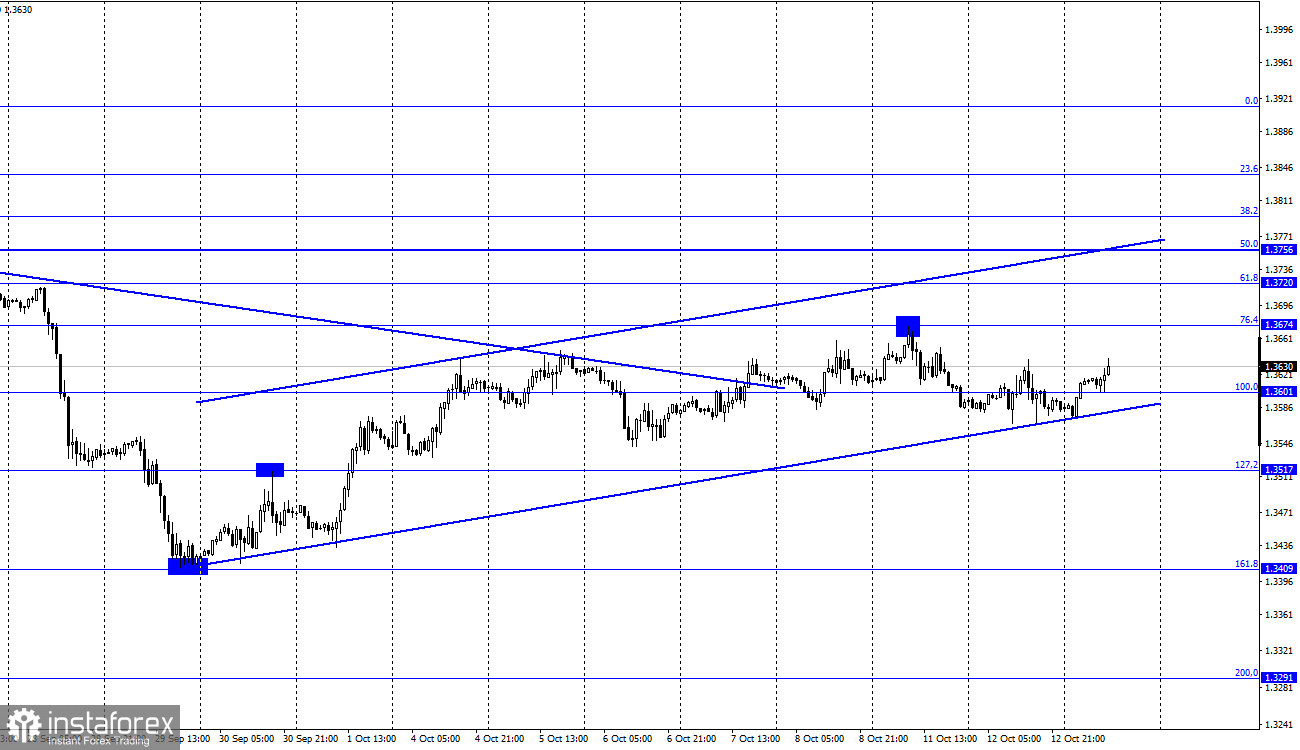

GBP/USD - H1.

Hello, dear traders! According to the hourly chart, the GBP/USD pair has bounced off the lower border of the ascending corridor, which means that the current market sentiment is bullish. The quotes are likely to rise to the retracement level of 76.4%, 1.3674, and even above. If the price fixes below the ascending channel, the US currency will have a chance to recover. In this case, the pair will most likely drop to the levels of 1.3517 and 1.3409. Yesterday's fundamental factors could have contributed to the British pound's growth. However, despite the lower unemployment rate and a significant increase in average earnings, the pound sterling failed to close the previous trading day with gains. Today's macroeconomic calendar included reports on GDP for August (+0.4% m/m - below analyst expectations) and industrial production for August (+0.8% m/m - above analyst expectations). After the release of these reports, the British pound advanced by 25 pips. However, its uptrend remained very weak.

