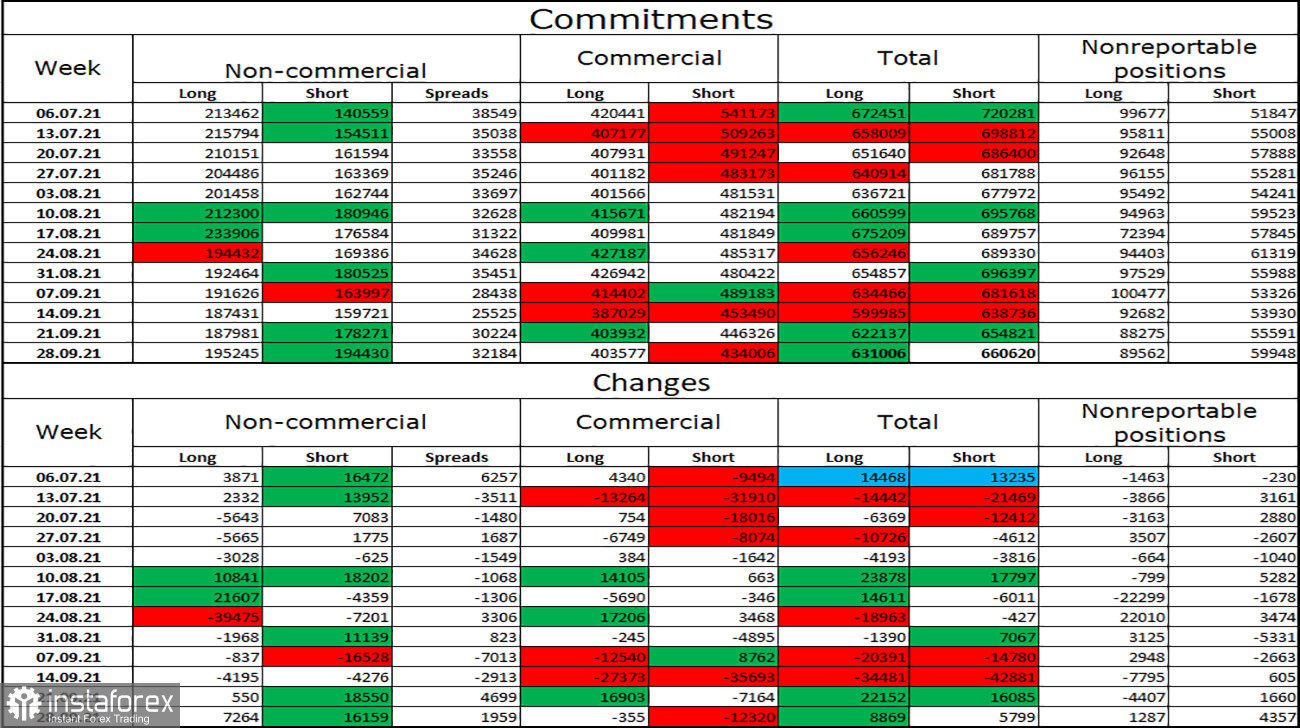

COT (Commitments of Traders) report:

The latest COT report showed that the mood of the "Non-commercial" category of traders changed very much during the reporting week. Speculators opened 7,264 long contracts on the euro and 16,159 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 195 thousand, and the total number of short contracts - to 194 thousand. Over the past few months, the "non-commercial" category of traders has tended to eliminate long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. This process continues now, and the European currency, meanwhile, continues to fall slightly. Thus, the actions of speculators affect the behavior of the pair at this time. The fall may continue.

Forecast for EUR/USD and recommendations to traders:

I recommended new pair purchases when rebounding from the level of 127.2% (1.1552) on the hourly chart with a target of 1.1629. However, this did not happen. I recommend selling if a new consolidation is made under the corrective level of 127.2% (1.1552) on the hourly chart with a target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.