While the rest of the world is watching the development of the cryptocurrency market and bitcoin separately, two opposing countries have taken diametrically opposite positions regarding digital assets. The Chinese authorities are going to tighten the existing restrictions, while the US waits for the approval of four more applications for the launch of ETF funds on BTC. At the same time, the main cryptocurrency is enjoying a temporary lull and is increasing its audience, preparing to storm the final resistance area.

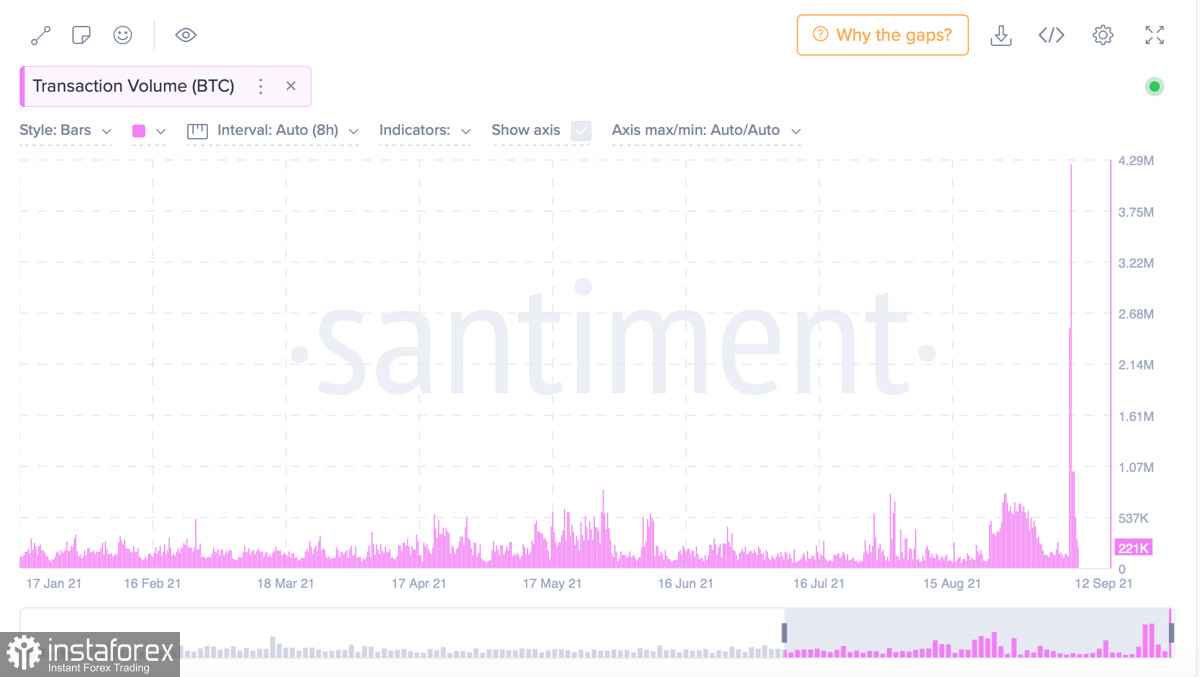

Thanks to the positive news background, the bitcoin price managed to show a significant increase over the past month. The on-chain analysis of the main coin indicates the preservation of the current dynamics of investor growth, which has already provoked record volumes of transactions in the asset network. In addition, most of the network companies associated with BTC began to make profits after reaching lows in early September. Despite this, the Chinese authorities plan to continue repressions against the cryptocurrency market and all those involved. Relevant government groups are considering the possibility of prosecuting traders and mining companies in the country. This idea was approved by the State Prosecutor's Office, as well as the Ministry of Public Security. Due to the tightening of the current rules, Chinese crypto exchanges are forced to accelerate the pace of account liquidation, which may provoke a local sale or interruptions in the operation of the network algorithms of the main coins.

At the same time, the US decided to launch the first bitcoin ETF fund in the country. The market took this step with enthusiasm, which was reflected in the network metrics of the cryptocurrency. By the end of October, the SEC has four more potential positive decisions on launching ETF funds for BTC futures. On cryptocurrency platforms, open interest in bitcoin futures continues to grow, which indirectly confirms the approval of at least one application. However, even with the current news background, the BTC/USD pair looks very strong and will soon begin storming the final resistance area of $58k-$60k.

In addition to bullish signals on the technical charts of the coin, the continuation of the bullish rally is evidenced by a powerful increase in activity on the on-chain metrics. First of all, it is worth noting the growth in the number of unique addresses in the coin network, which indicates that the dynamics of the expansion of the BTC retail audience remains. This is also confirmed by record transaction volumes and the minimum supply of assets on crypto platforms since 2017. Taking into account the historical context, the bullish rally of the main crypto asset has always been associated with the expansion and activation of the retail audience, thanks to which the cryptocurrency looks more confident during corrective falls.

However, the main factor that indicates the continuation of bitcoin's bullish rally is the 30-day MVRV reading, which is below zero. The metric is moving near the value of -3, which indicates that most investors purchased cryptocurrency at a loss. With the current positive market situation, this means that players will continue to store coins or accumulate volumes in anticipation of growth. On-chain metrics continue to grow, and this time there is no obvious divergence between price and indicators on the charts, which indicates a planned and logical growth.

In the near future, BTC will begin to test the strength of the sales range of $58k-$60k, after which the coin will open the road to a historical maximum. Most likely, the coin will not be able to conquer the resistance area on the first attempt, and therefore we are waiting for a systematic growth with local pullbacks to the support zones during this week. However, taking into account the changing news background and the activation of large capital that buys bitcoin instead of gold, the situation on the Bitcoin market may change in a few days.