The first US Bitcoin ETF launched on Tuesday, and its debut did not disappoint.

Traded under the ticker "BITO", the ProShares Bitcoin Strategy ETF jumped more than 3% yesterday morning, as in just 20 minutes about 6.4 million shares worth about $ 264 million changed hands.

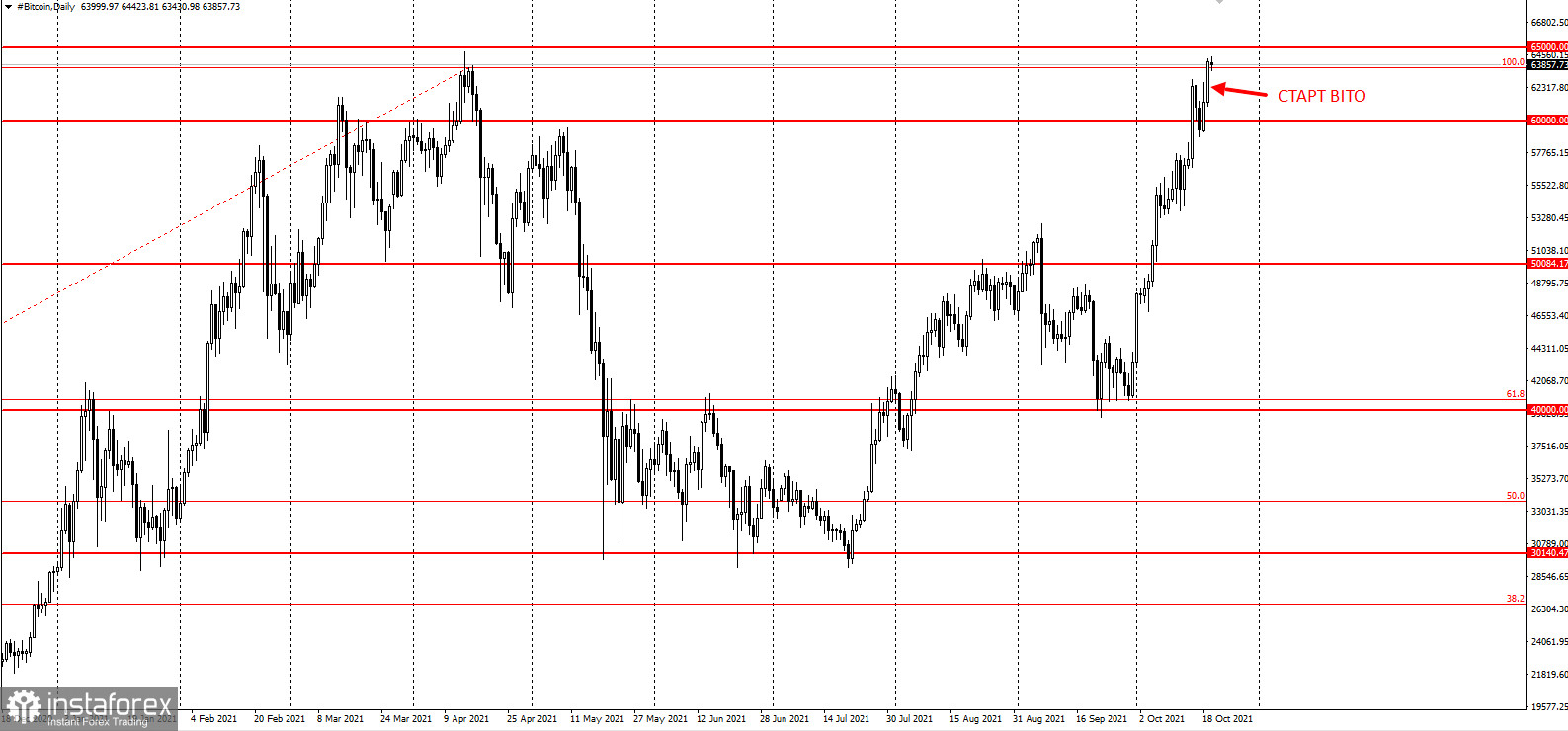

Investors are now watching closely to see if BTC will hit new all-time highs below $ 65,000.

Although the ETF is tied to Bitcoin futures and has no direct impact on the spot price, sentiment over its approval has lifted it in recent days.

Bitcoin hit $ 63,000 shortly after the ProShares ETF began trading. But now it is down at $ 62,500, posting an increase of about 1.3% over the day.

Coinbase Global (COIN) also traded 3% higher, while Marathon Digital (MARA) recovered from early losses and traded 1.7% higher. MicroStrategy (MSTR), on the other hand, fell by 2.2%, despite owning $ 5 billion worth of cryptocurrency.

SEC Chairman Gary Gensler said crypto ETFs that comply with his strict laws can provide investors with significant protection.

The agency did not directly explain why it allowed ProShares ETFs to start trading, but Gensler hinted that it was due to the fact that futures are already controlled by the Commodity Futures Trading Commission (CFTC).

"I think what we have here is a product that's been overseen for four years by a US federal regulator and CFTC," Gensler said. "It's being wrapped within our jurisdiction called the Investment Company Act of 1940, so we had to bring it inside for investor protection," he added.

Gensler also warned that it is still "a very speculative asset class."

ProShares isn't the only ETF associated with Bitcoin. There are already several Bitcoin-related ETFs ready to launch in the coming months. But Invesco suspended its futures ETFs late Monday night without giving a reason.

Aside from the symbolic meaning in terms of mass acceptance, there is even more at stake after what is likely to be a tipping point for cryptocurrency.

The initial performance of the ETF can dictate where the Bitcoin goes next. As such, strong demand is needed to break new records. According to Oanda analyst Edward Moya, if traders view early results as promising, next resistance will come from the $ 70,000 level. Conversely, low trading volumes could trigger a sell-off.