Wave pattern

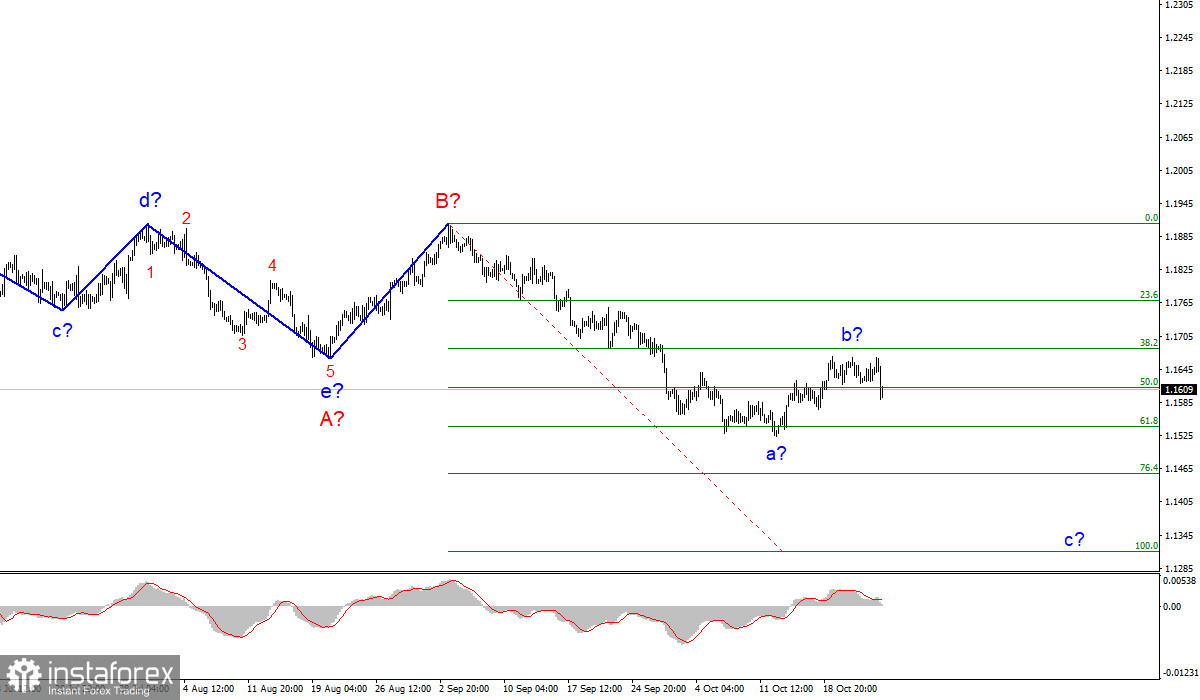

The wave counting of the 4-hour chart for the Euro/Dollar instrument has undergone certain changes, but at the moment it looks quite holistic. Thus, now the a-b-c-d-e trend segment, which has been forming since the beginning of the year, is interpreted as wave A, and the subsequent increase in the instrument is interpreted as wave B. If this assumption is correct, then the construction of the proposed wave C has now begun and is continuing, which can take a very extended form.

The exit of quotes from the reached highs means that the expected wave b can be completed. If this is indeed the case, then the construction of wave c has now begun, which can also turn out to be very long. Thus, its targets are located below the 15th figure, up to the 13th. At the same time, wave b can take on a more complex three-wave form. Although, at the moment, it looks quite complete. Deep corrections are not accepted inside the current wave C.

There were no news and reports on Monday, nevertheless, the markets found reasons to buy the dollar.

There was no news background for the EUR/USD instrument on Monday. Now the markets are fully focused on the future meeting of the Fed, which will be held in early November. From my point of view, this event is somewhat overblown and exaggerated. The news background is an important component of the foreign exchange market, but at the moment we see that everything is proceeding according to a wave scenario. Therefore, I believe that wave analysis is more important now.

