To open long positions on EURUSD, you need:

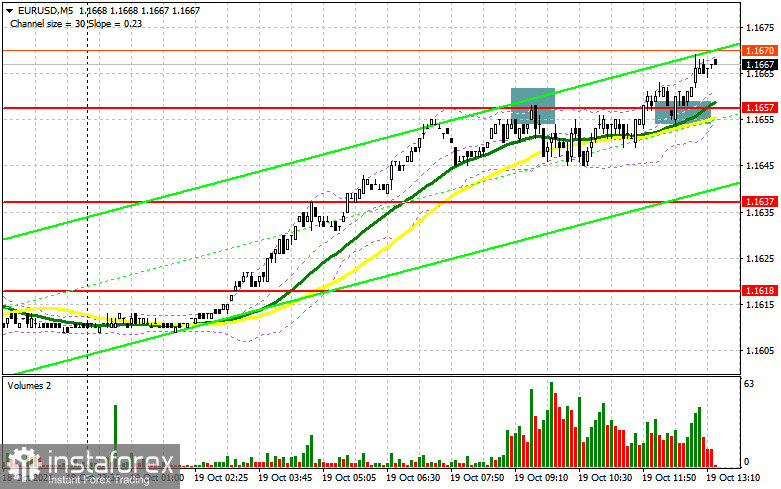

In my morning forecast, I paid attention to the 1.1657 level and advised them to make decisions. Let's look at the 5-minute chart and analyze the entry points. The first attempt of the bulls to get above 1.1657 led to the formation of a signal to sell the euro, but it was never fully implemented. A slight decline by 12 points and then a smooth return to this level with a subsequent breakdown crossed out the bears' plans for a downward correction. The 1.1657 test from top to bottom formed a signal already for the purchase of the euro, which continues to work out at the time of writing. From a technical point of view, minor changes need to be taken into account in trading.

The entire focus of buyers is shifted to the protection of the 1.1655 support, on which quite a lot depends. In the afternoon, representatives of the European Central Bank speak, and data on the American real estate market are published. Do not forget about several interviews with the Federal Reserve System representatives – a surge in volatility will be provided. Only the decline and the formation of a false breakdown in the area of 1.1655 forms an additional signal to open long positions to continue the bullish trend and with the prospect of updating the nearest resistance of 1.1684. The breakdown of this level will depend on the US data and statements by ECB representatives. If the indicators do not surprise traders, the EUR/USD growth will likely continue. A breakout and consolidation above the resistance of 1.1684 and a reverse test of this level from top to bottom form a signal to buy the euro with the prospect of updating the maximum of 1.1713, where I recommend fixing the profits. A more distant target will be the 1.1742 area. If the bears become stronger during the American session, and the bulls do not offer anything above 1.1655, it is best to be patient and postpone purchases to larger support of 1.1632. It is possible to open long positions immediately for a rebound only from the minimum of 1.1613 based on an upward correction of 15-20 points within a day. There are also moving averages that play on the side of the bulls.

To open short positions on EURUSD, you need:

The second half of the day may be dictated by the sellers of the euro. However, you need to return the level of 1.1655. Only good fundamental statistics on the United States and soft statements by representatives of the European Central Bank on future monetary policy can undermine investor sentiment, which will lead to a breakdown of 1.1655. A test of this level from the bottom up forms an excellent entry point into short positions, which will push the pair to 1.1632. A similar breakthrough and the 1.1632 test will act as an additional signal to open short positions, quickly pushing EUR/USD to 1.1613, where I recommend fixing the profits. In the scenario of further growth of the euro, the main task of the bears will be to protect the resistance of 1.1684. Only the formation of a false breakdown there will lead to a new sell signal. It is possible to open short positions immediately for a rebound based on a downward correction of 15-20 points only from a new maximum of 1.1713.

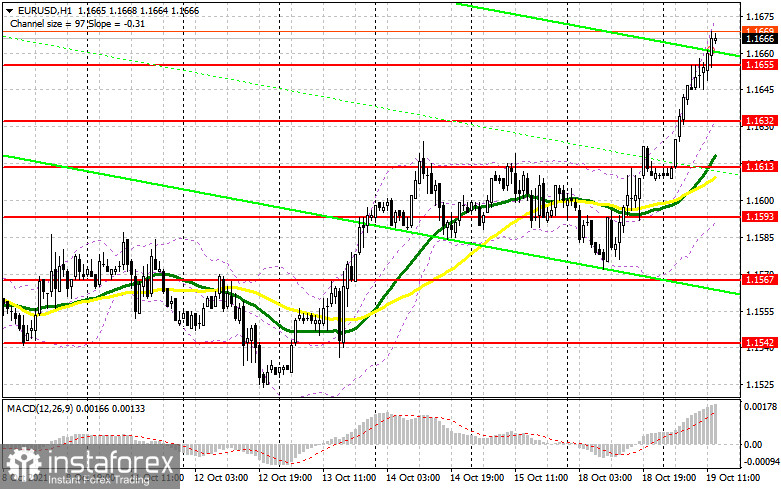

The COT report (Commitment of Traders) for October 12 recorded an increase in short and long positions. However, the former turned out to be more, which slightly reduced the negative delta. Political problems in the United States of America have been resolved. The latest fundamental reports do not cease to please traders, which indicates that the US economy continues to recover at a good pace. The fact that the Federal Reserve is already seriously considering curtailing the bond purchase program is no longer news that could help dollar buyers at the moment. But the fact that representatives of the European Central Bank began to express concern about the rate of inflation growth, even if not in the same form as colleagues from the Fed - all this allows the European currency to begin to win back positions gradually. This trend may continue in the future, especially in the case of strong statistics on the European economy. However, the larger medium-term demand for risky assets will remain limited due to the wait-and-see attitude of the European Central Bank. The COT report indicates that long non-profit positions rose from the level of 196,819 to 202,512, while short non-profit positions jumped from the level of 219,153 to the level of 220,910. At the end of the week, the total non-commercial net position increased slightly and amounted to -18,398 against -22,334. The weekly closing price dropped to 1.1553 against 1.1616.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates that the pair will continue to grow in the short term.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline in the euro, the average border of the indicator around 1.1632 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.