The topic of corporate reporting of companies for the third quarter continues to dominate the markets by fully conducting them. A positive continuation of the reporting season is highly likely to support the positive mood, which will put pressure on the rate of the US dollar.

Important data on consumer inflation in the EU and in the UK were released on Wednesday. UK figures showed that annual consumer inflation slowed its growth rate from 3.2% to 3.1%. It only rose by 0.3% in September, falling from 0.7% in August. As expected, the pound reacted with a decline against the US dollar, but then recovered and even received support at the end of Wednesday's trading.

A similar picture was observed with respect to the euro exchange rate on the currency market after the release of statistics on consumer inflation in the euro area. According to the presented values, inflation both on an annual and monthly basis increased by 3.4% and 0.5%, respectively. But just as in the case of the pound, this news failed to support the euro's exchange rate, which can be explained by the continuing expectations in the market regarding the prospects for an increase in ECB interest rates that remain extremely ambiguous. It seems that the European regulator will pull to the last, trying to stimulate the economy of the region in the hope that this will prevent the expansion of the global crisis amid the coronavirus pandemic.

Toda's European trading began in a negative zone and, as indicated above, the focus will be on the publication of corporate reports of companies. We believe that the market will continue to respond to strong reporting by buying shares of companies, which will support the euro, pound, and other major currencies against the US dollar. Such dynamics can also be explained from the perspective of the perception of the dollar as a kind of opposite to the growth of demand for risk or vice versa, its decline.

If the news from the United States about the reporting of companies also turns out to be generally positive – this will turn the current pessimistic mood towards their improvement with all the ensuing consequences in other financial markets.

Forecast of the day:

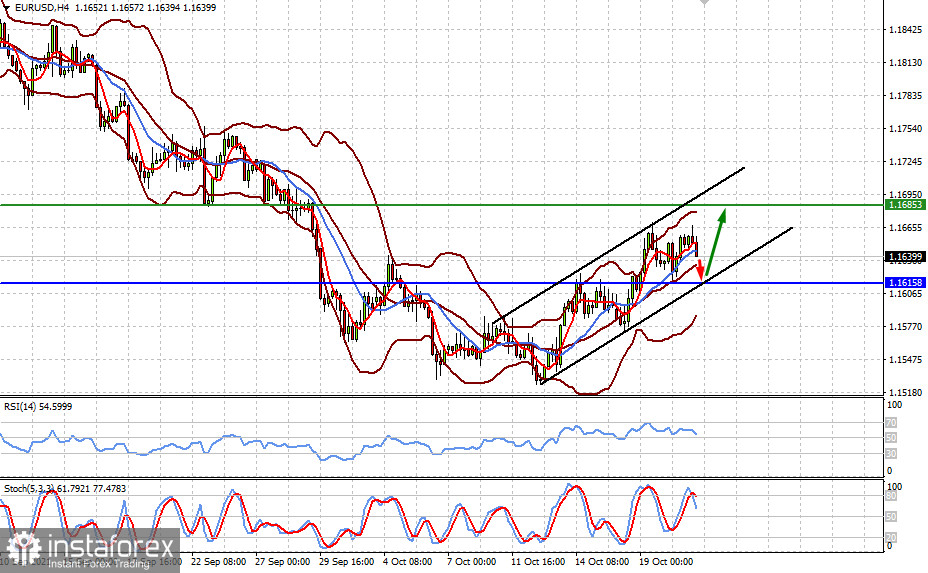

The EUR/USD pair is making a downward correction again in anticipation of the reporting of European and American companies. If the news is good, the pair will reverse up to the level of 1.1685 after a likely decline to 1.1615.

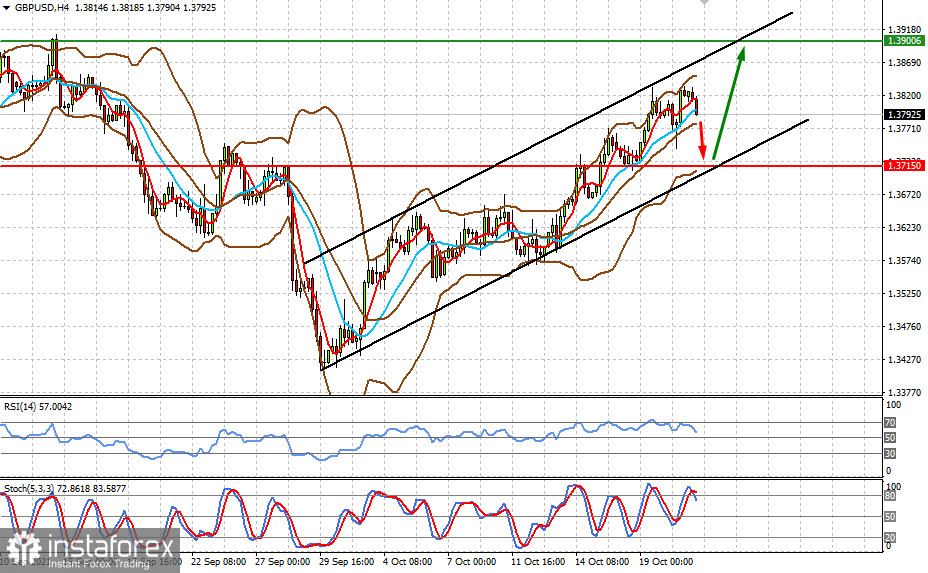

Under the influence of the same reasons as for the EUR/USD pair, the GBP/USD pair may also make an upward turn and rush to the level of 1.3900 after a downward correction to 1.3715.