Wave pattern

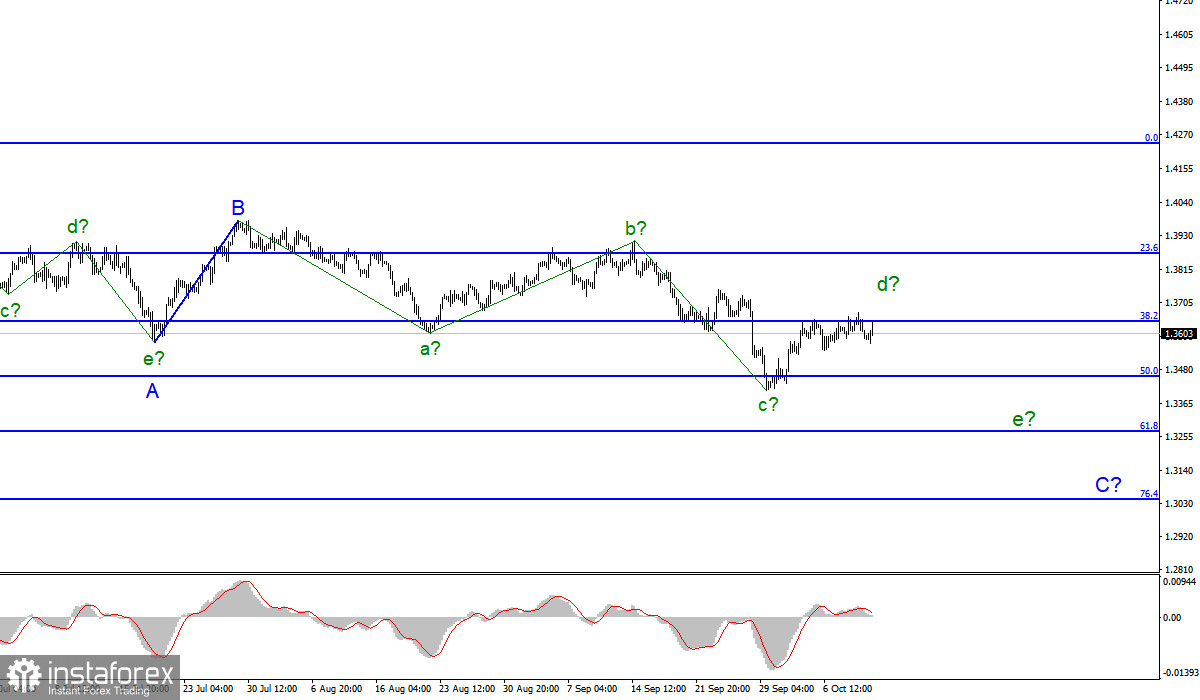

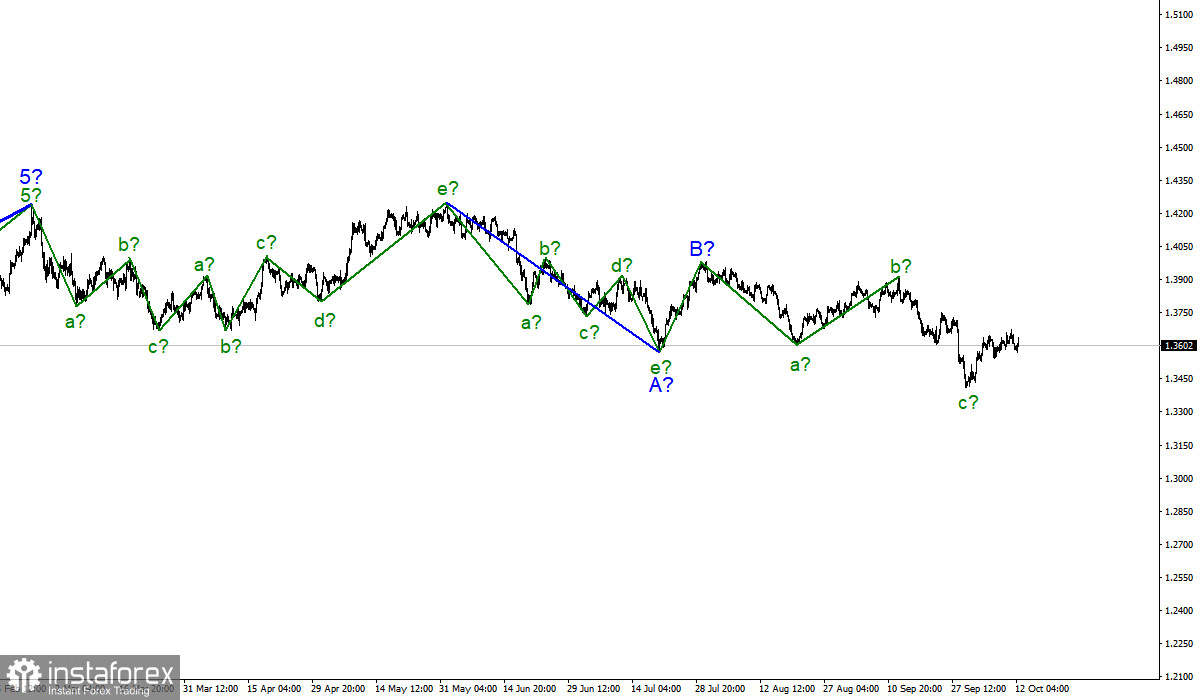

The wave counting for the Pound/Dollar instrument has become more complicated, and now it is expected to continue building a downward trend section. The instrument made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern and now it has acquired the form of a downward trend section, which can also be corrective in nature. This assumption is prompted by the internal structure of the proposed wave A, which cannot be called impulsive. Also, the assumed wave c in C assumed an absolutely non-impulsive form in this section of the trend.

At the moment, only three waves are clearly visible in it. However, within corrective structures, wave counts can be both three-wave and five-wave and take a very elongated form with complications. Thus, given the unsuccessful attempt to break through the 38.2% Fibonacci level, I expect the construction of a new downward wave, possibly e as part of c in C. A successful attempt to break through the 38.2% level may lead to the construction of a three-wave upward section.

There is little hope for the Fed's protocol, but the British statistics are not interested in the markets at all.

The exchange rate of the Pound/dollar instrument moved with an amplitude of about 35 basis points on Tuesday. This is about the same as the day before and the day before that. It is quite possible to talk about stability, but in general, the markets continue to trade the instrument very reluctantly. The same applies to the Euro/Dollar instrument. This is especially true for today, when reports on unemployment and wages have been released in the UK. It became known that the unemployment rate fell to 4.5% in August, and wages in the same month increased by 7.2%, taking into account premiums.

