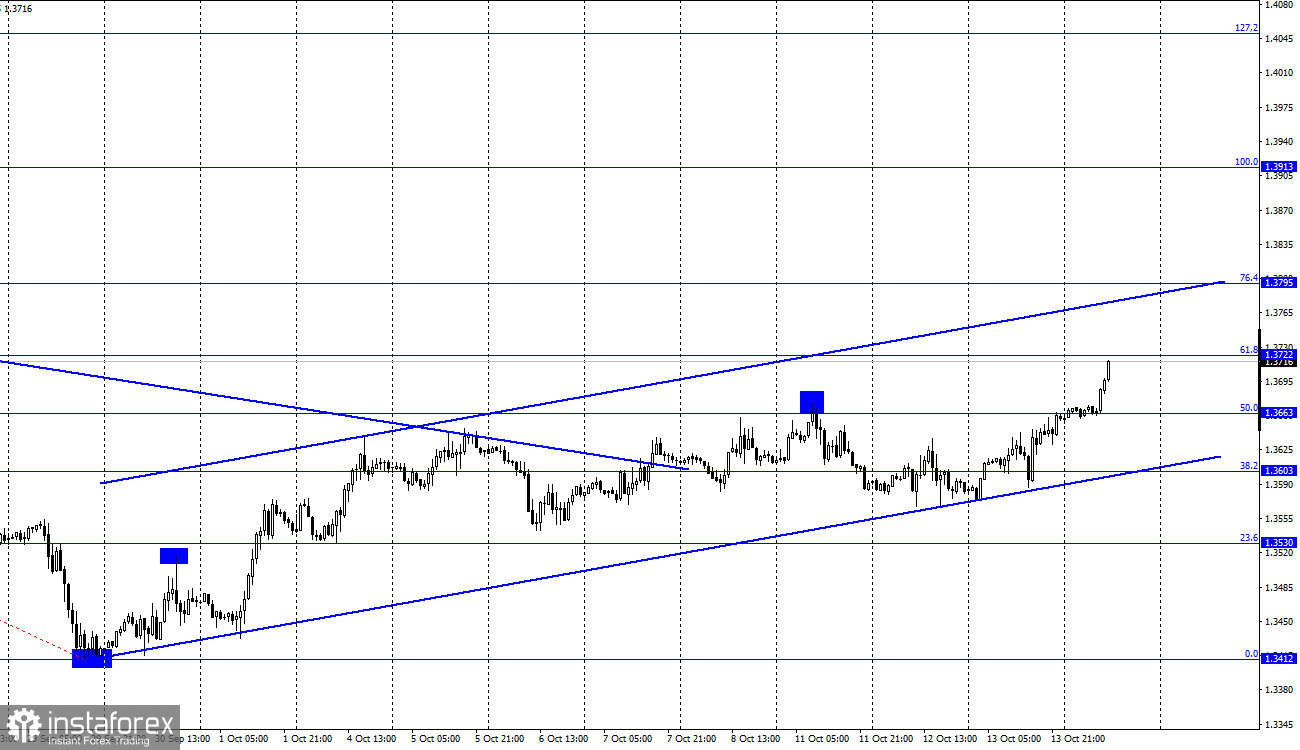

GBP/USD – 1H

Hello, dear traders! According to the hourly chart, the GBP/USD pair has performed a rebound from the correction level 38.2% at 1.3603 and the bottom line of the uptrend corridor. Consequently, GBP/USD has resumed its growth, and the quotes have already closed above the level of 1.3663 and reached 1.3722. The upward trend continues to maintain the bullish mood of traders. If the euro has just started to rise, the British pound continues its growth. The UK's releases were quite ambiguous yesterday. First, the GDP report was weaker than traders expected. On the contrary, the UK industrial production report turned out to be better. Anyway, the changes started after the US inflation report was published in the second half of the day. Besides, the US dollar started a new wave of growth, which was absolutely expected, considering rising inflation to 5.4% yoy. However, just in half an hour, the pound began to increase, though there were no visible reasons for that.

