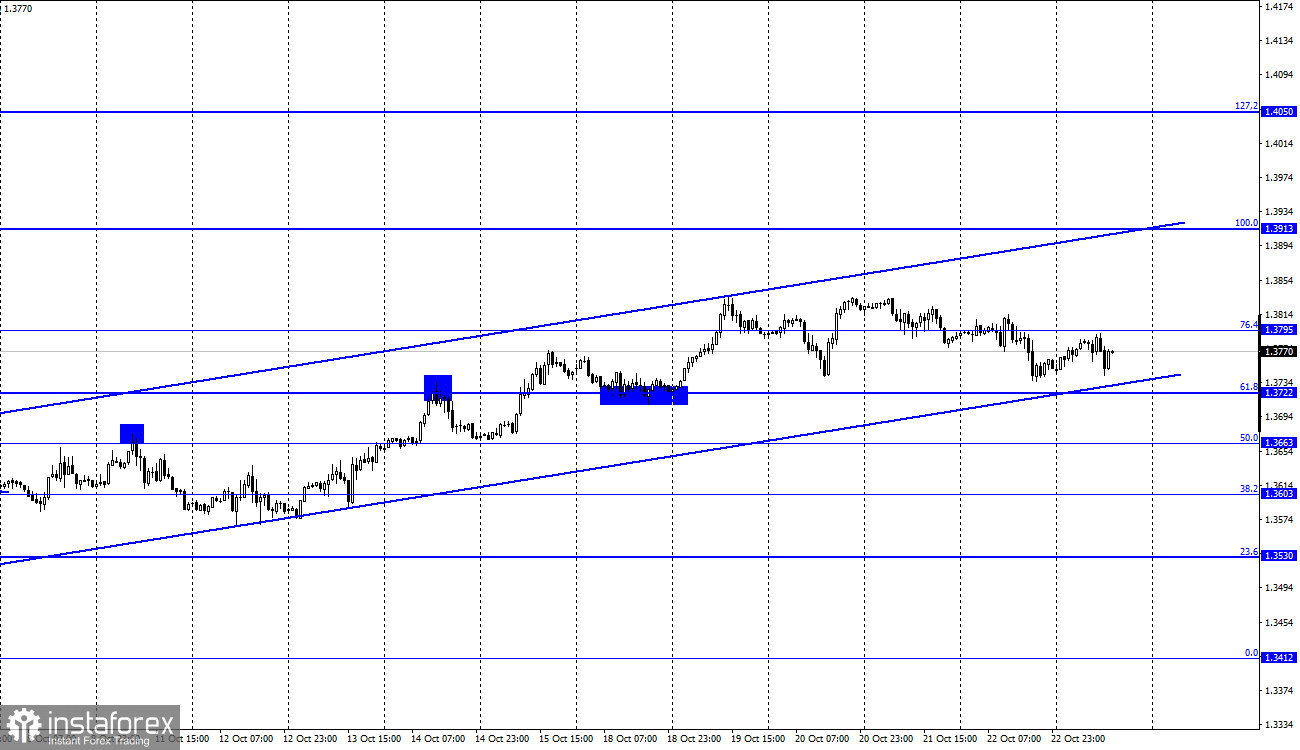

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair continues to fall in the direction of the lower boundary of the upward trend corridor. The rebound of quotes from the latter will favor the British and the resumption of growth in the direction of the corrective level of 100.0% (1.3913). The consolidation of quotes under the corridor will allow us to count on the continuation of the fall in the direction of the levels of 1.3663 and 1.3603. The information background for the pound is now quite neutral. All the attention of traders is now occupied by the future meeting of the Fed, although the ECB meeting will be held this week. There is not much news from the UK itself right now. However, it has become known that a new round of negotiations on the Northern Ireland protocol will start this week between London and Brussels. Let me remind you that London insists on a complete revision of the entire protocol and developing a new mechanism. Brussels opposes, and all this may end up in the courts.

Nevertheless, there are still some chances of reaching an agreement since the European Union has indicated its desire to concede in some points of the agreement. It is difficult to say whether this agreement will somehow positively impact the pound since it has already been growing quite confidently in the last month. It seems that only a meeting of the Fed and a meeting of the Bank of England can affect its course in the coming weeks. Also, an important event this week will be the report on GDP for the third quarter in the United States. Traders expect economic growth to slow down to 2.6% q/q, which may pressure the US currency exchange rate. At the same time, one report is unlikely to change the mood of traders radically. And if they are now tuning in to sales, as in the case of the European, then the GDP report will not prevent this. From my point of view, it is the ascending corridor on the hourly chart that has priority right now and the ascending corridor on the 4-hour chart.