Traders seem to have calmed down after the fuel chaos gripping Europe and have taken a wait-and-see approach. Today, market participants have shifted focus to data on US inflation, which is expected to remain unchanged at 5.3% y/y, as well as the Fed's meeting minutes. Both events are very important for traders. If US consumer prices decline, the British pound will gain in value. If the Fed does not drop any hints about the end of the stimulus program, the pound/dollar pair will most likely go up. Today, the US dollar will seek support from these two events. However, it makes no sense to predict the content of the FOMC minutes. The hawkish rhetoric has intensified lately, with an increasing number of Fed members supporting a reduction in asset purchases. Nevertheless, no one knows what it would be like this time.

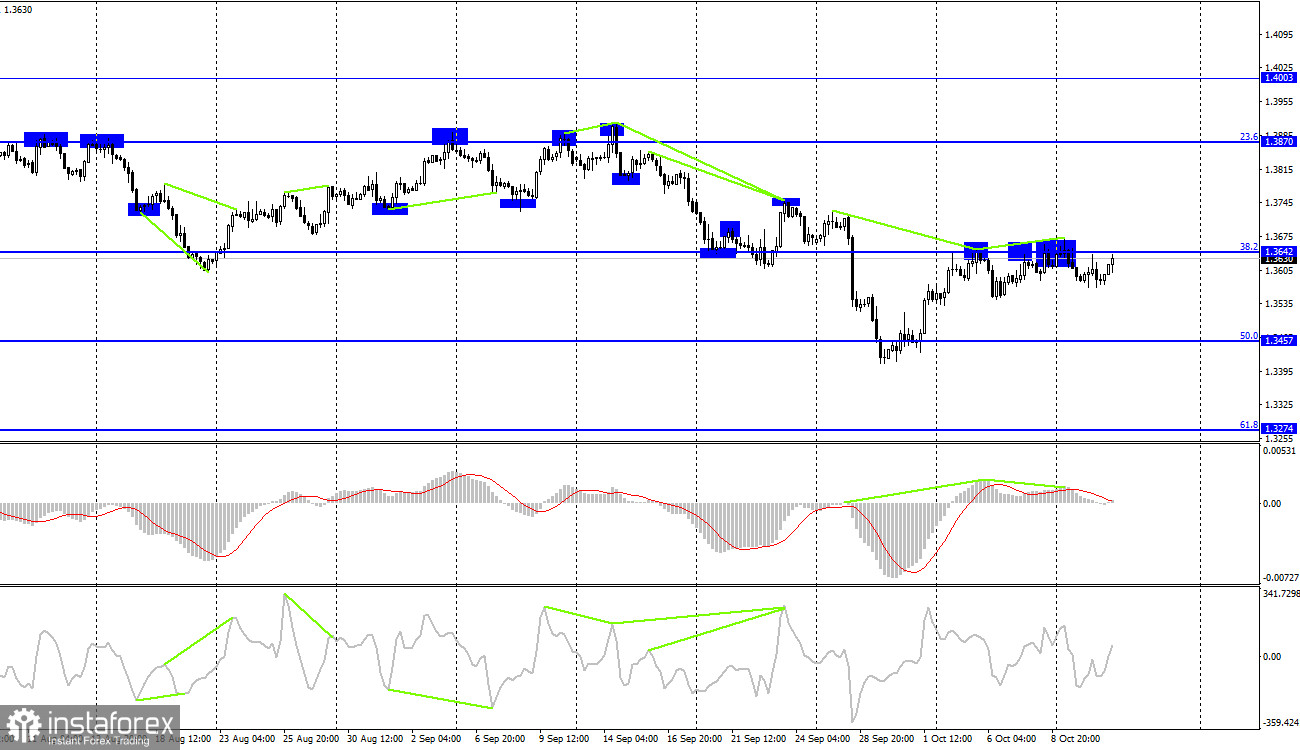

GBP/USD - H4.

According to the 4-hour chart, the GBP/USD pair returned to the 38.2% retracement level, the 1.3642 mark. Therefore, the pound sterling has every chance to resume its bearish trend. However, bears are not active. Thus, the pair has been trading near the level of 1.3642 for several days, but it cannot either start falling or continue rising. If the price consolidates above the Fibonacci level of 38.2%, the pair will most likely extend gains, approaching the retracement level of 23.6%, that is, 1.3870. Even despite two bearish divergences, the pair failed to go down.

Today's macroeconomic calendar includes the following reports from the US and UK:

UK - GDP.

UK - Industrial Production.

US - Consumer Price Index.

US - FOMC meeting minutes.

