The UK policy is always uncertain. Such issues as referendums on Scottish independence, withdrawal from the EU, prolongation of Brexit, resignation of the Prime Minister, and some others have caused a lot of concerns. At the moment, the stance of the Bank of England causes a lot of doubts and questions. The fact is that the regulator intends to raise the repo rate despite the economic slowdown and mounting stagflation risks.

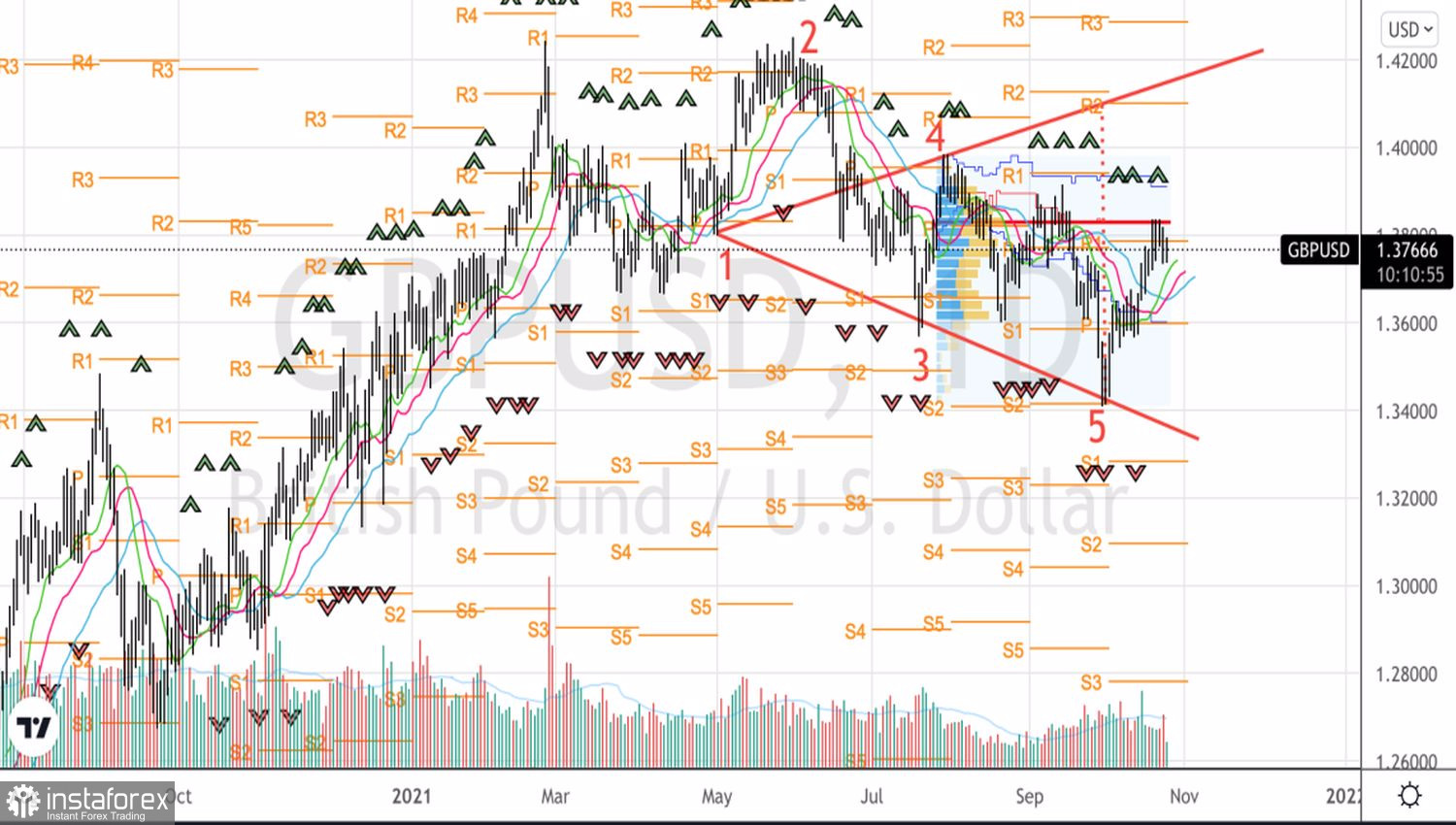

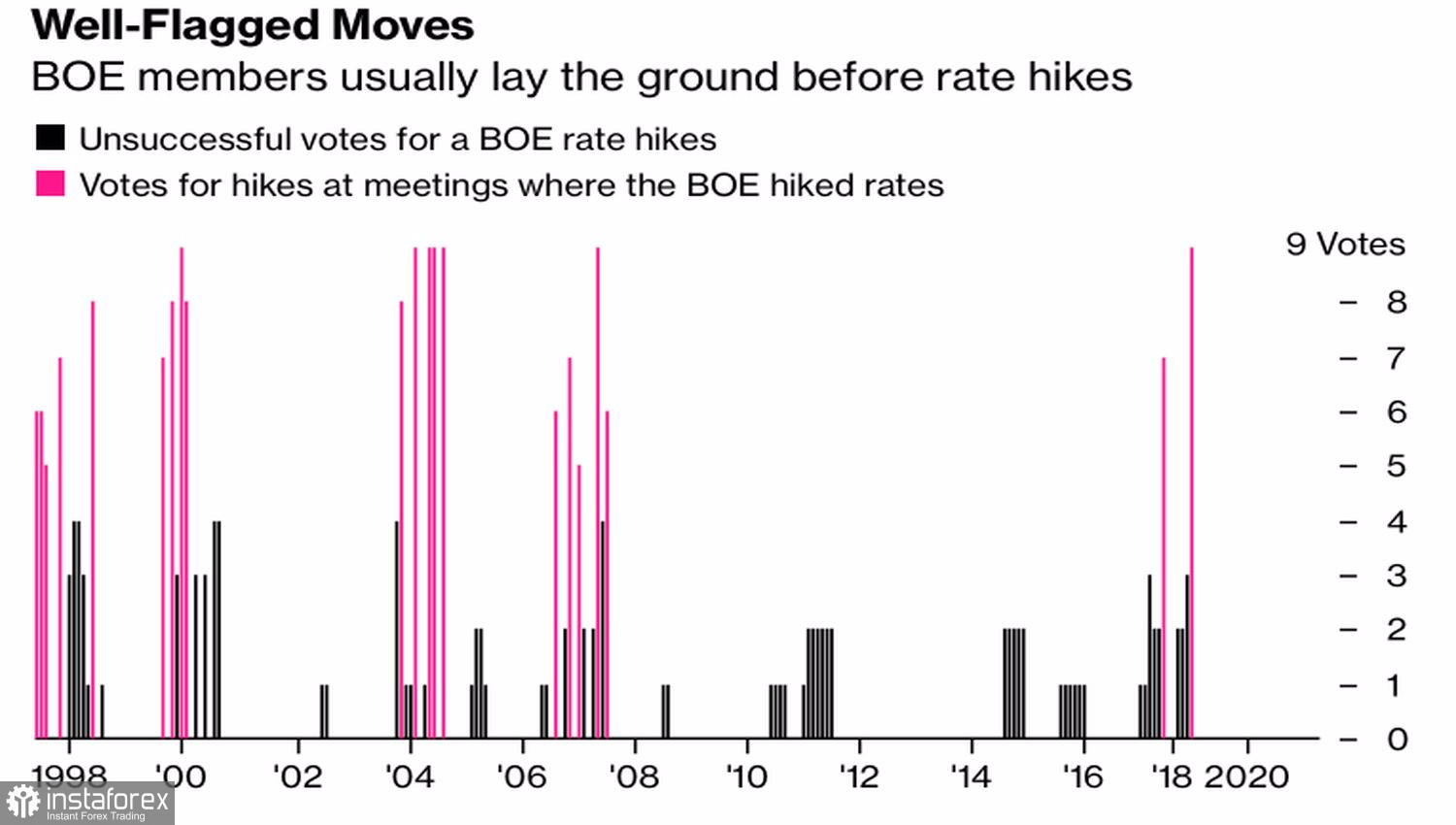

Ex-officials of the Monetary Policy Committee claim that markets are too active in pricing in the fact that the BoE will raise the repo rate at the meeting in November. As a rule, there are usually several opponents of the idea. This time, no one has voted for a higher repo rate since the last recession.

BoE's voting chart on repo rate change

On the other hand, if the regulator fails to make changes, investors may lose trust in the central bank. However, it may announce the QE tapering instead of implementation of its initial plans.