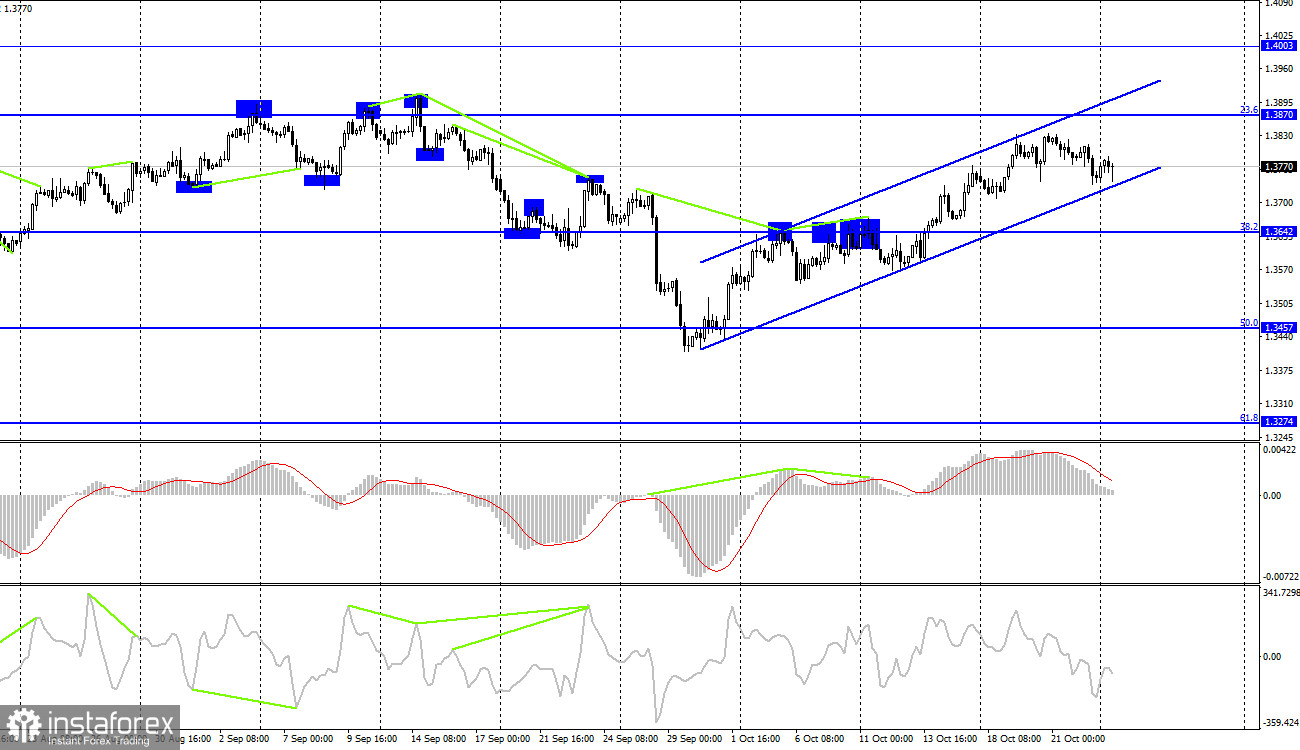

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart continues the process of falling, which is not strong yet. The rebound of quotes from the lower boundary of the ascending corridor, which is almost an exact copy of the corridor from the hourly chart, will allow us to count on the resumption of growth in the direction of the corrective level of 23.6% (1.3870). The consolidation of quotes under the corridor will increase the probability of a further fall in the direction of the Fibo level of 38.2% (1.3642).

News calendar for the USA and the UK:

UK - a member of the MPC of the Bank of England, Silvana Tenreyro, will make a speech (13:00 UTC).

On Monday, only a speech by MPC member Silvana Tenreyro will take place in the UK, which pleases traders with loud statements from time to time. However, in general, there is practically no information background.

