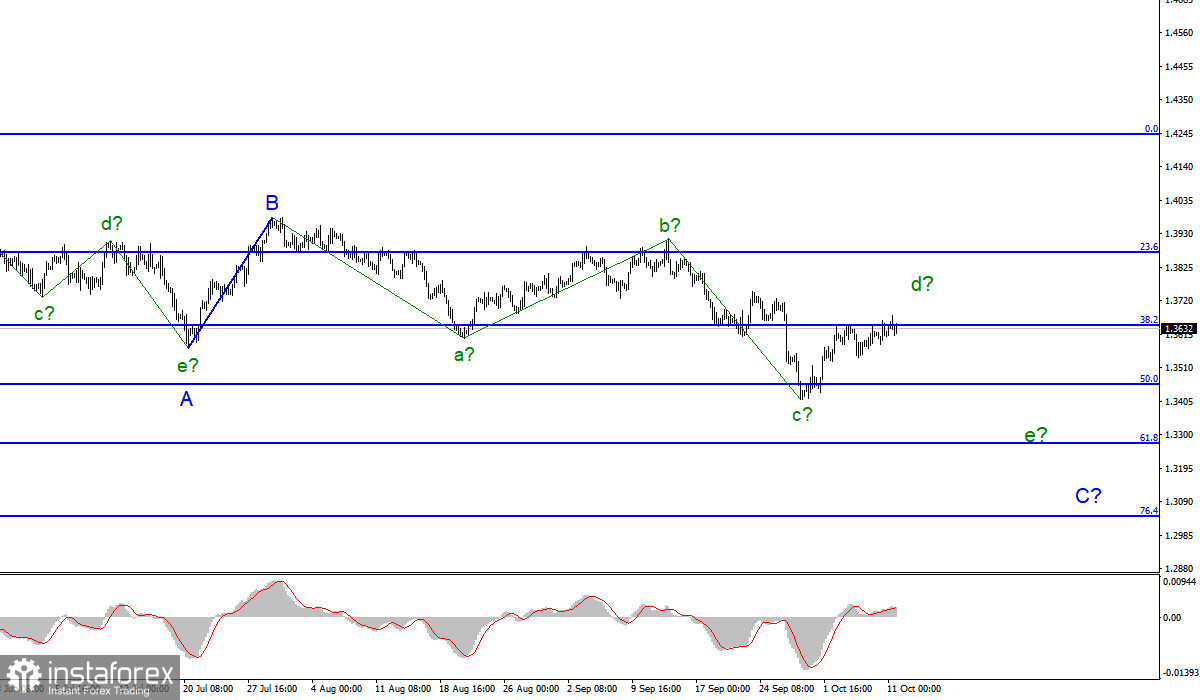

Wave pattern

The wave counting for the Pound/Dollar instrument has become more complicated and now it is expected to continue building a downward trend section. The instrument made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern and now it has acquired the form of a downward trend section, which can also be corrective in nature. This assumption is prompted by the internal structure of the proposed wave A, which cannot be called impulsive. The assumed wave c in C also assumed an absolutely non-impulsive form in this section of the trend. At the moment, only three waves are clearly visible in it. However, within the corrective structures, wave countings can be both three-wave and five-wave and take a very elongated form with complications. Thus, given the unsuccessful attempt to break through the 38.2% Fibonacci level, I expect the construction of a new downward wave, possibly e in the composition of c in C.

The EU and the UK cannot come to a common opinion in any way

The exchange rate of the Pound/dollar instrument remained virtually unchanged on Monday, and the amplitude was 30 basis points. Thus, the British pound also moved very inactively today. There was no news background for the Pound/Dollar instrument, which did not contribute to the growth of activity. The instrument did not have a single direction of movement either. I can only note once again that, at this time, the wave pattern is not completely unambiguous, since corrective structures always have a high chance of becoming more complicated or taking a different form, but it is the wave counting that is now the most accurate tool for predicting the movement of the instrument.