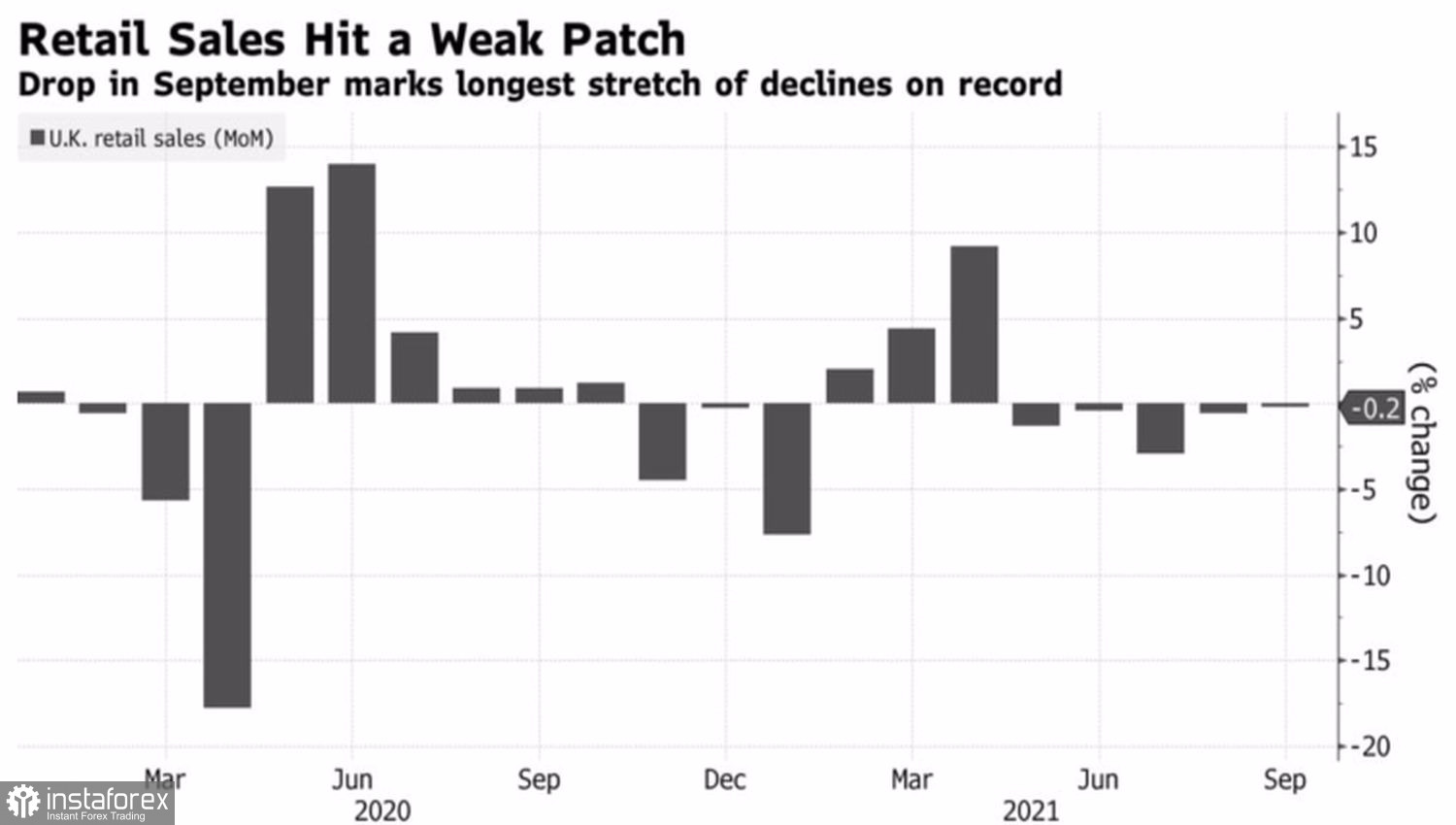

The UK economic situation is not that rosy. Consumer confidence has dropped to the lowest level since the beginning of the last lockdown. The share of manufacturers who reported a shortage of labor force has almost reached a record high. At the same time, in September, the UK retail sales declined for the fifth month in a row. It is the longest fall since the record began. According to the IMF, even in 2024, GDP may be 3% lower than before the pandemic. The UK economic recovery is the slowest among the G7 countries.

UK Retail Sales

Against such a background, the rise of the key interest rate could lead to a catastrophe. Notably, in September, inflation slackened to 3.1% from 3.2%. Nevertheless, the Bank of England still supposes that inflation may advance to 4%. At the same time, BoE's chief economist Huw Pill provides choking predictions, saying that at the beginning of 2022, the CPI may advance to 5%.

It is still unclear whether it is a good idea to tighten the monetary policy against this background. However, the Bank of England is likely to take such a decision. In addition, after raising the repo rate, it may decrease it again. Of course, this will be possible, if inflation slows down. According to other countries, consumer prices grow only after significant monetary and fiscal stimulus measures like in the US and the UK. If the central bank choses modest loosening of its monetary policy, like in China, the CPI is likely to climb slower.

That is why now we cannot apply the Wolfe Wave analysis on the daily chart of the pound/dollar pair. If the price breaks the level of 1.383, traders may start opening long positions with the target of 1.41.

GBP/USD, Daily chart