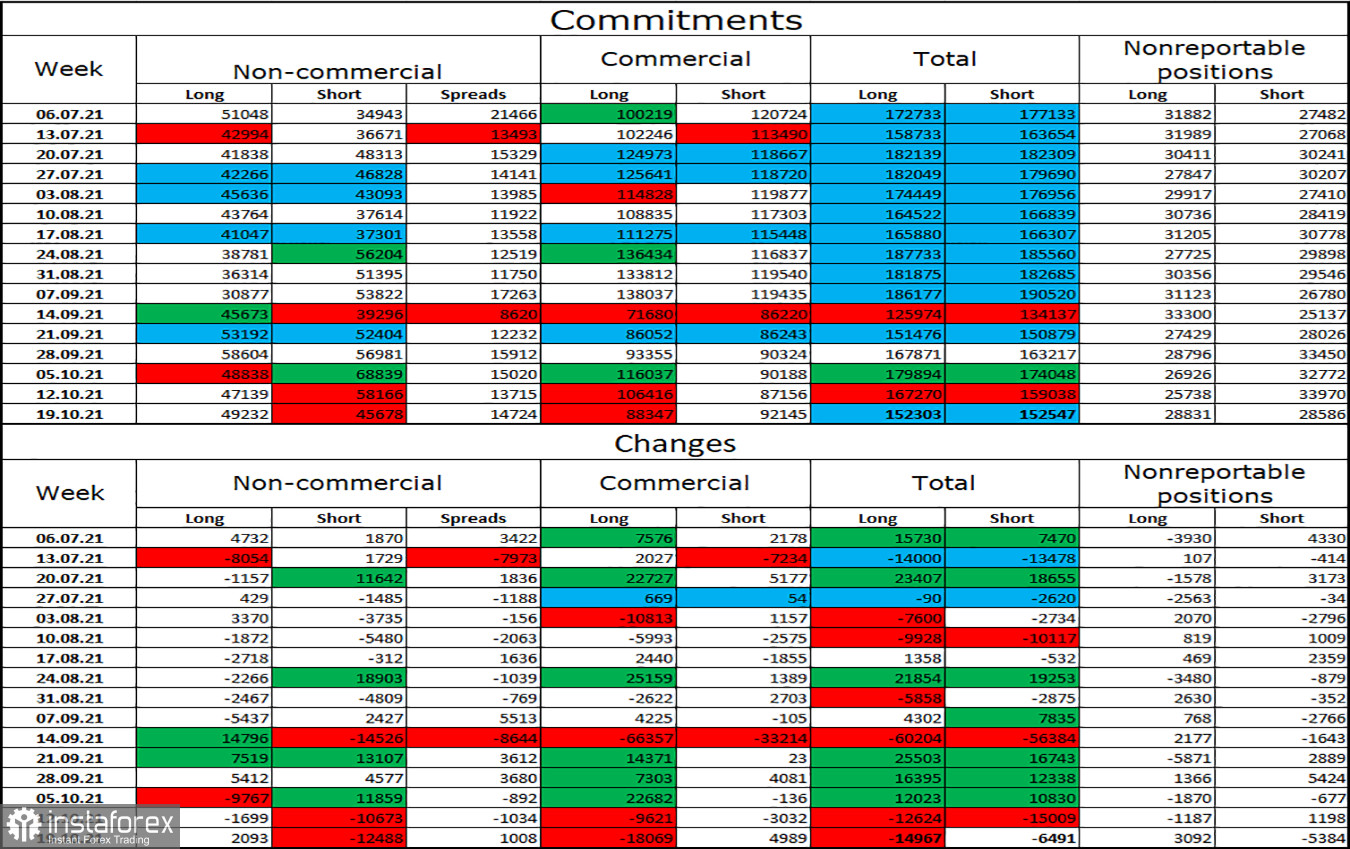

COT (Commitments of Traders) report:

The latest COT report from October 19 on the pound showed that the mood of the major players had become much more "bullish." In the reporting week, speculators opened 2,093 long contracts and closed 12,488 short contracts. Thus, the number of long and short contracts in the hands of major players has almost equalized. Now we can say that the mood of the "Non-commercial" category of traders is neutral, which means more attention should be paid to the graphical picture and signals. In recent weeks, the major players do not have any clear mood and then increase purchases, then increase sales. The total number of long and short contracts for all categories of traders is the same.

Forecast for GBP/USD and recommendations to traders:

I recommend new purchases of the pound when rebounding from the lower boundary of the corridor on the hourly chart with targets of 1.3795 and 1.3913. I recommend opening sales if there is closure under the ascending corridor on the hourly chart with targets of 1.3603 and 1.3530.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.