However, the British pound practically did not react to this information in any way. Moreover, immediately after the release of these data, a decline in the pound followed, then an increase, and now the quotes have returned to the positions of this morning. Tomorrow the situation may be different, as several more important reports will be released in the UK, including GDP for August and industrial production. In addition, a report on US inflation and the minutes of the Fed meeting will be released tomorrow.

Given how reluctant the markets are to trade reports, maybe at least the Fed minutes will interest them? The main question to them is: has the mood of the monetary committee members become more "hawkish"? Let me remind you that many members of the Fed board and presidents of federal banks have already spoken in favor of tapering the QE program. If their number has increased or the rhetoric has become more "tough" on this issue, this may further increase the demand for the US currency.

General conclusions

The wave pattern has changed dramatically in recent weeks. It received a downward view, but not an impulse one. Therefore, now I advise you to sell the instrument for each MACD signal based on the construction of wave C, which can turn out to be quite long, with targets located near the calculated mark of 1.3273, which corresponds to 61.8% Fibonacci. An unsuccessful attempt to break through the 1.3643 mark indicates that the markets are not ready for further purchases of the British pound, so now the construction of a new downward wave may begin.

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward trend section has been canceled and now we can assume that on January 6, the construction of a new downward trend section began, which can turn out to be almost any size.