To open long positions on GBP/USD, you need:

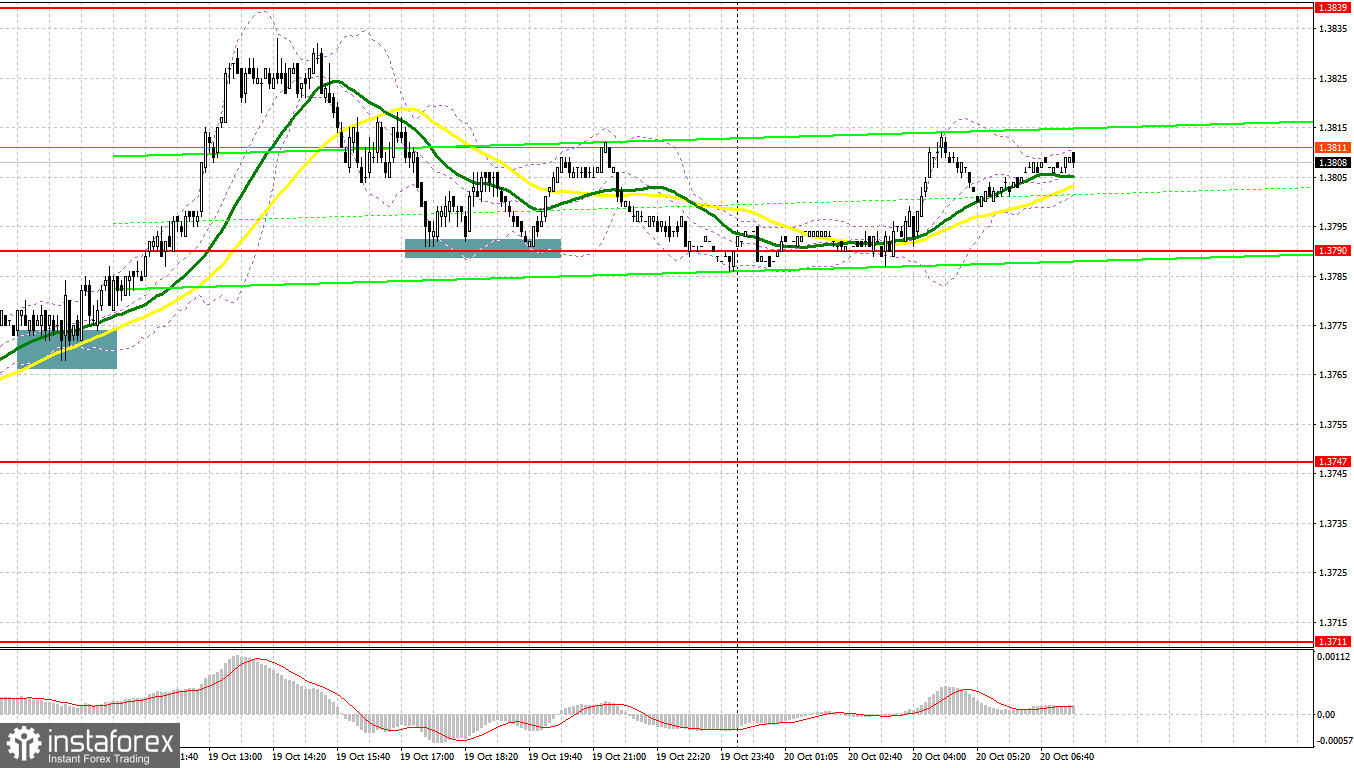

The British pound hit another monthly high around 1.1830 and is aiming for a breakthrough. Let's take a look at the 5-minute chart and talk about the signals that were generated yesterday. Smooth breakthrough and consolidation above resistance at 1.3770, followed by its renewal from top to bottom, formed an excellent entry point for long positions, which resulted in further growth in GBP/USD and a renewal of the 1.3805 high. A breakthrough of this level also caused the pair to rise, however, we did not reach the target value of 1.3839. A slight downward correction of the pound in the second half of the day and a false breakout around 1.3790 - all this formed another entry point into long positions, which brought about 25 points of profit.

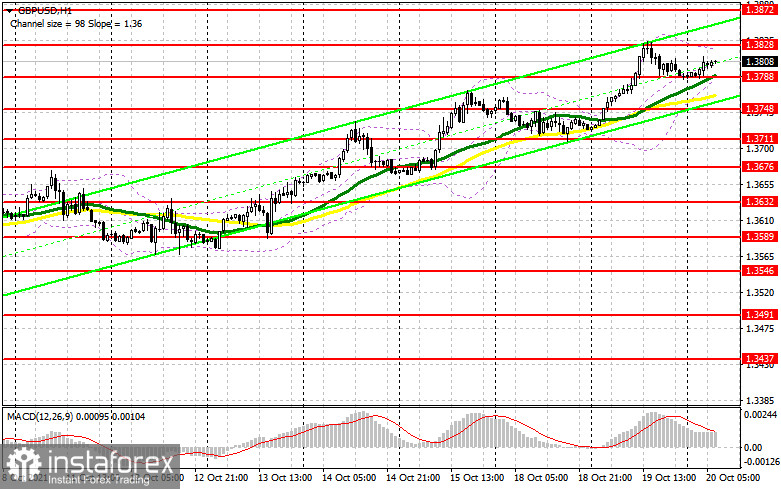

Very important statistics for the UK are coming out today. Pay attention to inflation indicators for September this year, which are now a serious problem for the Bank of England. If the data goes beyond economists' forecasts, it is possible that in the near future the central bank will indeed curtail economic stimulus programs and raise interest rates - this will be a good signal for pound bulls. The primary task for today is to protect the support at 1.3788, in the area of which the moving averages are, playing on their side. In general, the upward trend and forming a false breakout in the 1.3788 area creates a good entry point to long positions with the goal of recovering to the weekly high of 1.3828. A breakthrough and consolidation above this range with a reverse test from top to bottom will allow the British pound to reach new local levels: 1.3872 and 1.3910, where I recommend taking profits. The next target is still the area of 1.3955, but it will be available only in case of a very strong rise in inflation in September this year. If the bulls are not active in the 1.3788 area, the best option to buy the pound would be to test the next support at 1.3748. I advise you to watch long positions of GBP/USD immediately for a rebound only from a low like 1.3711, counting on an upward correction of 25-30 points within a day.

To open short positions on GBP/USD, you need:

The bears managed to form resistance at 1.3828 yesterday, which is only temporary protection against a further upward trend. It will be possible to talk about the pair being under pressure again only after the next formation of a false breakout at this level, which may occur during the release of inflation data in the UK. A slowdown in inflationary pressures will be good news for the Bank of England, which will spoil the sentiment of pound bulls. And although such a scenario will only lead to GBP/USD hanging in a horizontal channel and will not seriously affect the bulls' plans, it is better than nothing. An equally important goal for the bears is to regain control over the support level at 1.3788, as there are moving averages playing on the side of the bulls. A breakthrough of this area and its reverse test from the bottom up will form a signal to open short positions in hopes that the pair would fall to 1.3748, and then to renew the low in the area of 1.3711, where I recommend taking profits. In case the pound recovers further and the bears are not active at 1.3828, only a false breakout in the area of the next resistance at 1.3872 will be a signal to open short positions in GBP/USD. I advise selling the pound immediately on a rebound from the larger resistance at 1.3910, counting on the pair's rebound down by 20-25 points within the day.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which indicates the formation of a new bullish scenario.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.3828 will lead to forming pressure on the pair. Surpassing the lower boundary at 1.3788 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.