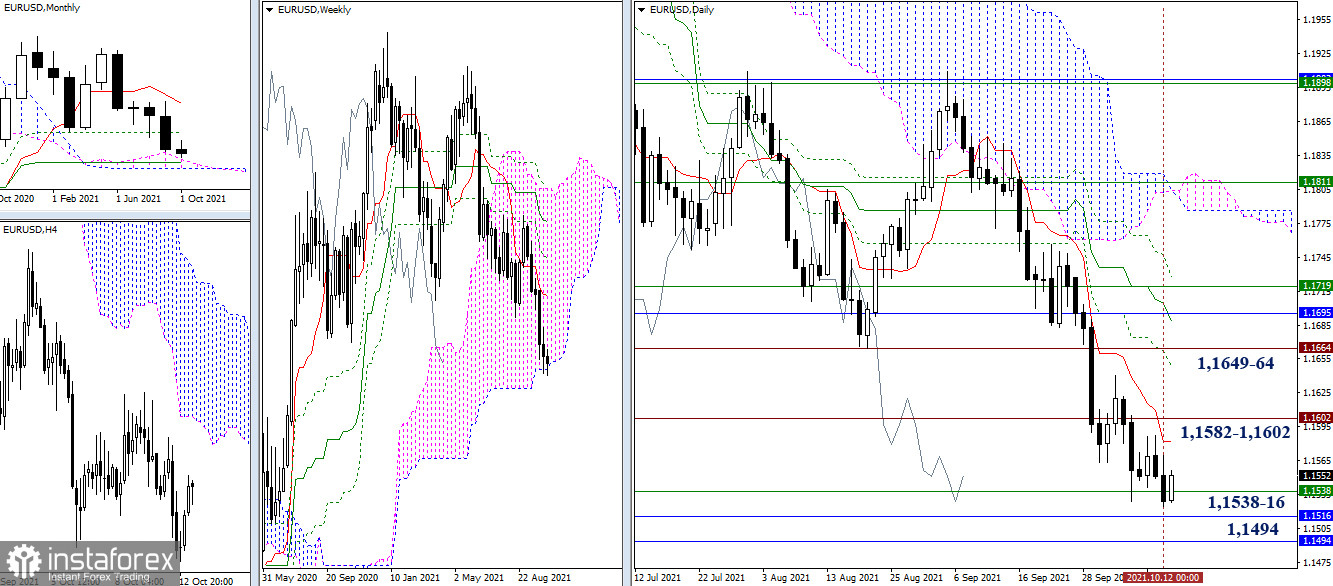

EUR/USD

The situation has not changed significantly in recent days. The bears continue to struggle to break through the encountered support levels of 1.1538 (the lower limit of the weekly cloud) - 1.1516 (the upper limit of the monthly cloud) - 1.1494 (medium-term monthly trend). This is their main task in this area. But if the opponent manages to implement the next upward correction, then we can consider the next resistances waiting in the area of 1.1582 - 1.1602 (daily short-term trend + historical level) and further at 1.1649-64 (daily Fibo Kijun + historical level).

The euro went into an upward correction after testing the support of the classic pivot levels and forming the low yesterday. On the hourly chart, there is an interaction with the key levels 1.1541 (central pivot level) - 1.1556 (weekly long-term trend) of the lower timeframes. A consolidation above and reversal of moving averages will change the current balance of forces. To strengthen the bullish mood today, the levels of 1.1587 - 1.1604 (resistances of the classic pivot levels) can be useful. However, a rebound from the tested levels will bring the bears back to the market. Their pivot points are set at 1.1512 - 1.1495 - 1.1466 (classic pivot levels).

