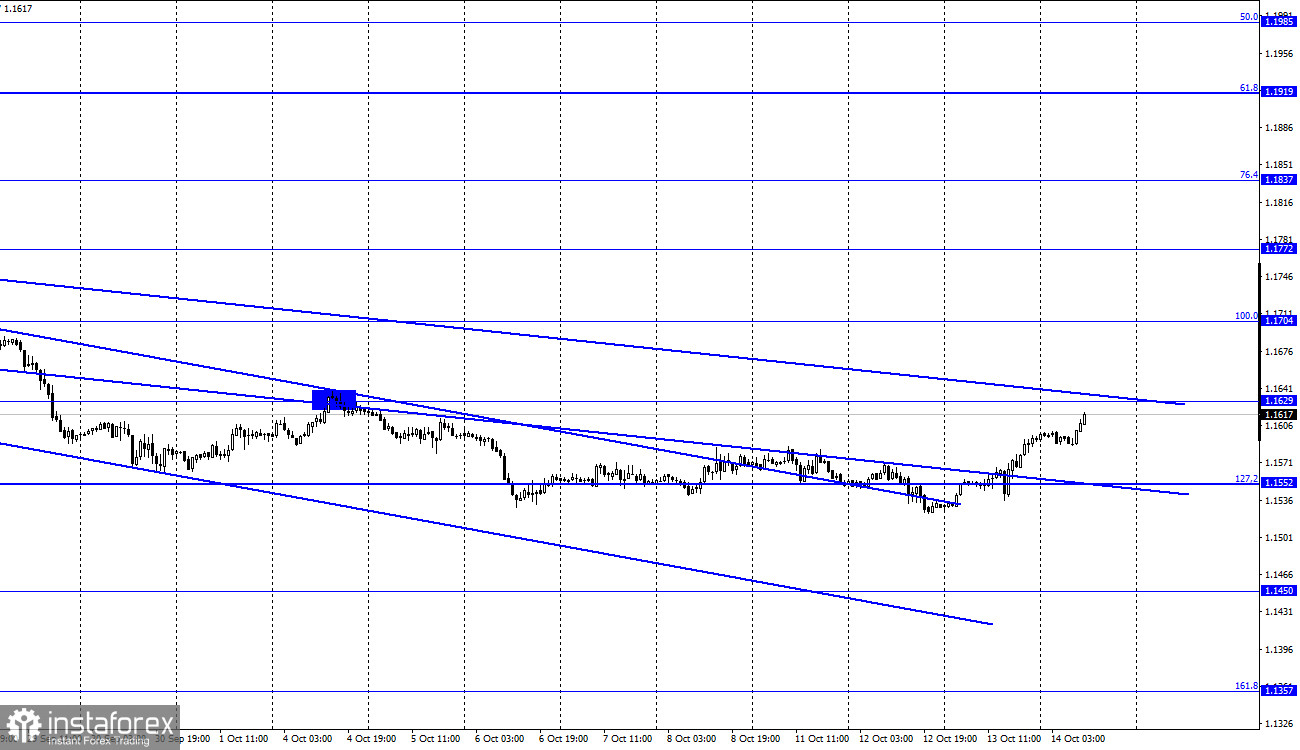

EUR/USD – 1H.

The EUR/USD pair performed a reversal in favor of the European currency on Wednesday and began the growth towards the level of 1.1629. The pair's quotes are still inside one of the two downward trend corridors, so the mood of traders is still characterized as "bearish." Thus, the rebound of quotes from the level of 1.1629 may work in favor of the US dollar and resume falling in the direction of the corrective level of 127.2% (1.1552). The pair's growth looks quite impressive on the chart, although its length is only 80 points. The pair walked half of this distance last night and half of it today. Thus, it is impossible to call this growth strong, but after five days, when the pair was standing still at all, this movement is like manna from heaven. Let's try to figure out what its causes are. The first thing that comes to mind is that bear traders failed to continue moving down, so the bulls took matters into their own hands. There was a change of mood in the market. The second possible reason is the US inflation report, which showed a new acceleration to 5.4% y/y in September, although traders did not expect this.

