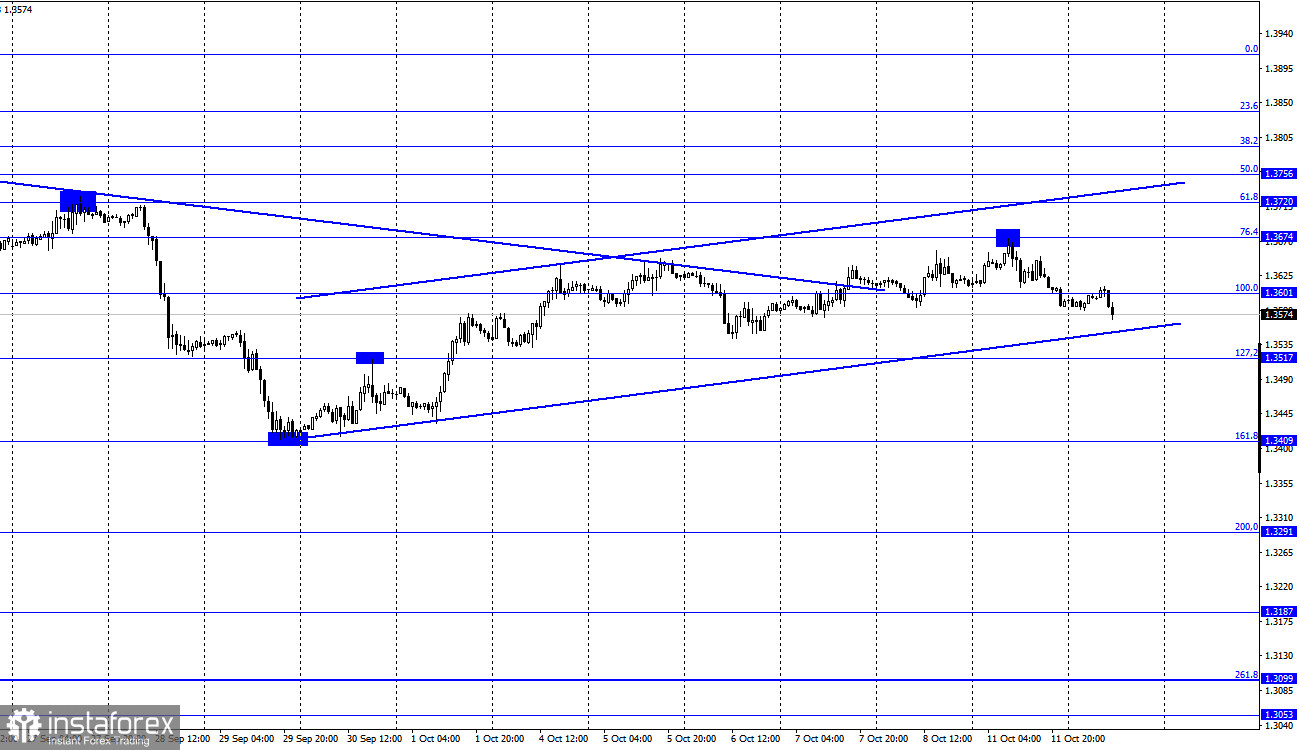

GBP/USD – 1H

Hello, dear traders! On the H1 chart, GBP/USD bounced from the 76.4% retracement of 1.3674, reversed, and went down to the lower boundary of the new trend corridor that indicated bullish sentiment. Calm trading in GBP/USD, as well as in EUR/USD, was observed in the market in recent weeks. It is difficult to explain why traders refrain from active trading. For example, trading was calm during the release of important macroeconomic reports in the UK today. Traders were closely watching this data. Thus, the UK's unemployment rate dropped to 4,5% from 4.6%, average earnings soared by 7,2% compared with the forecast of a 6,9% increase, and the number of people claiming unemployment benefits declined by 51.1 thousand. Given all that, the pound should have strengthened. Instead, it went down. In a couple of hours, however, it started to rise again. Anyway, the report cannot be responsible for such price behavior. Moreover, the quote started to move several hours after the release. The sterling is expected to remain bullish because of the ascending trend corridor. The pair may reverse today and extend the rally towards the 76.4% retracement of 1.3674. Perhaps traders will be more active during the North American session.