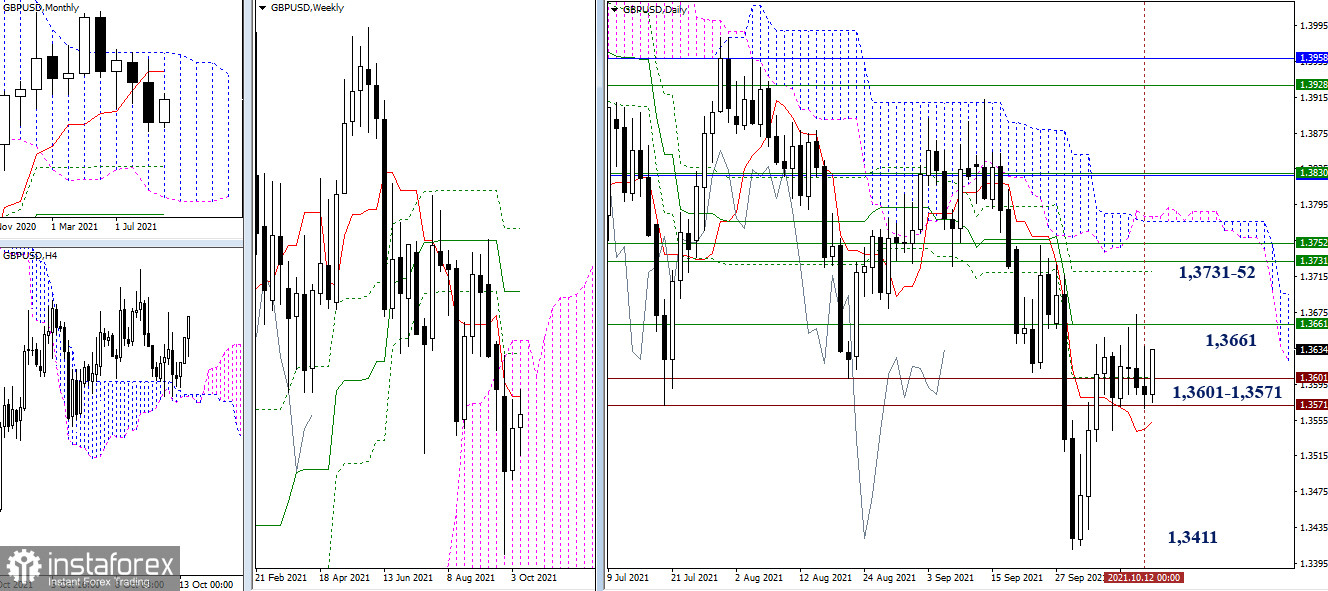

GBP/USD

Recently, consolidation has been maintained between the resistance of 1.3661 (weekly short-term trend + daily medium-term trend) and the supports of historical levels (1.3571 - 1.3601). Going beyond the designated borders will provide opportunities to change the situation and open up new prospects. For the bulls, the next pivot point will be the area of 1.3731-52 (the upper limit of the weekly cloud + weekly Fibo Kijun). As for the bears, the main interest is to shift to updating the low (1.3411) and restoring the downward trend.

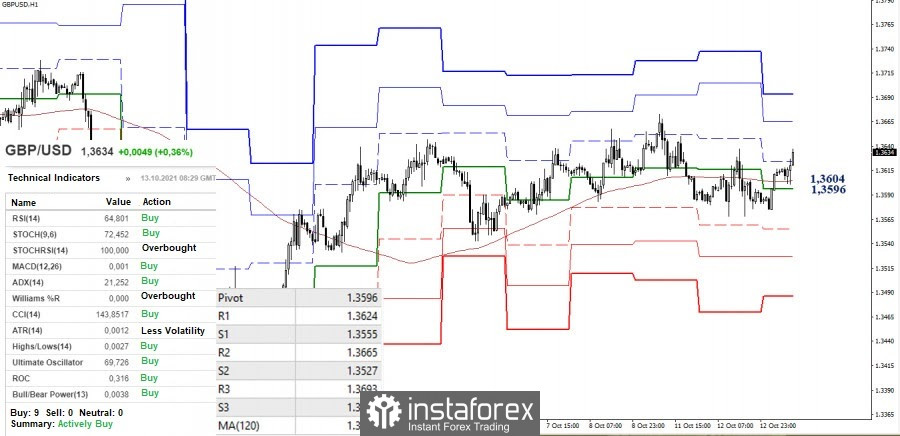

In the smaller time frames, daily consolidation leads to the fact that the pair trades with varying success on each side, continuing to remain in the attraction and influence zone of key levels, which are located at 1.3596 (central pivot level) and 1.3604 (weekly long-term trend) today. These classic pivot levels form benchmarks. At the moment, the upward pivot points can be noted at 1.3665 (R2) and 1.3693 (R3), and the downward ones are at 1.3555 (S1) - 1.3527 (S2) - 1.3486 (S3).

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.