Before the publication of the September inflation report, the CEO of the Federal Reserve Bank of Atlanta, Bostic, said that inflation is probably not temporary, but long-term. Speaking at the Institute for International Economics, Bostic said that "the intense and widespread supply chain disruptions that cause buoyant price pressures will not be short-lived. He also added that the forces that create inflation are not temporary."

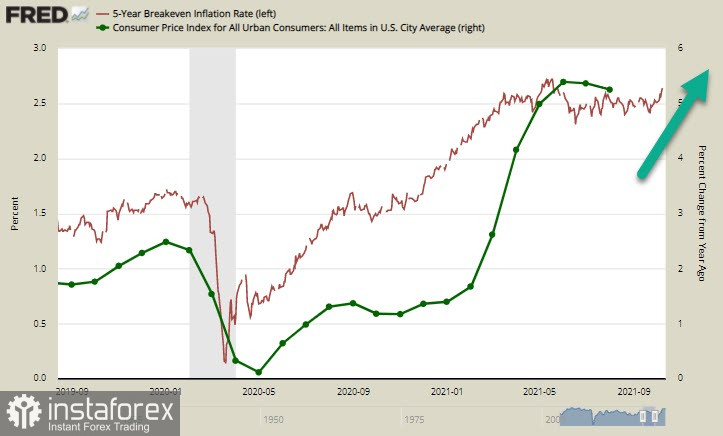

Bostic's statement actually draws a line under the uncertainty over the Fed's plans. An increase in inflation requires a reaction, which increases the chances of an early start of curtailing incentives. The yield of inflation-protected 5-year TIPS bonds, which are an excellent indicator of inflationary expectations in the business environment, went up again after a short period of consolidation.

It can be assumed that the US dollar will continue to strengthen across the entire spectrum of the currency market.

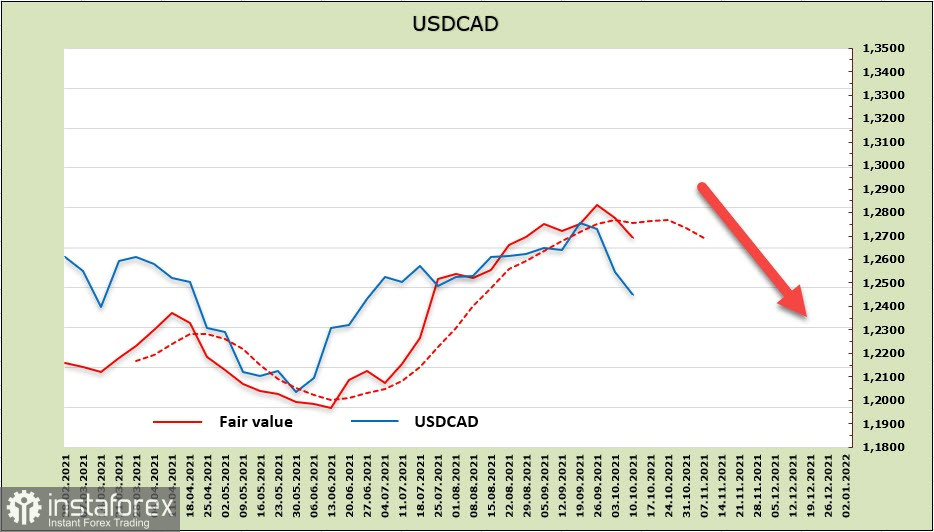

USD/CAD

The Canadian dollar looks noticeably stronger than most commodity currencies, maintaining a bullish orientation against the dollar. In addition to the general market factors supporting commodity prices, Canada has a number of additional strong factors.

Judging by a number of reports published last week, there are no weak spots – exports are growing amid falling imports, construction activity is high, and consumer demand is also showing no slowdown. Second, the state of the labor market is noticeably better than in the United States. Canada's employment rose by 157 thousand people, returning to pre-pandemic levels, while the number of jobs in the US is 3.2% which was lower than it was before the pandemic. The number of hours worked rose by 1.1% m/m, which is good for GDP, meaning the prospects for seeing strong GDP growth in Q4 are higher.

