Wave pattern

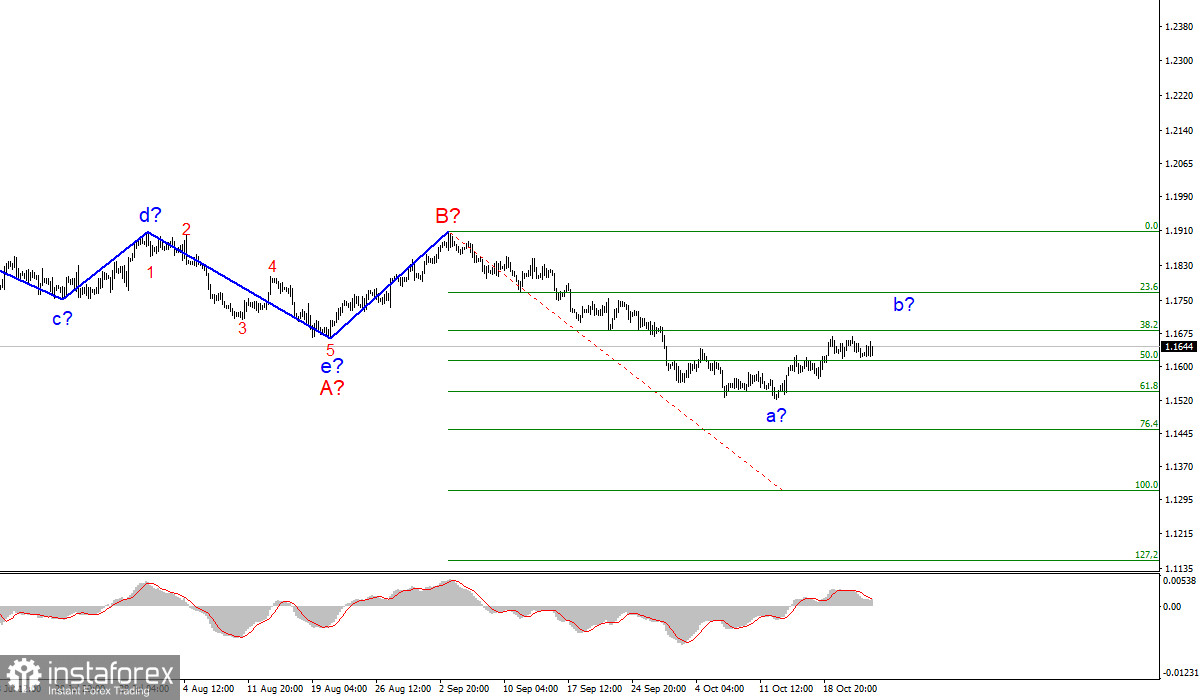

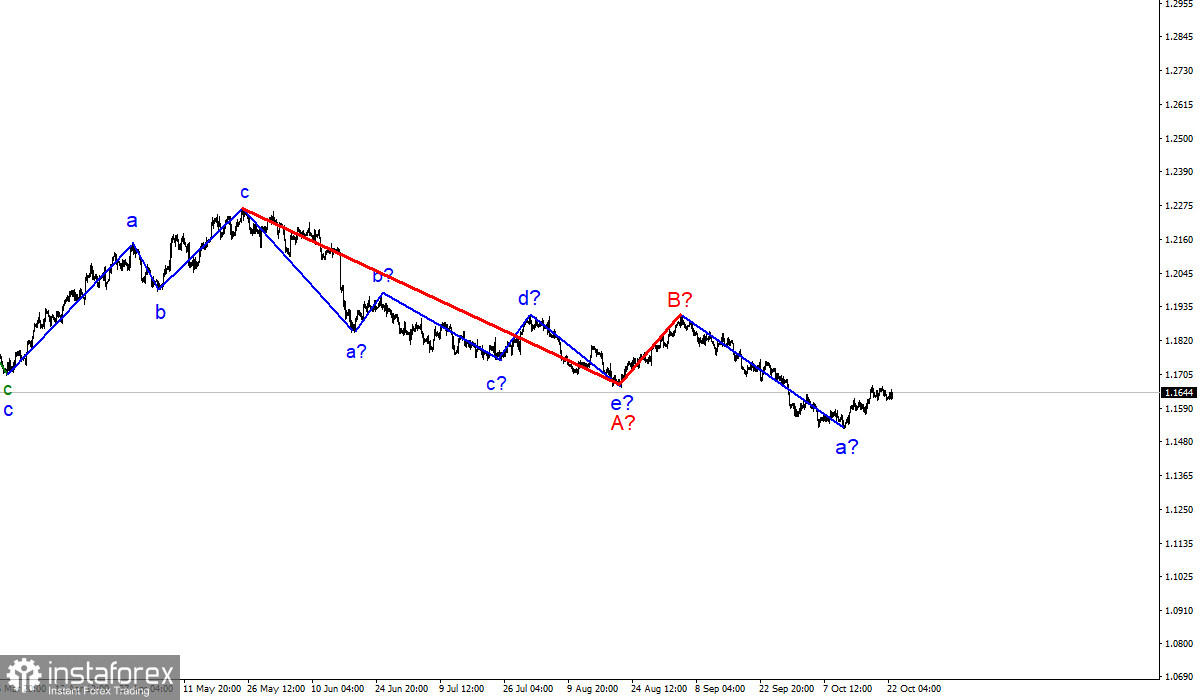

The wave counting of the 4-hour chart for the Euro/Dollar instrument suffered certain changes after the quotes fell below the low of the previous wave. Thus, now the a-b-c-d-e trend segment, which has been formed since the beginning of the year, is interpreted as wave A, and the subsequent increase in the instrument is interpreted as wave B. If this assumption is correct, then the construction of the proposed wave C has now begun and is continuing, which can take a very extended form. Its internal supposed wave a has completed its construction and has received a very extended form.

At this time, the construction of the corrective wave b has begun, after the completion of which at least one more downward wave should be built. Thus, the current wave count does not indicate that the reduction of the instrument is completed. At the same time, corrective structures are very problematic, since at any moment they can become more complicated or take on an unusual appearance. I do not advise working out the corrective wave b. It is better to wait for its completion and work out wave C. There is also a risk that the wave counting will become more complicated again.

PMI and Jerome Powell's speech on Friday did not arouse due interest among the markets.

The news background for the EUR/USD instrument was quite interesting On Friday. However, this did not affect either the mood of the markets or the current wave counting in any way. This is due firstly to the fact that business activity indices in the European Union decreased compared to the previous month. These data could have put a little pressure on the euro currency, but they did not. Secondly, the US business activity indices turned out to be slightly better than the markets expected. However, these data did not lead to an increase in demand for the US dollar. There was only a small spike in activity when Fed Chairman Jerome Powell gave a speech in the evening.

In his speech, Powell stressed that the Fed continues to follow the path leading to the tapering of the asset purchase program, but at the same time does not consider the possibility of raising interest rates. The markets considered the information received important and slightly increased the demand for the US currency. However, the total amplitude of the day did not exceed 20 basis points, so the reaction of the markets to Powell's speech is not even visible on the chart. Thus, I would say that nothing has changed at the end of the past week. The construction of the corrective wave b is also continuing, which can end at any moment. The news background is not a priority right now, so more attention should be paid to the wave picture. This week, the ECB will hold a meeting, which may lead to a change in the wave pattern.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C will continue, but at this time an internal corrective wave is being built. Therefore, now I advise you to wait for the completion of this wave, and after that - to sell the instrument for each signal from the MACD "down," with targets located near the calculated marks of 1.1454 and 1.1314, which corresponds to 76.4% and 100.0% Fibonacci levels. An unsuccessful attempt to break through the 38.2% Fibonacci level will indicate the readiness of the markets for new sales of the instrument.