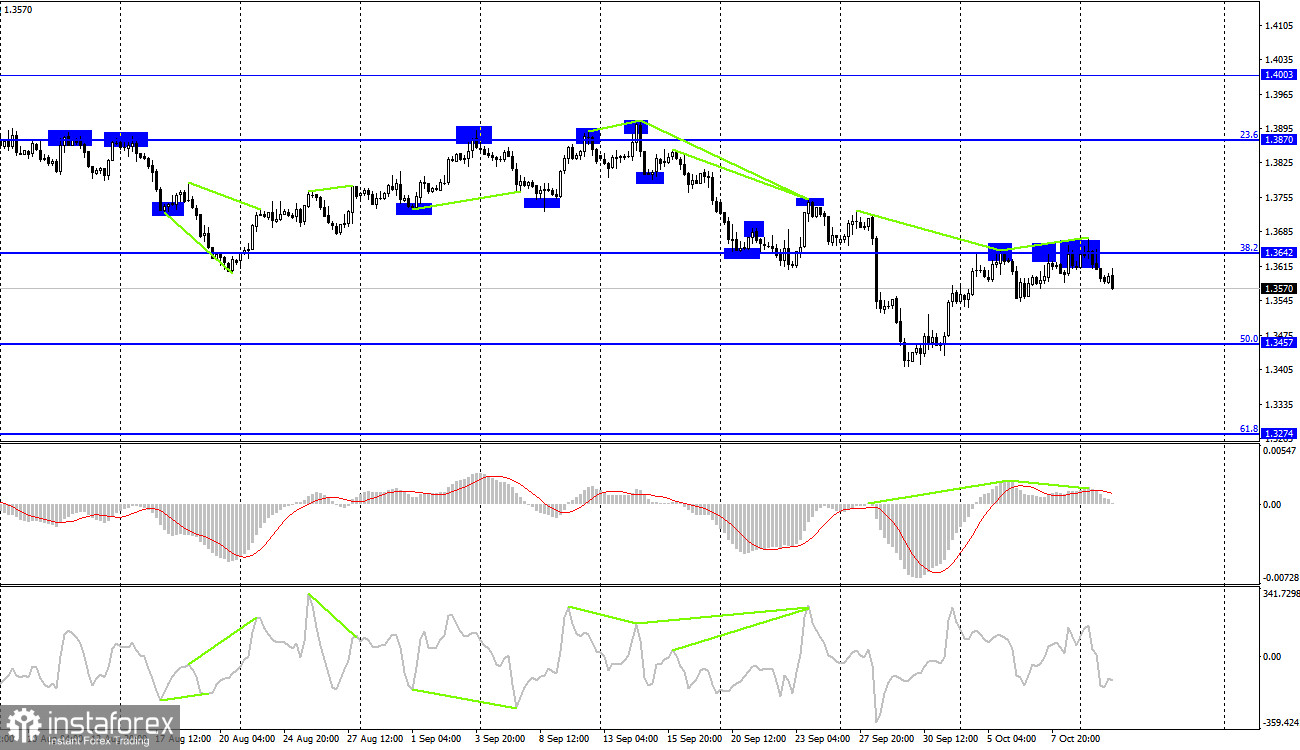

GBP/USD – 4H

On the H4 chart, GBP/USD bounced from the 38.2% retracement of 1.3642 for the third and fourth time and the MACD formed bearish divergence. The pound may well fall now. At the same time, bears are reluctant to trade actively. The pair has been trading near 1.3642 for several days unable to either fall or extend the rally. In case of consolidation above the 38.2% Fibo level, the price may rise to the 23.6% retracement of 1.3870.

The UK's macroeconomic calendar contains several important reports on Tuesday. They are Claimant Count, Unemployment Rate, and Average Earnings. All of them have already been released.

