Bitcoin continues to rise and gradually moves to the resistance area of $ 58,000 - $ 60,000 to break through it. All this is accompanied by a surge in the on-chain activity and all-time record transaction volumes. In addition to the start of the bullish market, an important factor that caused such an extensive increase in interest in the main cryptocurrency was the launch of a revolutionary ETF fund on BTC. However, taking into account the historical context, some experts agree that the approval of the first full-fledged fund on Bitcoin will provoke a powerful sale of coins.

Pantera Capital's CEO Dan Morehead outlined this version of events. According to him, the launch of an ETF fund may be similar to the same period in 2017, when Bitcoin futures was released. Four years ago, this provoked an overheating of the market, and as a result, the price of the cryptocurrency declined by 83%. The entrepreneur said that the market will continue its bullish rally before the launch of a full-fledged ETF fund for Bitcoin, and gradually approach the historical record. After that, the price will strongly decline and a bearish market will begin.

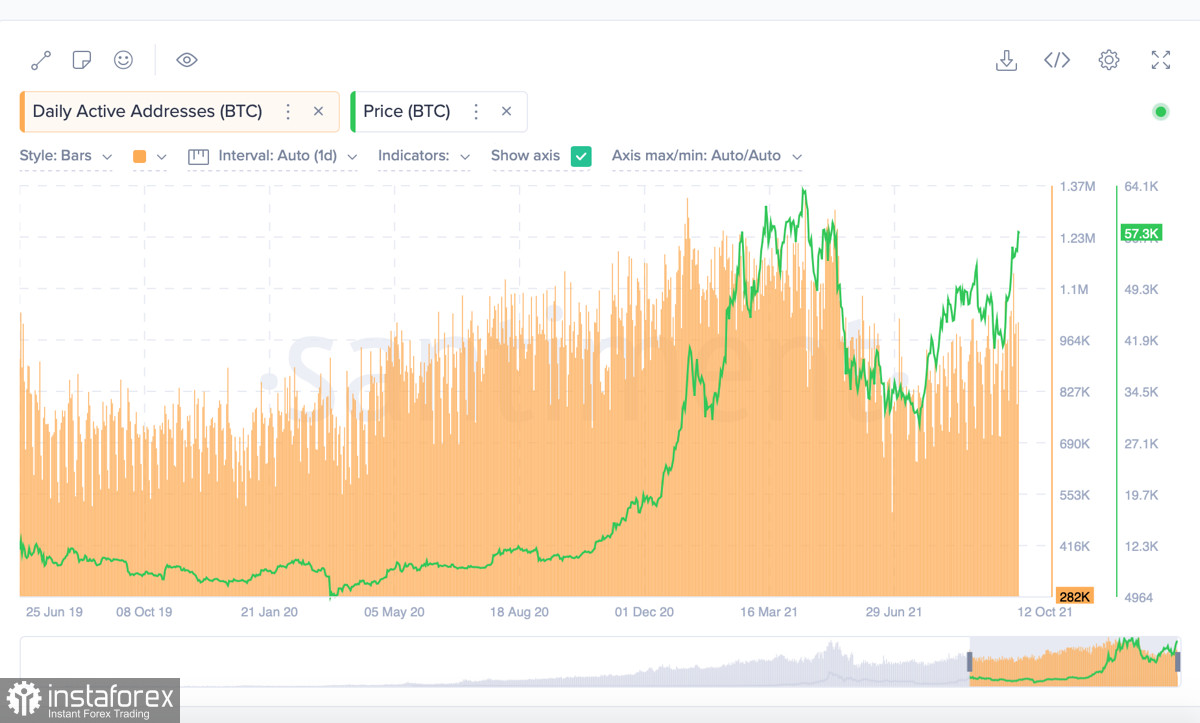

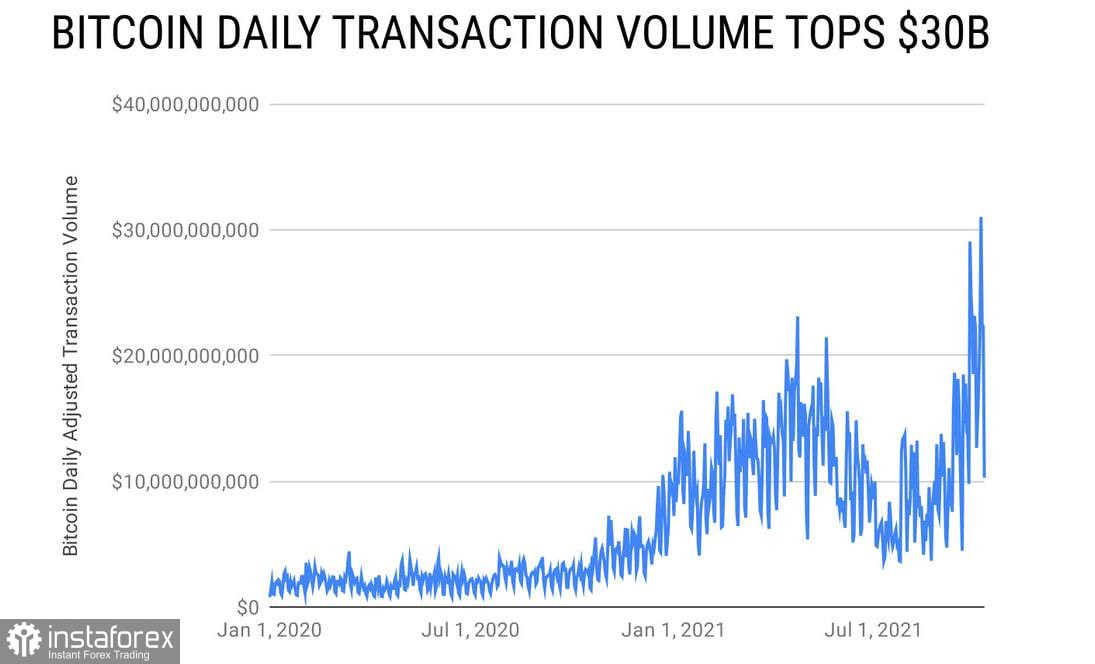

The main argument of Morehead is the historical context and excessive overbought market. This scenario is acceptable, but as of October 12, it is worth omitting that the BTC market is overbought. The main on-chain charts follow the price and show an upward trend. The number of unique addresses is growing along with the volume of daily transactions and the demand for bitcoin futures. In addition, the analysis of the MVRV metric for 365 days indicates that the market is only approaching a full-fledged bull market and the indicator shows an upward movement from the 14 mark. Therefore, the forecast that the Bitcoin market may collapse due to excessive hype, like 2017, is exaggerated.

But in case that this really happens, the altcoin market will gain an obvious advantage by reducing the dominance of BTC. Over the past few weeks, the main coin has significantly increased the level of its presence on the market as a whole, which put altcoins in an awkward position and slowed down their growth. So, if there will be a negative market reaction to the ETF fund on bitcoin futures and a further drop in price, the altcoin market will begin to recover much faster. This will increase the number of retailers who will enter the coins with short and medium-term plans. However, if this is not the case, then Bitcoin will continue to reduce the opportunities of altcoins and will become the number one coin again for the next bullish rally.

Meanwhile, the digital asset continues to stabilize near the area of $ 58,000-$ 60,000. Technical indicators still signal an imminent breakdown of this level, but strong pressure from sellers keeps quotes near the line, preventing them from crossing it. The bullish flag figure continues to form on the charts, and it is likely that Bitcoin will break through the level of $58,000 in the next two days, but it will fall to the local support zone later. This is proven by MACD indicators, which continue to grow, unlike the stochastic oscillator, which completes the formation of a bearish intersection. The relative strength index is also starting to decline towards 70. All this indicates signs of weakness of the current bullish momentum and without the support of a strong buyer, the metrics will decline, as will the price.