The contradictory fundamental background today provoked increased volatility for the NZD/USD pair. On the one hand, there is an abrupt increase in inflation in New Zealand, on the other hand, there is the coronavirus crisis, which has not yet been stopped. As a result, the New Zealander paired with the greenback is trading within the 60-point range today. So, if in the first half of the day the kiwi updated the monthly price high by testing the 71st figure, then at the start of the US trading session, the NZD/USD bears returned the pair to the middle of the 70th price level. In general, the New Zealand dollar is in an uptrend, which is due to the hawkish attitude of the Reserve Bank of New Zealand. Today's inflation release only confirmed the validity of such intentions. However, the notorious COVID continues to put a spoke in the wheels of kiwi bulls.

Let me remind you that in early October, the New Zealand central bank raised the interest rate by 25 basis points, that is, to 0.5%. By and large, the RBNZ has become a "pioneer" among the central banks of the leading countries of the world in the context of tightening monetary policy parameters against the background of the next wave of the coronavirus crisis. But at the same time, the regulator rather vaguely outlined the prospects for further tightening of monetary policy parameters. In its accompanying statement, the central bank only indicated that "over time, a further reduction in economic stimulus through monetary policy is expected." Representatives of the RBNZ also noted that the outbreak of coronavirus and subsequent quarantine restrictions "did not significantly affect the medium-term forecast for inflation and employment," while the growth of inflation indicators "is becoming more stable." The New Zealand central bank expressed hope that the coronavirus crisis will be overcome in the foreseeable future, which will allow the regulator to "move on."

It is noteworthy that inflation data and further anti-epidemic measures were published today in New Zealand.

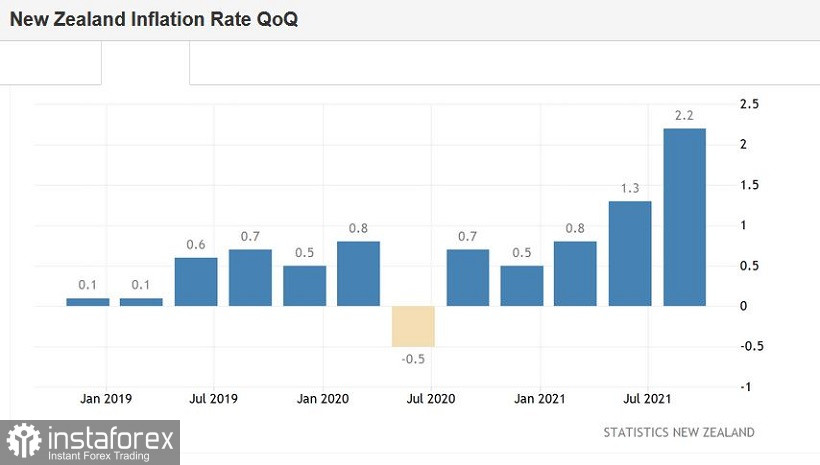

Inflation was on the side of the New Zealand dollar. Thus, the consumer price index in the third quarter of this year jumped to 2.2% (QoQ). This is a 10-year record: the last time the CPI was at a similar height (in quarterly terms) was in early 2011. On an annualized basis, the index also came out in the "green zone", at 4.9%. Both components of the release have been showing upward dynamics for several consecutive quarters, reflecting an increase in price pressure. It should be noted here that some members of the RBNZ not so long ago (after the October meeting) stated that the central bank could tighten monetary policy again if "the necessary conditions for this" remain in the country. Representatives of the "hawk wing" of the central bank also predicted that in September next year the rate should be 1.4%-1.5%. The US Federal Reserve, which is also standing in the way of normalizing monetary policy, cannot boast of such speed. Even in the face of the delta strain, the RBNZ remains resolute.

However, the coronavirus still makes its own adjustments, including in the context of the development of the upward trend. Today it became known that the New Zealand government is extending quarantine restrictions in Auckland (the country's largest city) and Waikato - "for at least another two weeks." Government representatives said that the exit from the isolation regime will be possible after a "higher level of vaccination of the population" is achieved in New Zealand. At the moment, the coverage of vaccination with a single dose of persons older than 12 years is about 85%. About 65% of the country's citizens were fully vaccinated. Quarantine restrictions are expected to be relaxed in the largest cities of the state from about mid-November.

This news has extinguished the upward momentum today, but this is just a temporary victory for the NZD/USD bears. Traders have not yet fully played back the record growth in inflation in New Zealand. This fundamental factor will still manifest itself, given the strengthening of the hawkish expectations of the market regarding the further actions of the RBNZ.

Against the background of such a fundamental picture, the New Zealand dollar paired with the US currency has every reason to retest the 71st figure, updating the 4-week high. On the daily chart, the price is on the upper line of the Bollinger Bands indicator, and the Ichimoku indicator has formed a bullish Parade of Lines signal. This suggests that the NZD/USD pair retains the potential for its further growth. In the medium term, the goal of the upward movement is 0.7130 (the upper limit of the Kumo cloud, coinciding with the upper line of the Bollinger Bands indicator on the weekly chart). If we consider the short-term prospects, then within the day there may be pullbacks to the middle of the 70th figure. However, it is advisable to use any downward pullbacks now to open long positions to the above resistance level.