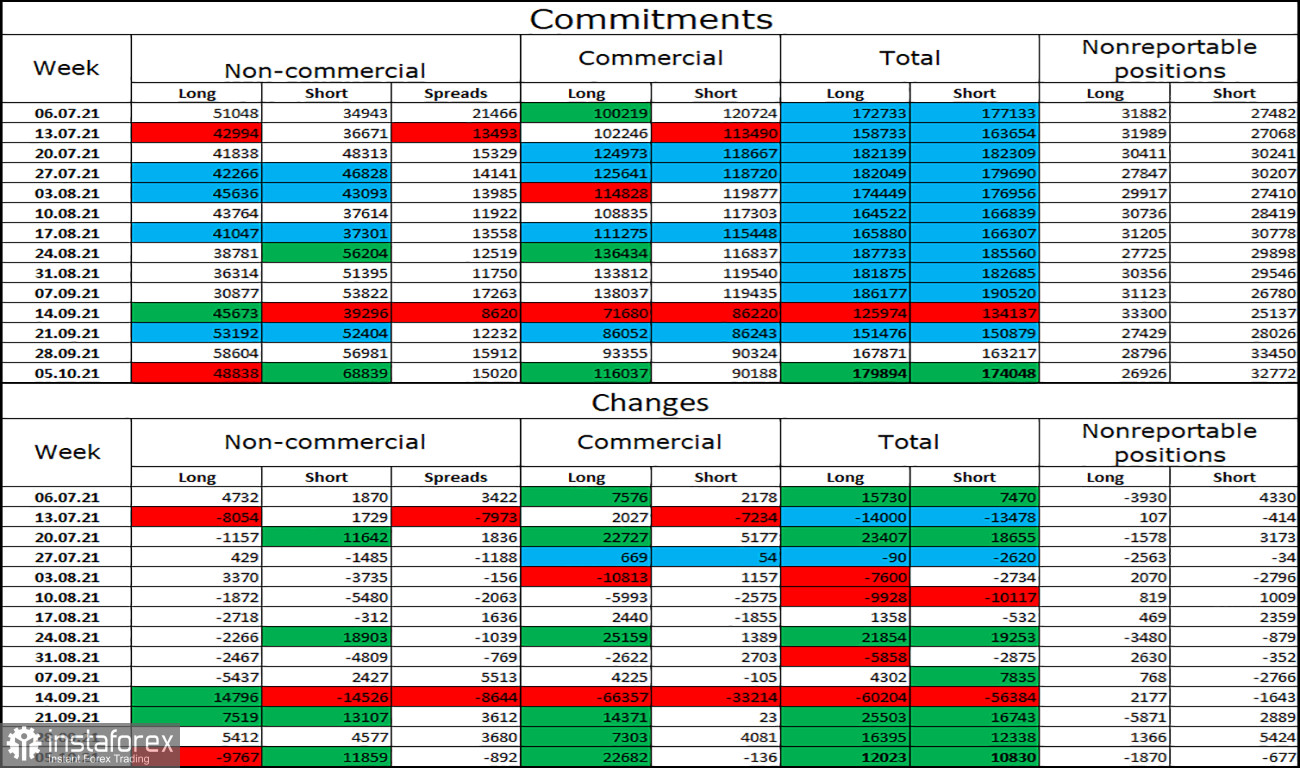

Commitments of Traders:

The latest COT report as of October 5 logged an increase in bearish sentiment. During the reporting week, speculators closed 9,767 long positions and opened 11,859 short ones. The number of short positions held by speculators is now exceeding the number of long ones by one-and-a-half times. All this shows an increase in bearish sentiment. For that reason, the pound may start falling soon. The level of 1.3642 may become an insurmountable barrier for bulls.

GBP/USD outlook:

It is wise to buy GBP when the quote consolidates above the 38.2% retracement of 1.3642 on the H4 chart with the target at 1.3720. I told you earlier to consider selling the pair because of a bounced from the level of 1.3642 on the 4-hour chart with the target at 1.3517. These positions can be held open for now.

TERMS:

Non-commercial traders are major market players: banks, hedge funds, investment funds, private, and large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, and companies that buy currency not to yield speculative profit, but to ensure current activities or export-import operations.

Non-reportable positions are small traders who do not have a significant impact on the price.