We have witnessed more than once in recent months when important events or reports do not affect the demand for the dollar or the euro in any way. Or they have such a weak influence that it, in turn, has no effect on the wave counting. Thus, even important reports on inflation in the EU and GDP in the US this week may have only a small impact on the mood of the markets. The same applies to the ECB meeting.

The ECB made it clear that it was also considering reducing the volume of asset purchases under the PEPP program, but at the same time immediately stated that the main asset purchase program (APP) could be increased at the same time. That is, the total amount of incentives, in fact, does not change. Therefore, I do not think that the European currency will be in demand after the ECB meeting and Christine Lagarde's speech.

General conclusions

Based on the analysis, I conclude that the construction of the downward wave C will continue, and its internal corrective wave has completed its construction. Therefore, now I advise you to sell the instrument for each signal from the MACD "down," with targets located near the calculated marks of 1.1454 and 1.1314, which corresponds to 76.4% and 100.0% Fibonacci levels. A successful attempt to break through the 50.0% Fibonacci level may indicate that the markets are ready to sell the instrument.

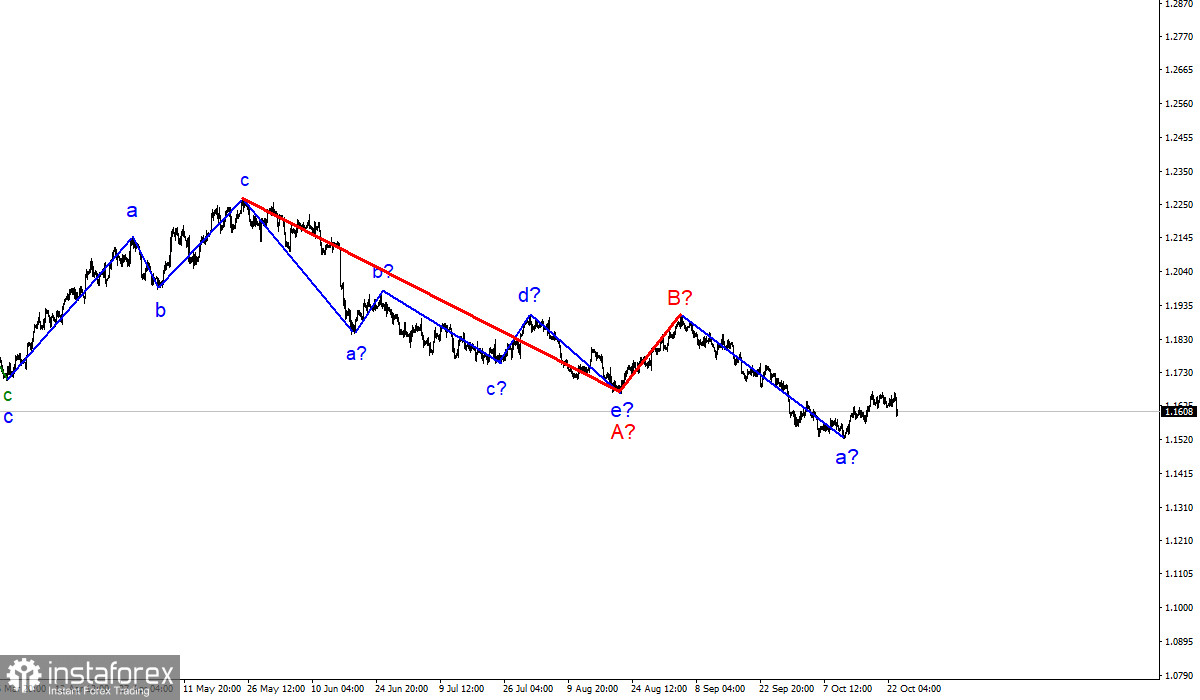

The wave counting of the higher scale looks quite convincing. The decline in quotes continues and now the downward section of the trend, which originates on May 25, takes the form of a three-wave corrective structure A-B-C. Thus, the decline may continue for several more months until wave C is fully completed.