American inflation did not disappoint – the main components of today's data came out either at the level of forecasts or in the green zone. The US dollar reacted to the publication accordingly, strengthening throughout the market. However, dollar bulls did not have to rest on their laurels for a long time – the declining Treasury yields pulled the greenback like an anchor. As a result, the EUR/USD pair reflexively declined by almost 50 points, but immediately resumed corrective growth. Buyers of the pair are trying to make the most of the temporary weakness of the greenback in order to approach at least the local high of 1.1585 (Tenkan-sen line). The previous attempt at a corrective recovery ended precisely in this price area. At the moment, EUR/USD buyers cannot even approach the specified price barrier, let alone overcome it.

At first glance, today's publication went unnoticed. Traders showed a relatively small and rather formal reaction. And yet, in my opinion, the inflation release will remind you of itself - including in the context of the prospects for tightening the parameters of the Fed's monetary policy.

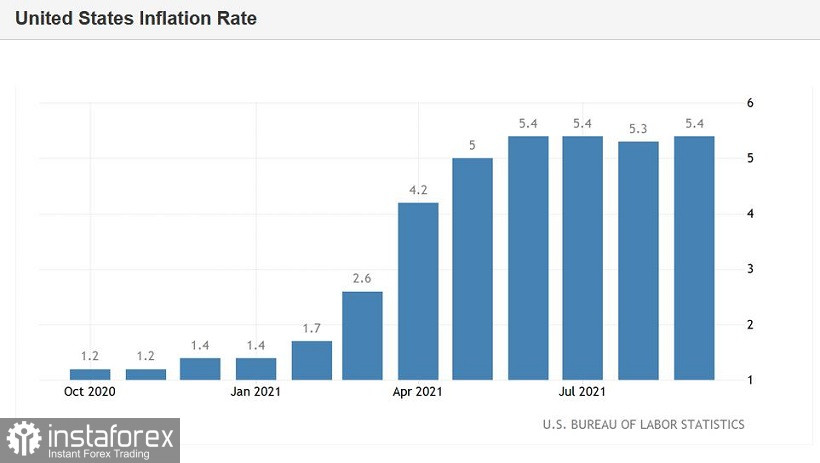

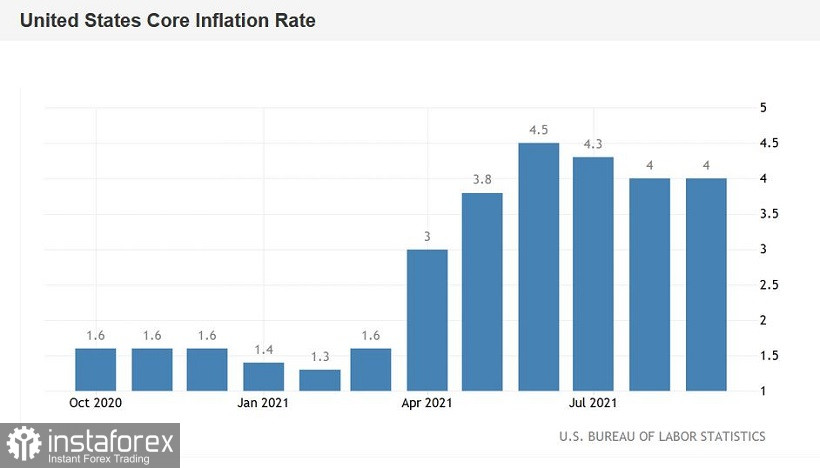

According to the data published today, the overall consumer price index in September accelerated to 5.4% YoY (with a forecast of growth up to 5.3%). At this level, the overall CPI was released in August and July, and before that - back in 2008. On a monthly basis, the index also showed positive dynamics, rising to 0.4% (after a two-month downward movement). The core CPI, excluding volatile food and energy prices, came out at the level of forecasts: an increase of up to 0.2% was recorded in monthly terms, and up to 4.0% in annual terms.

Today's figures suggest that the US Federal Reserve will indeed begin to curtail the stimulus program at the next meeting, which will be held on November 3. The Fed representatives who spoke yesterday (Richard Clarida and Rafael Bostic) confirmed these intentions. The Vice-president of the Federal Reserve, in particular, stated that "all conditions have been created for this," and the head of the Atlanta Federal Reserve in this context urged not to turn off the planned course, ignoring the autumn weakening of the labor market.

But, as you know, "appetite comes with eating." The market actually played back the curtailment of QE – an extra confirmation of this fact provides only temporary support to the greenback. Whereas the prospects of tightening the parameters of monetary policy are already perceived differently by dollar bulls. Partly for this reason, the dollar reacted so coolly to today's inflation report – the published figures only reinforced the confidence that incentives will begin to "cut" next month, while the fate of the interest rate remains in limbo.

There is an opinion in the market that the Fed will be forced to stop the growth of inflation indicators by raising rates next year. Jerome Powell theoretically allowed the probability of such a scenario. In his speech in Congress at the end of September, he said that the US regulator "should consider raising rates if it sees evidence that rising prices are forcing households and companies to expect higher prices to take root, creating more stable inflation."

Again, in this context, it is necessary to recall the results of the last Fed meeting. According to the updated point forecast, half of the 18 members of the Committee reported that they expect an interest rate increase by the end of 2022. At the same time, according to the results of the June meeting, only seven members of the Fed did not rule out this scenario – 2023 was then an absolute priority.

Against the background of the "hawkish" intentions of the Federal Reserve, the European Central Bank looks like an antipode. The majority of ECB representatives (the overwhelming majority) declare that the regulator will continue to implement a soft monetary policy, despite the increase in inflation in the eurozone. For example, yesterday the head of the Bank of France, who is also a member of the ECB Governing Council, reminded the markets that the curtailment of the Pandemic Emergency Purchase Program (PEPP) "will not be the end of the accommodative policy." At the same time, he expressed concern that inflation may be below the target both in the second half of 2022 and in 2023. Such a situation, according to him, "requires continued monetary support." A similar position was voiced the other day by the ECB's chief economist Philip Lane, saying that the medium-term dynamics of inflation "is too slow." He also called for ignoring the current inflationary growth, as it is provoked, in his opinion, by "only temporary factors" – in particular, the rise in the cost of energy.

In other words, the Fed and the ECB are still at different poles, declaring opposite intentions. This fact will not allow EUR/USD buyers to reverse the trend in the foreseeable future. And therefore, any upside pullback on the pair can be regarded as a temporary correction. In this case, the greenback follows the Treasury yields, which have declined quite sharply today. In my opinion, the current upside momentum can be used as an excuse to open short positions, since the general fundamental background is in favor of the dollar (and against the euro, which is important).

Technically, the pair on the daily chart is between the middle and lower lines of the Bollinger Bands indicator below all the lines of the Ichimoku indicator, which demonstrates a strong bearish "Parade of Lines" signal. The main support level (the target of the downside movement) is 1.1510 - this is the lower line of the Bollinger Bands indicator on the same timeframe.