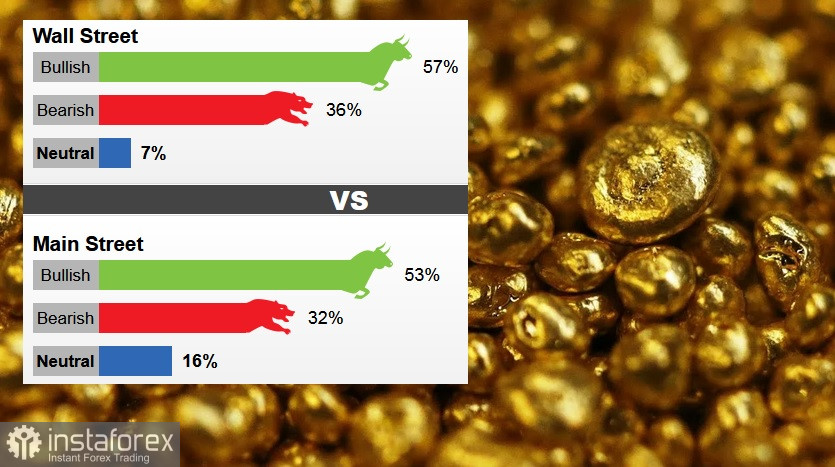

The latest weekly gold survey showed that both Wall Street analysts and retail investors from Main Street are firmly set on the growth of gold in the near future.

Last week, 14 Wall Street analysts took part in the gold survey. Eight participants, or 57%, voted for the price increase, while five analysts, or 36%, acknowledged a decline in prices during the week. At the same time, one analyst, or 7%, rated gold neutrally.

As for th Main Street's online polls, 841 votes were cast. Of these, 442 respondents, or 53%, expected gold prices to rise during the week. Another 265 voters, or 32%, said they expected a decline, while 134 voters, or 16%, were neutral.

On the other hand, prices for December futures were almost unchanged compared to the previous week. Some analysts believe that despite the fact that the Fed will inevitably reduce the volume of bond purchases, weak labor market data may provide some short-term momentum for gold, as investors will resist when the Fed eventually reduces its monthly purchases.

However, Dutch commercial investment bank ABN AMRO disagrees with Wall Street's version of gold. According to it, gold will cost $ 1,700 by the end of this year, and $ 1,500 per ounce next year.

Based on their analysis, gold has been stuck in a downward trend since June, while the strengthening of the US dollar and higher yields on US Treasuries are putting pressure on prices.

In addition, the markets began to evaluate a faster increase in Federal Reserve rates due to concerns about inflation, which put pressure on gold.

"This year, gold prices have decreased by 7.5%. The outlook for gold prices remains negative. We maintain our price forecast at the end of the year at $1,700 per ounce, and by the end of 2022 at $1,500 per ounce," writes Georgette Boele, senior precious metals strategist at ABN AMRO.

According to the analysis of the Dutch commercial investment bank, investors have adjusted their expectations regarding the Fed. They expect the US regulator to raise rates faster than previously thought. Moreover, the 2-year US Treasury bond yield and the 2-year real yield have risen to reflect this. In addition, the US dollar has grown by 5% this year.

It is worth noting that tightening monetary policy is usually bad news for gold, as it causes an increase in government bond yields.