The Fed's September meeting minutes published yesterday left mixed feelings. On the one hand, the tone of the report is predominantly hawkish and meets the general expectations of dollar bulls. On the other hand, the comments of the regulator's dovish members led to a weaker US dollar yesterday. Falling Treasury yields exerted pressure on the greenback yesterday despite an increase in inflation and the publication of the FOMC minutes. As for EUR/USD, buyers approached 1.1600 by breaking the intermediate resistance level of 1.1580 (the Tenkan-sen line on the D1 chart). Even dovish comments of the ECB's representatives (Villeroy and Lane) could not reverse the pair. All this indicates that the greenback keeps playing first fiddle. Anyway, there is a flipside in the current situation: as soon as a correction ends, the bearish trend in EUR/USD will start whether we want it or not.

Let's get back to yesterday's FOMC minutes. After the September meeting, the US central bank updated its dot plot. Meanwhile, the greenback ignored the outcome of the meeting. The Fed's officials did not disappoint dollar bulls but fell short of their expectations. Ahead of the meeting, some analysts were talking about a hawkish surprise. Yet, nothing of the sort happened. The American regulator decided not to rush. That is why a mass USD sell-off took place after the FOMC meeting ended. Traders simply acted according to the 'buy the rumor, sell the fact' strategy.

The FOMC minutes were not sensational as well. However, the report opened the veil of secrecy as to the QE tapering algorithm. The Federal Reserve members discussed a rough plan that involved reducing the volume of asset purchases by $15 billion per month, Treasuries by $10 billion, and mortgage bonds by $5 billion. At the same time, some Fed representatives said they would prefer to curtail bond-buying at a faster pace.

Unfortunately, the minutes do not disclose how many FOMC members do or do not support the initiative. Market participants have to draw their conclusions based on what the Fed has said. Although some members opposed and others approved the approximate tapering date, many of them eventually agreed that the reduction in asset purchases could begin this year and be completed by mid-2022.

However, it remains unclear as to when exactly the regulator will start tapering. The document states that more than half of the Committee members consider December to be the most likely date for the first QE reduction. Meanwhile, some members assume that tapering could begin in November. Overall, the Fed expects to end the process in July next year.

As for the future of the interest rate, the Fed sounds more hawkish. According to the minutes, some FOMC members stated that the economic conditions in the country justify keeping the interest rate at the current level for the next two years. They pointed to the unstable recovery of the labor market and low employment and also suggested that inflation would remain under bearish pressure in the coming years.

At the same time, some members, on the contrary, said they expected interest rates to be raised by the end of next year. They assumed that employment and inflation could reach their targets by that time.

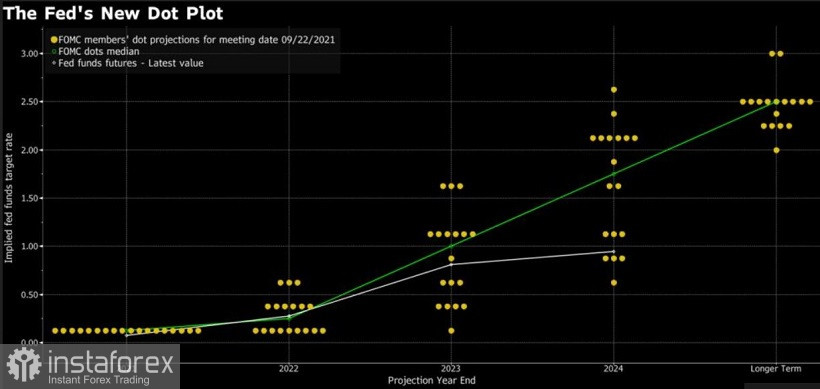

Let's compare this information with the updated dot plot published after the September meeting. As a reminder, 9 members of the Committee predicted that the first rate hike would take place in 2022. Meanwhile, the regulator admitted that it would raise the federal funds rate three times in 2023.

All in all, the Federal Reserve maintains its course aimed at stabilizing monetary policy with a subsequent increase in interest rates. The report has a hawkish tone with some dovish notes in it. Overall, the regulator is gradually changing its stance on monetary policy to hawkish (for example, if we compare the September minutes with the June report after which the dot plot was also published).

All this suggests that the current decline in the greenback has not been caused by the publication of the FOMC minutes and is only temporary. Speaking of EUR/USD, the greenback has a significant advantage over the euro. While the Fed is discussing the date of QE tapering (which is likely to begin this year anyway), the European Central Bank keeps saying that its monetary policy will remain accommodative even without the PEPP. At the same time, the European regulator will consider the issue of raising interest rates as earlier as 2024.

After a breakout of the resistance level at 1.1580 (the Tenkan-sen line on the D1 chart), the price is expected to go to the next barrier at 1.630 (the middle Bollinger Bands line of the D1 chart). If the quote slows down in this range, you should consider selling the pair with the target at 1.1580 (the Tenkan-sen line) and 1.1530 (the yearly low).