Bitcoin kicked off a new trading week with a jump to $62,000-64,000. Neat this level, a new support area has been formed. The euphoria over ETF funds is not over yet. Institutional investors continue to push the BTC price higher. This is why few people doubt bitcoin's further rally. Reportedly, the United States has become the largest bitcoin mining center. China seems to mull over the ban on mining and may even ease restrictions to regain its leading position.

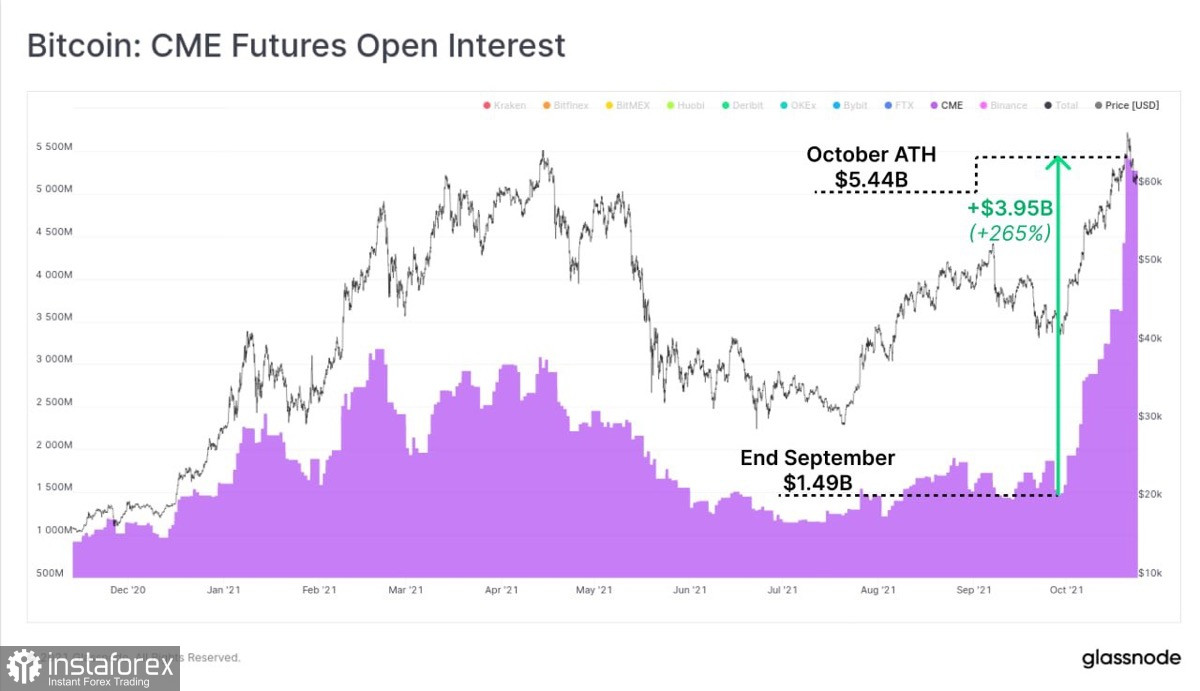

At the end of last week, ProShares, the company that launched the first ETF fund in the United States, called for the government to lift the limit on trading futures contracts. The company is facing a large influx of investors into the futures market thanks to bitcoin. As a result, the new record in futures trading was hit. The company needs to increase the volume. Yet, it is unable to do so due to the limit. Taking into account the launch of two more ETF funds, there is every reason to believe that the futures market will continue to break records and push the BTC price higher. This means that the regulator and the CME are likely to reach a consensus and remove or increase the limit on the futures market. Currently, the company has 1,600 October and 2,100 November transactions on its balance sheet, with a total value of more than $1 billion. The limit is 5,000 contracts. This figure is likely to be passed before mid-November. Notably, apart from the growing institutionalization and the BTC price, the launch of the BTC exchange-traded fund had a positive impact on the performance of other cryptocurrencies. Trading on ETH futures has also started to grow, which indicates the formation of a trend for investments in the futures cryptocurrency market. This will strengthen the positions of coins and enable them to become more resistant to external headwinds.

For instance, Beijing decided to conduct mass polls regarding cryptocurrencies and the legal status of mining in the country. The National Development and Reform Commission of China has been collecting data on the attitude to crypto mining and plans the possible lifting of restrictions on mining in the country. Market participants were not surprised by this news. China may ease restrictions yet not for a long period of time. Thus, bitcoin is no longer vulnerable to negative news from China and its tough stance on the crypto market. Bitcoin keeps approaching new record highs.

Now, it continues to recover. After a rebound from $59,000 to-61,000, BTC is gaining momentum. Yesterday, it rose by 4% with daily trading volumes of $32 billion. As of 16:30, the coin was trading near $63,000. Despite the strong rally, buyers' positions look weak on the daily chart. After two powerful bearish candlesticks, bulls managed to take the upper hand on Sunday. It signals the weakness of sellers, but not the resumption of the upward movement. At the same time, technical indicators are showing bullish momentum. The MACD is moving above the red zone and is close to forming a bullish intersection, which indicates the possible development of a medium-term upward momentum. Stochastic continues to grow. The RSI indicator has passed the 50 mark, which also signals strong bullish momentum. The nearest resistance level is located at $64,100. Then, the coin will try to approach a new all-time high.