The settlement price is directed downwards despite the fact that the Canadian dollar's short position increased by 540 million based on the CFTC report. This means that the bearish impulse for the USD/CAD pair has not yet been completed.

The USD/CAD pair is trading near the support level of 1.2455 on Wednesday morning, which represents a 50% pullback from the June growth. Technically, a local bottom can be found here before an upward reversal, but since fundamental factors support the strengthening of the Canadian dollar, we expect that an attempt will be made to reach the next support level of 1.2363. In any case, the US dollar will regain the initiative in the long term, but until that happens, the CAD has the opportunity to slightly strengthen.

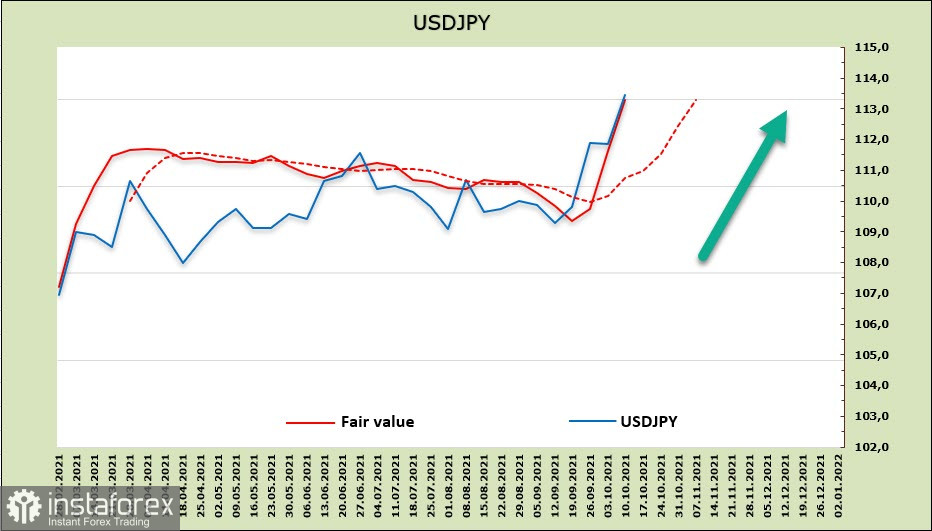

USD/JPY

The CFTC report showed a minimal change in the yen's net short position for the reporting week (+117 million). The accumulated short position (-7.143 billion) is too large to ignore. The futures market is clearly bearish for the yen, and major players see the prospect of its further decline. The estimated price is steadily rising.

The general state of Japan's economy is contradictory. Macroeconomic indicators look generally stable. Orders for equipment declined in August after an increase in July, but the drop is insignificant, and most likely, the volume of orders will remain at current levels. At the same time, consumer demand is stable, and the only thing that can destroy long-term calculations is the dynamics of energy prices. Japan is a net importer of raw materials, so the current dynamics contribute to the weakening of the yen.

As for the financial sector and the plans of the Bank of Japan, everything is much worse here. Koji Yano, Deputy Finance Minister, wrote an article for the November issue of BungeiShunju monthly magazine, in which he compared the state of Japan's public finances to the Titanic. The article had a deafening effect, as it came out just before the likely announcement of new government spending. Yano warns that Japan "faces a very real danger," since plans to further increase incentives threaten to bring down the entire management pyramid.

It is clear that the article has more political than economic direction, but one fact cannot be ignored. While most central banks are preparing to roll back stimulus programs, Japan is expanding it. Accordingly, the outlook for the yen is becoming increasingly bearish.

It can be assumed that further growth of USD/JPY is almost inevitable. The nearest resistance is 114.50/70, while the long-term target of 125 is quite likely before the end of the year.