The most significant reports from Britain have already been published. Thus, market participants are awaiting statistics from the United States. Notably, the morning reports released by Britain have hardly caused any reaction from traders.

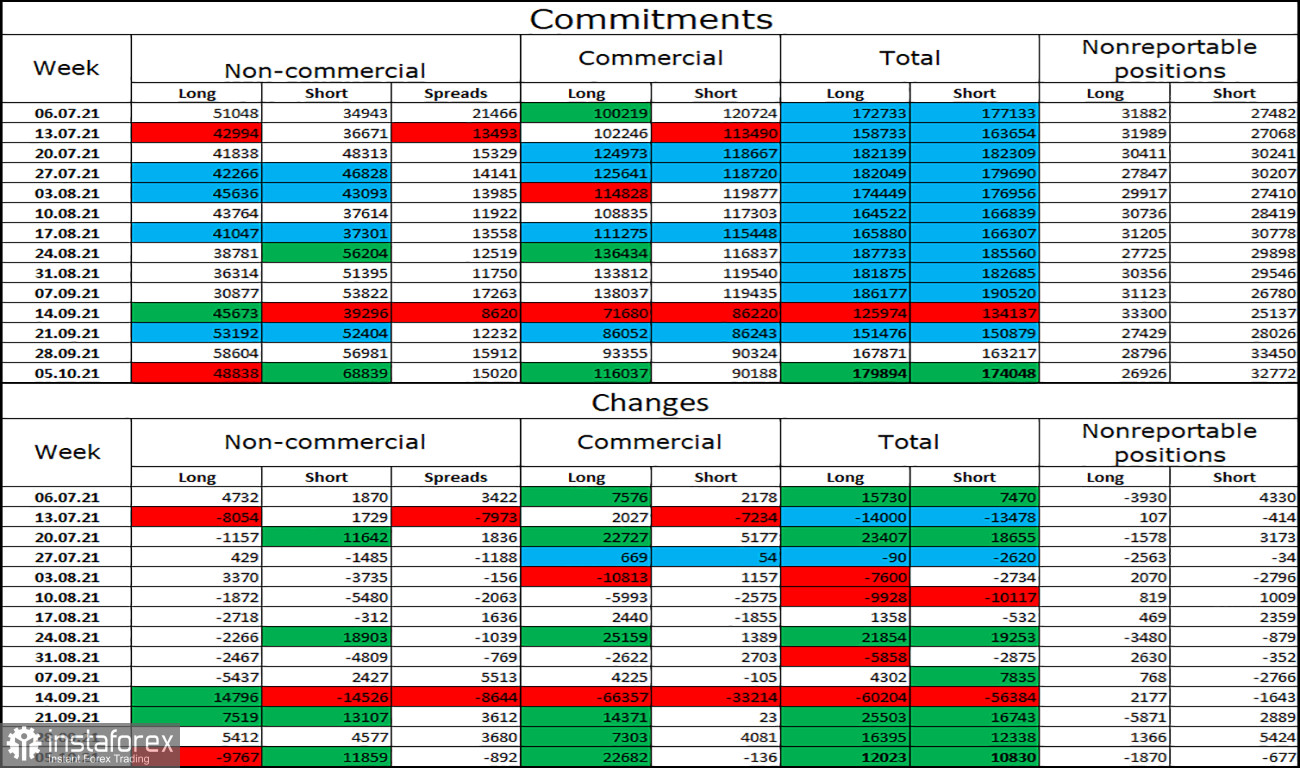

COT (Commitments of Traders) report:

The latest COT report posted on October 5 showed that the sentiment of major market players had become more bearish. During the reporting week, speculators closed 9,767 long positions and opened 11,859 short positions. Thus, bearish sentiment became stronger by about 20,000 contracts. Now, the number of short contracts exceeds the number of long ones by one and a half times. This suggests that the British pound may resume its downward trend in the near future. The pair's bullish run can be limited by the level of 1.3642.

GBP/USD forecast and recommendations for traders:

Long positions on the pound sterling can be opened when the quotes close above the Fibonacci level of 38.2%, the 1.3642 mark, on the 4-hour chart. The level of 1.3720 can be seen as a target. Earlier, I recommended going short with a view to reaching the target level of 1.3517 as the quotes had bounced off the level of 1.3642 on the 4-hour chart. These trades can still be held open.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy a currency not to obtain speculative profit but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a severe impact on the price.