Can the era of cheap oil supplies end forever? This is the question asked by some analysts from large commodity departments on Wall Street, where banks raise their long-term price forecasts by more than $10.

At the moment, the world is focused on climate change and declining investment in fossil fuels. Instead of increasing supply, companies are forced to limit their costs, which leads to structural underfunding of new production, and this will keep oil prices high for a longer time.

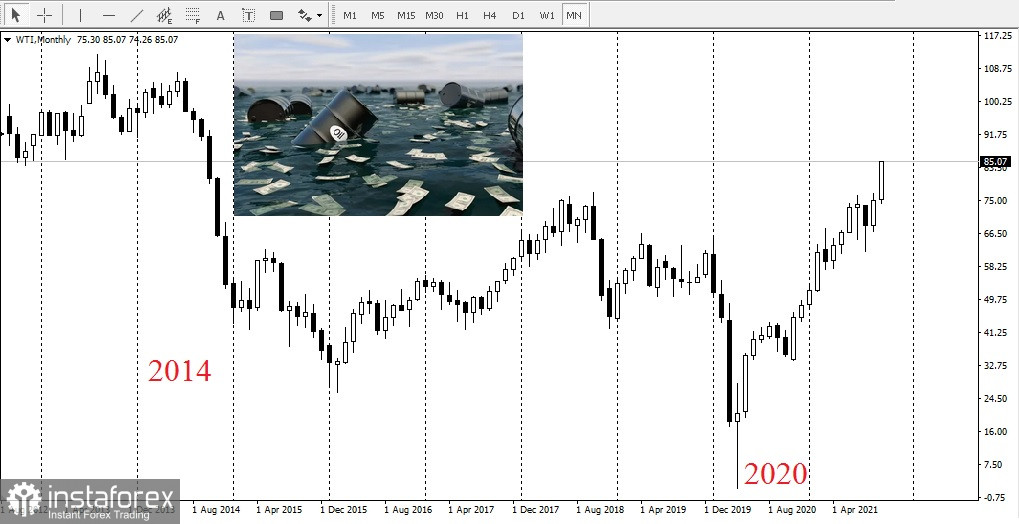

There is nothing new in the concept of supply shortage. After the collapse of prices in 2014, analysts started talking about the fact that demand could exceed production volumes due to insufficient investment. However, the drop in energy prices due to COVID-19, combined with pressing environmental problems, gives reason to think that everything is different this time.

Following last year's negative oil prices, the number of oil and gas drilling rigs worldwide has recovered.

Several banks that forecast price increases:

Goldman claims that oil will cost $85 in 2023. Last week, Morgan Stanley raised its forecast by $10, saying that oil would cost $70. At the same time, BNP Paribas predicts that the price of oil will be almost $ 80 in 2023. Other banks, including RBC Capital Markets, said that oil is at the beginning of a structural bullish movement.

Such forecasts mean that a commodity vital to the global economy has become more expensive. Oil price expectations are supported by hundreds of billions of dollars of capital valuations of major international oil companies such as Royal Dutch Shell Plc and BP Plc.

As for the investors' part, the desire for lending is falling. In the last week alone, the largest French banks have announced that they will cut funding for the shale oil and gas industry from the beginning of next year.

However, not everyone supports the idea that prices will be high. In the October forecast of Citigroup Inc., they said that oil's price below $ 30 and above $ 60 looks unstable in the future. The bank's analysts, including Ed Morse, wrote that a prolonged price above $50 could add 7 million barrels per day of additional supply.

The International Energy Agency stated a little earlier in October that if the current growth in demand continues, then the cost of fossil fuels will be lower than necessary. According to the IEA, oil demand will begin to decline only in the 2030s under the current policy. However, according to Morgan Stanley estimates, the supply may stop growing by 2025, which will lead to a significant deficit.