At the auction on October 11-15, the EUR/USD currency pair showed minimal growth. However, it's not even about strengthening the main currency pair of the Forex market, but about some technical nuances, which we will discuss a little later. Market expectations that the Federal Reserve System (FRS) will release specific information about the curtailment of the quantitative easing (QE) program continue to remain expectations. In fact, in this regard, investors do not receive any new information. In other words, the announcement of the curtailment of incentives is delayed, and it is not at all the fact that this will be announced in November. It seems that the rampant jumps in inflation, which continue to take place in the world's leading economy, are to blame for everything. Although earlier, if you remember, Fed Chairman Jerome Powell, and other high-ranking Fed officials, called this a temporary phenomenon.

The decision of the US Central Bank to move to tighten its monetary policy is also influenced by the spread of the fourth wave of COVID-19, which has not bypassed the United States of America. The situation with the coronavirus pandemic in the United States leaves much to be desired. However, this topic is also very relevant in several European countries. Another factor that is holding the Fed back from starting to reduce bond purchases is the mixed macroeconomic statistics that have been released recently. In particular, some indicators on the labor market and inflation are either encouraging or disappointing. This week, no such significant and important macroeconomic events are expected to change the balance of power in EUR/USD radically. Regarding today, I recommend paying attention to the data on industrial production in the United States. Well, it's time to move on to the consideration of price charts, and let's start with the weekly timeframe.

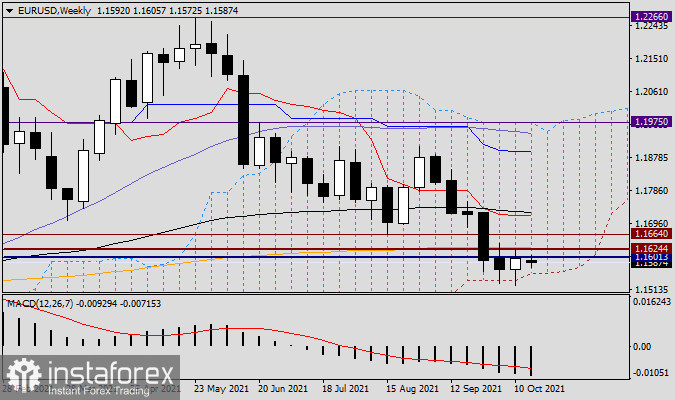

Weekly

Although for the second week in a row, euro/dollar bears tried to bring the price down from the Ichimoku indicator cloud, they failed to do so. Moreover, the last candle, leaving a shadow under the cloud's lower border, formed with a bullish body. Technically, this can serve as a prerequisite for the subsequent strengthening of the exchange rate. On the other hand, the players for the increase could not return trading above the important technical level of 1.1600, and weekly trading closed slightly below this significant mark. Looking at the weekly timeframe, the task of the euro bulls looks like the rise of the quote above 1.1640 and the broken support of 1.1664. Bears on the pair still need to bring the price down from the weekly cloud and then consolidate trading below the psychological level of 1.1500. Considering that a strong support level is passing at 1.1475, it will be necessary to break through this mark as well. I think it is premature to talk about the larger tasks of the warring parties at the moment.

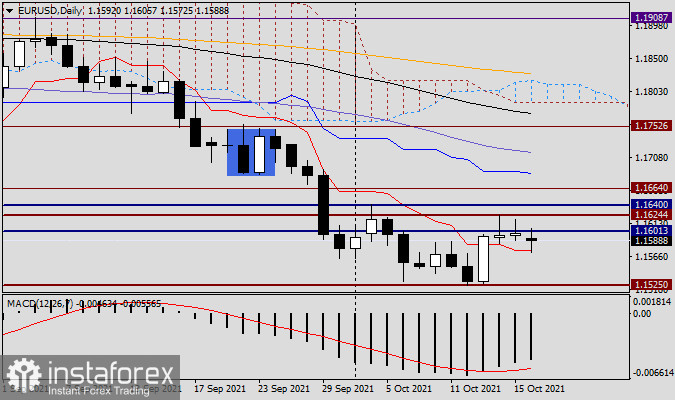

Daily

Despite the growth shown from 1.1525, the last two candles of the Doji set up a bearish mood. Moreover, the highs of the last Doji are lower than the maximum values of the previous candle. On the other hand, the consolidation of three consecutive daily candlesticks above the red Tenkan line of the Ichimoku indicator implies the support that this line can now provide. If this does not happen, the quote is likely to rush to the highs of trading on October 12-13 in the area of 1.1525. In my personal opinion, in the last two trading days of last week, the market was in some confusion, not knowing or not understanding where to move the course. Sellers' resistance is at 1.1624, 1.1640, and 1.1664. Support is located at 1.1580,1.1525, and 1.1500. Given the uncertainty of the current situation, I recommend waiting for candle sell signals near the listed resistance levels. The same thing makes sense to take into account for opening purchases in areas of designated support levels. Tomorrow, after considering smaller time intervals, adjustments may be made to today's recommendations.