The FOMC minutes were published late at night, which I have already analyzed in the article about euro-dollar, did not change traders' expectations. The GBP rose by another 55 points, though no news or reports were released this morning. Consequently, the British currency now continues its growth, according to the upward trend. Bear traders in both pairs are likely to have made huge profits. Besides, it is high time for bulls to take action. There are almost no UK or US releases today. However, the GBP may continue to demonstrate further growth, though there is no correlation between the news background and the pound's rise. This week the US significant retail trade report is also due tomorrow. It may cause a reaction of traders similar to inflation. Otherwise, traders have their own trading strategy now and do not pay much attention to the economic reports.

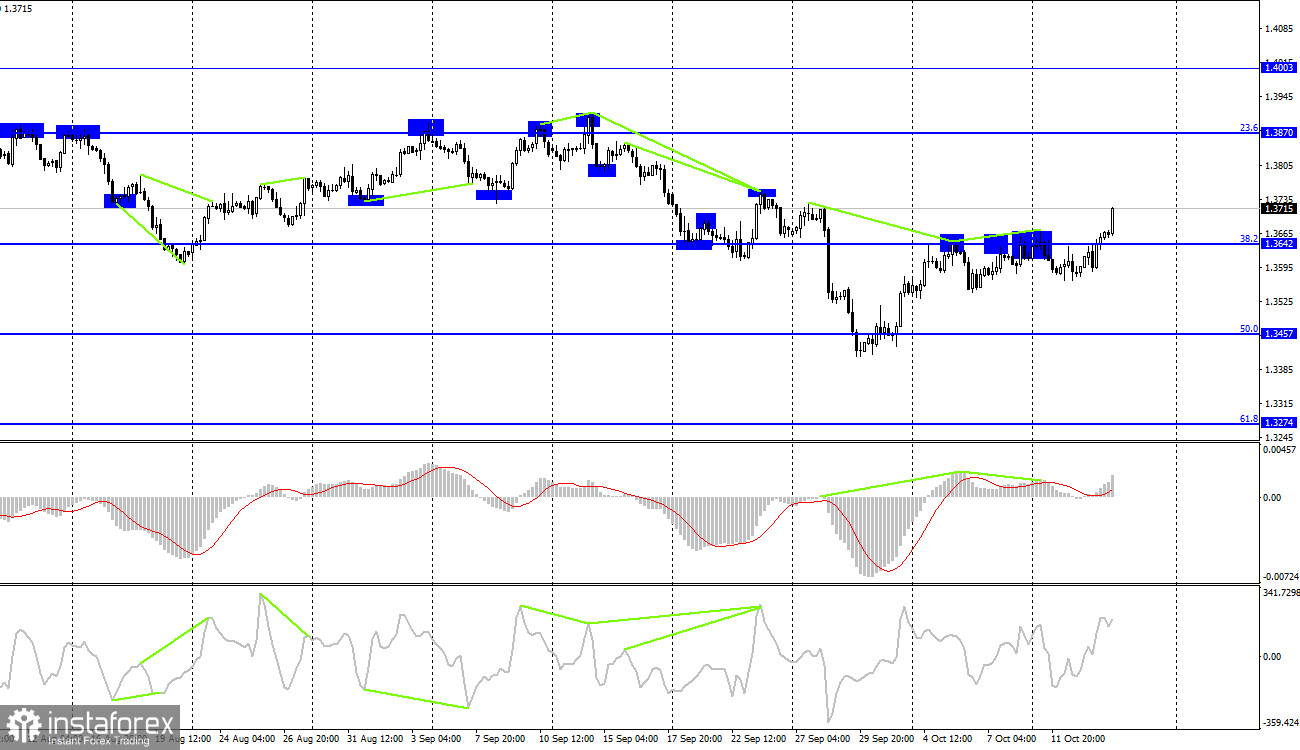

GBP/USD – 4H.

On the 4-hour chart, GBP/USD has closed on the fifth or sixth attempt above the retracement level of 38.2% at 1.3642. Consequently, the growth may continue within the next Fibo level of 23.6% at 1.3870. In the near future, I do not expect reversal signals on the 4-hour chart concerning the US currency. There were a lot of them last week. However, bears did not manage to resume their fall.

US and UK news calendar:

US - Producer price index (12-30 UTC).

US - Initial and repeated jobless claims (12-30 UTC).

On Thursday the UK and US economic calendars include no relevant data. There are some insignificant reports and speeches by the Fed's monetary committee members. Information background is going to be very weak today.