At this time, Brexit Minister David Frost threatened the European Union that relations between them and the UK could deteriorate significantly if they did not agree to completely revise the Northern Ireland protocol. "The stakes are extremely high, the arguments of the parties may differ radically, and I am worried that this process may cause a cold distrust between us and the EU, which may negatively affect our relations," Frost said.

Note that the Northern Ireland Protocol is part of the Brexit agreement signed by the parties. However, a few months after the completion of Brexit, the UK stated, for the first time, that the protocol was poorly implemented in practice and it wanted to revise it. With that, not individual items, but almost the whole thing. The European Union does not agree to such a scenario and only shows its readiness to negotiate on certain points of the protocol. Disagreements persist.

General conclusions

The wave pattern has changed dramatically in recent weeks. It received a downward view, but not an impulsive one. Therefore, now I advise you to sell the instrument for each MACD signal based on the construction of wave C, which can turn out to be quite long, with targets located near the calculated mark of 1.3273, which corresponds to 61.8% Fibonacci. An unsuccessful attempt to break through the 1.3643 mark indicates that the markets are not ready for further purchases of the British pound, so now the construction of a new downward wave may begin.

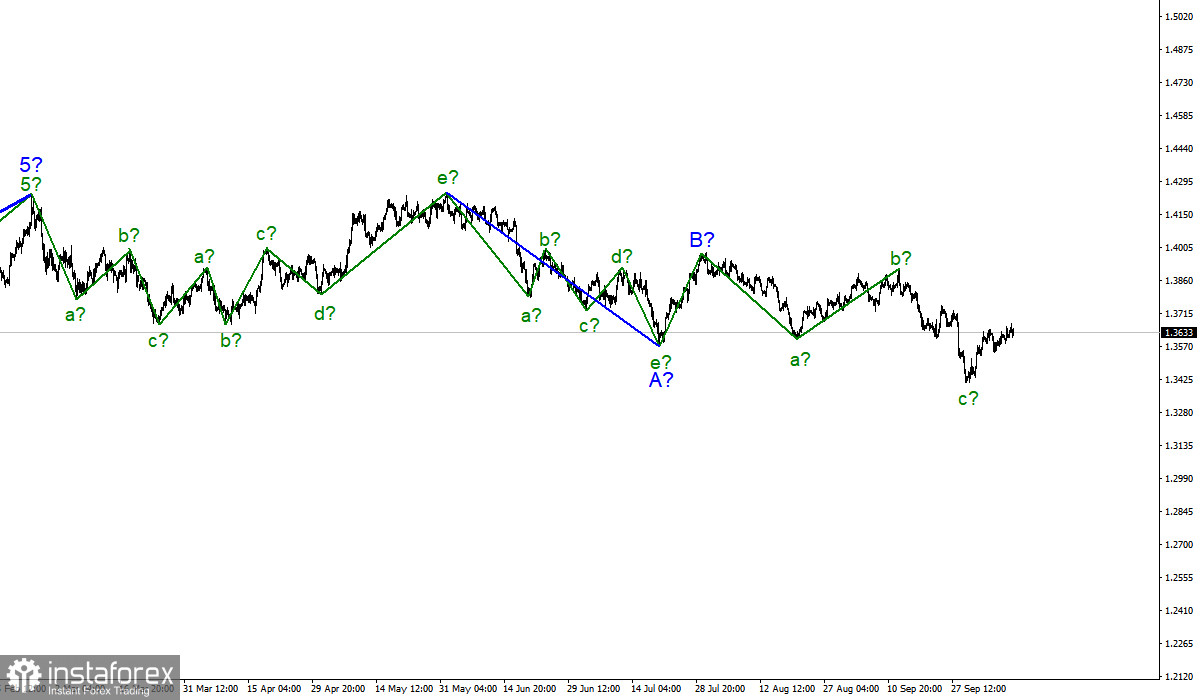

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward trend section has been canceled and now we can assume that the construction of a new downward trend section began on January 6, which can turn out to be almost any size.