But here, it is hardly possible to conclude that an increase in inflation causes the dollar's fall. In the past, when inflation accelerated, the US dollar also grew. And yesterday, immediately after the release of this report, it also showed a slight increase. There is a third possible reason – the Fed protocol. What was it said in the protocol that the US dollar began to fall? If these two events are connected at all. By and large - nothing important. The entire protocol is replete with "some members of the Fed" and "most representatives of the monetary committee." It was impossible to understand exactly how many members of the Fed are in favor of curtailing the QE program in November and how many in December. Thus, the protocol did not bring any clarity to the most important issue. It could disappoint bear traders, but it could not cause any reaction. Then we return to the first reason.

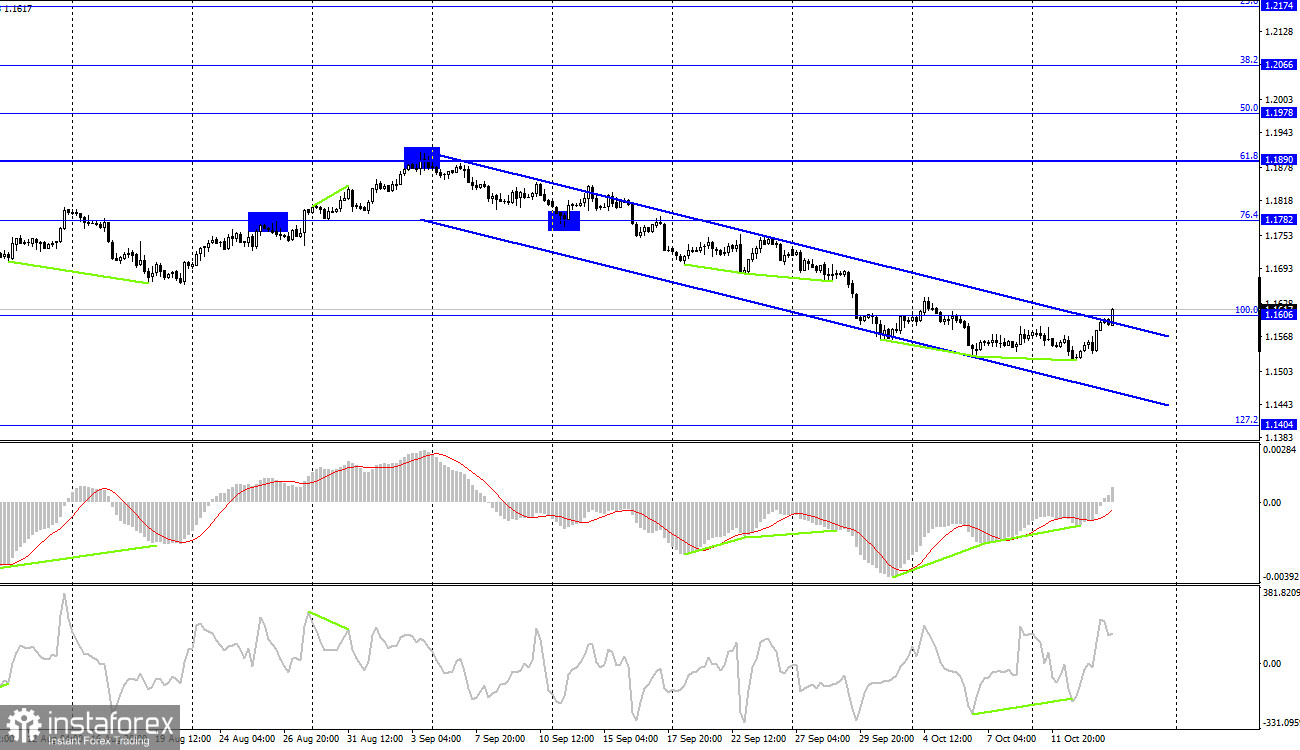

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed an increase to the corrective level of 100.0% (1.1606) and closed above it. There was also a closure over the downward trend corridor, so the mood of traders is now characterized as "bullish." The growth process can now be continued toward the corrective level of 76.4% (1.1782).

News calendar for the USA and the European Union:

US - producer price index (12:30 UTC).

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

On October 14, there will be no single interesting report in the European Union, and in the United States, the calendar of economic events contains only minor entries. In addition to the two reports, which are unlikely to provoke a reaction from traders, Fed members Michelle Bowman and Rafael Bostic will make speeches. However, in general, the information background will be weak today.

