It's time to consider a rather curious currency pair of Australian and American dollars. The main attention in this review will be paid to the technical component. However, before that, let us briefly talk about the comments of the head of the Reserve Bank of Australia (RBA), Philip Lowe. According to yesterday's comments by this high-ranking monetary official, inflation spikes are a temporary factor. Thus, the head of the RBA shares the opinion of most of his colleagues, in particular, the position on the inflationary component of the two leading world Central Banks, the Fed, and the ECB. According to Lowe, the Australian Central Bank is closely monitoring and aware of the factors that lead to sharp spikes in inflation. A lot will depend on the labor market, more precisely on how wage growth will affect sustainability and long-term high inflation.

In general, nothing new. The head of the RBA echoes his colleagues from the Fed and the ECB. It can't be any other way. In my opinion, these two largest world Central Banks, especially the Fed, determine the world monetary policy, or rather, its vector. At the moment, despite the raging fourth wave of COVID-19, everything is going to the fact that the world's leading central banks intend to curtail their incentive programs gradually. However, intentions are not yet a fact, and expectations of tightening monetary policy, particularly from the Fed, have already dragged on.

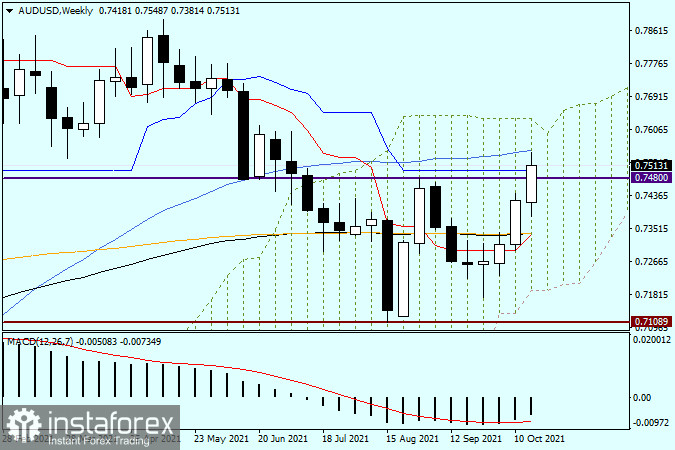

Weekly

It's time to move on to the technical part of the review. Otherwise, you can go so far. It refers to descriptions and forecasts on the monetary policy of the leading Central banks. So, what do we see on the weekly chart of the AUD/USD currency pair? And we see growth, which is very actively resisted by the 0.7480 level, the blue Kijun line of the Ichimoku indicator, and the 50 simple moving average, which is located at 0.7553. It was from 50 MA that the price bounced, and at the moment of completion of the review, the pair is trading near the most important technical, historical and psychological level of 0.7500. Now about the prospects. Closing the week above the resistance level of 0.7480, and even more so above the 0.7500 mark, will create good prerequisites for further growth. If the bulls on the "Aussie" manage to complete the weekly trades above 50 MA and the level of 0.7553, there will be a great opportunity for the subsequent withdrawal of quotes up from the Ichimoku indicator cloud. I would venture to assume that in this case, the rate will continue to rise, and perhaps with renewed vigor.

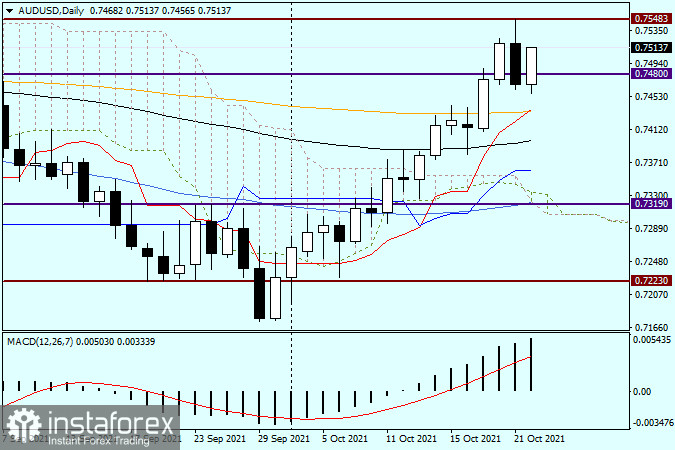

Daily

A very interesting and, at the same time, difficult situation is observed on the daily AUD/USD chart. As a result of yesterday's flight from risks and the strengthening of the US dollar, a rather impressive bearish candle appeared, which also has a rather big upper shadow. Now the bulls on the "Aussie" need to rewrite yesterday's highs shown at 0.7548. In this case, it is possible to count on further progress of the pair in the north direction. At the end of the article, the pair is actively growing and is trying to reach serious resistance of sellers near 0.7550 again.

According to the author's personal opinion, the pair remains bullish. However, given that the trades are held under a strong level of resistance from sellers, I consider opening purchase transactions right here and now to be a rather risky and technically unreasonable event. It is better to buy with kickbacks to the bottom in such cases, and it was already there. In order not to mislead you and not risk losing your deposit, I recommend staying out of the market for AUD/USD for now. Let's see how the current trading week ends and then build trading plans based on weekly and daily trading closing prices.