Bitcoin had a strong weekend and managed to overcome the $60k mark, which was a key resistance level for the price. Now the coin is one step away from setting a historical record, but the coin ended Sunday's trading day on a bearish note, forming a bearish absorption candle. With this in mind, reaching the absolute maximum of BTC may take longer. In order to determine how much influence Sunday's bearish evening had on the price, it is necessary to conduct a technical analysis of the cryptocurrency price on horizontal charts.

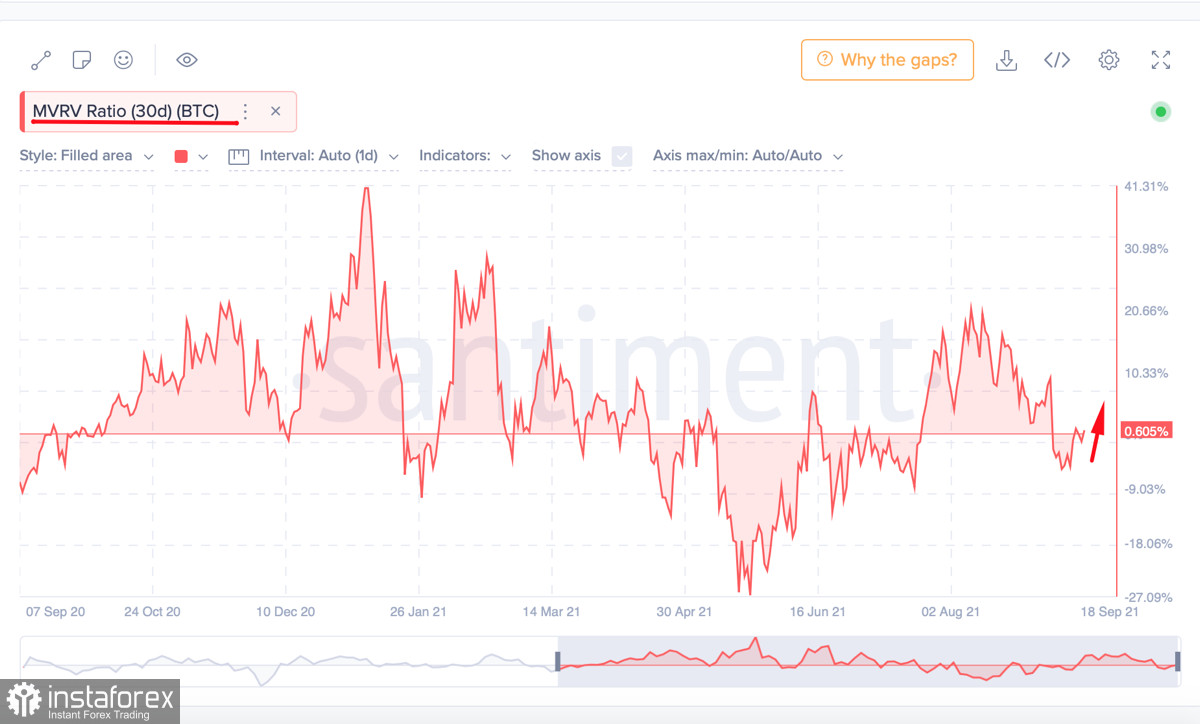

First of all, it's worth noting that as of 13:00 UTC, the coin is trading in the $61k region with an average trading volume of $36 billion. This suggests that large companies, which have already begun to receive their first profit, are behind the current rise in the price of the asset. According to the on-chain metric, the ratio of the market and realized value of BTC, 99% of all BTC in circulation are in positive territory. This could increase the pressure on the price as many investors want to be on the safe side and take profits. Thanks to this, the price of the cryptocurrency will move more slowly upside, which will also be noticeable on the technical indicators of BTC.

On the hourly chart, we see an encouraging picture, as the price was on the verge of breaking the supertrend line, which could give an additional advantage to sellers in exerting pressure on quotes. However, bitcoin managed to form a bullish candle with a long lower wick, thanks to which it leveled most of the bearish pressure over the past few hours. The protection of the supertrend line was carried out thanks to the bullish breakdown of the bearish triangle.

In the long run, this means a broad bullish reversal after a bearish first half of the day. Technical indicators confirm this picture: the MACD indicator has stopped declining and is moving sideways, while the stochastic oscillator formed a bullish intersection and broke out upwards. This suggests that the upward movement has received a new impetus, which has no prospects for the future.

*Learn and analyze

MVRV (Market Value to Realized Value) indicator - displays the ratio of the market and realized value of a particular cryptocurrency. This metric gives a more objective view of the current value of the coin and the period of the market. The indicator also displays the results of the movement of coins: if the value is below 0, then the players moved coins with a loss, and if it is above 0, then investors have made a profit from operations with coins.

Relative Strength Index (RSI) is a technical indicator that allows you to determine the strength of a trend (downward or upward), warns of possible changes in the direction of price movement. Thanks to this metric, you can determine in what stage the asset is - overbought or underbought. The optimal mark for this chart is 60 for a bullish trend. It indicates strong demand for the coin and the strength of the current upward momentum. Upon crossing this mark, the coin begins to move towards overbought.

MACD (Moving Average Convergence Divergence Index) is an indicator that allows you to draw certain conclusions about the trend based on the movement of moving averages and finding the metric values between them. A common bullish signal is the intersection of the white line below the red and bearish, on the contrary, when the white line crosses the red from above, which indicates a downward movement.

Stochastic (Stochastic Oscillator) - the indicator indicates the strength of the momentum of the current prevailing trend. If the indicator is above 80, then the asset can be considered overbought, but if the stochastic is below 20, then this is a signal that the asset is oversold.

SuperTrend line is a technical indicator that reflects a bullish (green - a buy signal) and bearish (red - a sell signal) trend on the horizontal charts of a cryptocurrency.

On the four-hour chart, the upward trend continues, albeit with definite bearish signals for the MACD, which continues to move sideways with a gradual decline. At the same time, the figure foreshadowing further price growth is supported by the upward movement of the stochastic and the relative strength index. This indicates the desire of buyers to push the price higher. However, divergence continues to form according to MACD, which may indicate weakness of the local bullish momentum. If the gap between the price movement and the MACD continues to grow on the daily chart, it will be possible to talk about a subsequent correction.

On the daily chart, Bitcoin continues its confident upward movement, which suggests that all doubts about narrower timeframes do not affect the overall picture. This indicates the strength of the upward movement and the locality of the weakening in narrower timeframes.

In addition to the bullish flag ascending figure, the MACD divergence is completely leveled, which will continue the upward movement. Stochastic Oscillator and RSI continues to go up, despite being in the overbought zone. This suggests that Bitcoin may well offset yesterday's bearish end and form a bullish engulfing candlestick.

The general situation around BTC indicates that correction processes are taking place within narrow ranges, due to which the price goes up evenly. Right now, the chance of a corrective breakout of the swing area is extremely low. BTC may touch the $64k mark for the first time since April.