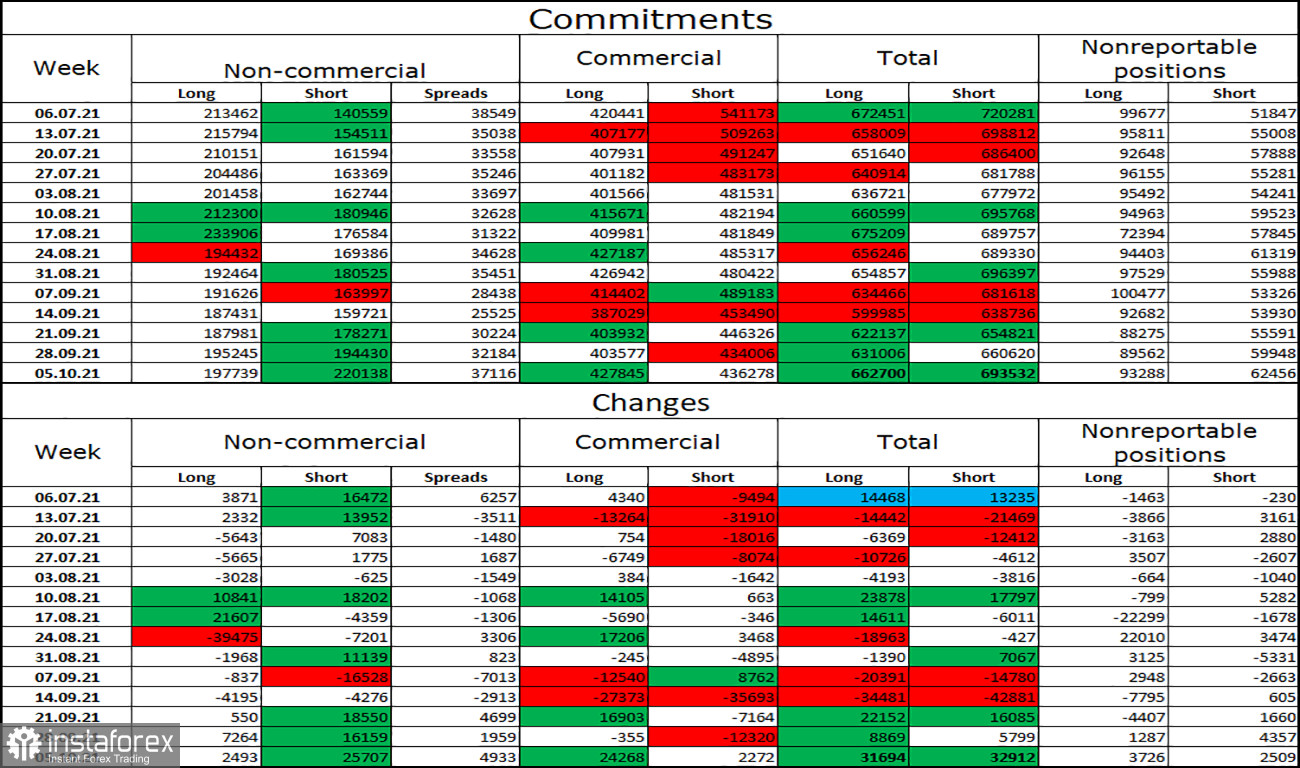

COT (Commitments of Traders) report:

The latest COT report showed that the mood of the "Non-commercial" category of traders changed very much during the reporting week. Speculators opened 2,493 long contracts on the euro and 25,707 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 198 thousand, and the total number of short contracts – up to 220 thousand. Over the past few months, the "Non-commercial" category of traders has tended to eliminate long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. This process continues now, and the European currency, meanwhile, continues to fall slightly. Thus, the actions of speculators affect the behavior of the pair at this time. The fall may continue.

EUR/USD forecast and recommendations to traders:

Traders show a desire to start trading more actively. Fixing the pair's rate above the level of 100.0% (1.1606) on the 4-hour chart allows you to buy with a target of 1.1704. I recommend selling the pair in case of a rebound from 1.1629 on the hourly chart with a target of 1.1552.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.