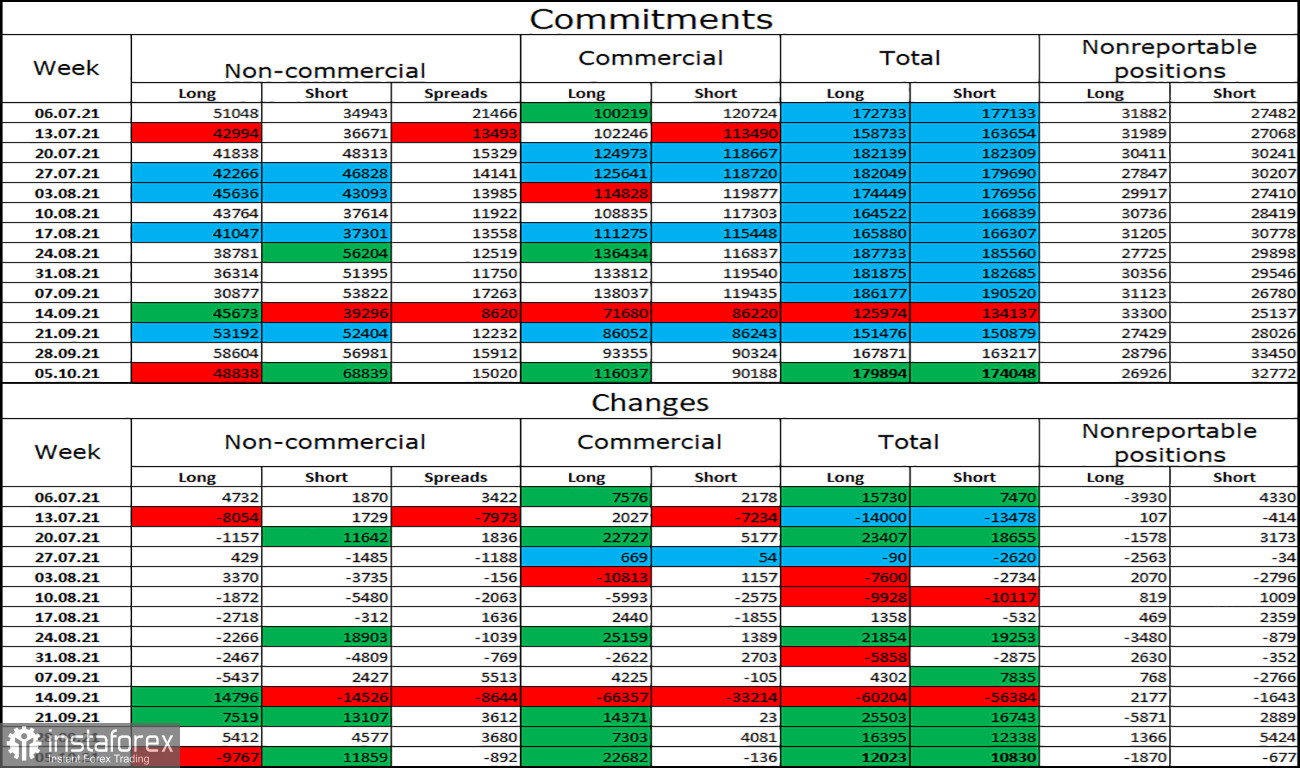

COT (Commitments of traders) report:

The latest COT report on the British pound on October 5 showed that the mood of huge players has become much more bearish. During the reporting week speculators closed 9767 long contracts and opened 11859 short contracts. Consequently, the bearish mood has become stronger by about 20.000 contracts. Besides, now the number of short contracts, held by speculators, exceeds the number of long contracts by half as much. It means that the bearish mood is quite strong and we expect the British pound to fall again in the near future. The level of 1.3642 may become an insurmountable barrier for bulls-traders.

GBP/USD forecast and recommendations for traders:

Yesterday, I recommended buying the pound when quotations closed above the level of 38.2% at 1.3642 on the 4-hour chart with a target of 1.3720. The closing above the level of 1.3720 will allow to keep these levels with the targets 1.3795 and 1.3913. I recommend selling the pound in case there is a close below the upward corridor on the hourly chart with a target of 1.3530.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.