The EUR/USD pair showed increased volatility on the first day of the trading week. Initially, the price increased to a local high of 1.1666 and then declined to a weekly low of 1.1591 after a few hours. However, the bears also were not able to consolidate below the level of 1.1600, so the pair stayed at the bottom of the 1.16 mark.

It can not be said that yesterday's behavior of the pair was surprised by something. Throughout the previous week, traders traded using a similar algorithm: EUR/USD bulls organized an intraday price impulse, and in turn, the bears resisted, causing a downward pullback. In fact, the pair has been trading in a wide price range of 1.1600-1.1650 since October 19, with short-term surges, plus or minus 10-20 points. Neither buyers nor bears dare to launch a large-scale offensive, which is why the upward and downward impulses are so quickly extinguished. The parties are shackled by doubts: the euro is waiting for the ECB's October meeting (which will take place this Thursday), while the dollar is waiting for the Fed's November meeting (the results of which we will learn next Wednesday).

As a result, the pair goes in a circle, within the above range. On the other hand, the current situation is characterized by its "stability": sales can be considered at the intersection of 1.1650, and purchases at the intersection of 1.1590. The intrigue lies only in when exactly traders will come out of this "vicious circle". After all, there is no doubt that this will happen in the near future, most likely in the coming weeks.

The pair's growth yesterday was due to several fundamental factors. The trading week started positively as Joe Biden's resonant statement last Friday was smoothed over by senior White House officials. It can be recalled that the American leader unexpectedly announced that the United States would defend Taiwan in the event of an attack by China. According to experts, this is a clear departure from the US foreign policy position, which the country has been taking for many years. Nevertheless, the key figures of the presidential administration did not develop the aggressive rhetoric of their "boss". On the contrary, the tone of their statements was diplomatic. In particular, US Secretary of Defense Lloyd Austin said that Washington will continue to adhere to the "one China" policy towards China, while maintaining established relations with Taiwan, including in ensuring its security – in the context of supplying it with weapons for self-defense. Beijing also did not escalate the situation: Chinese Foreign Ministry spokesman Wang Wenbin only warned the American president against "careless statements on a sensitive issue for China."

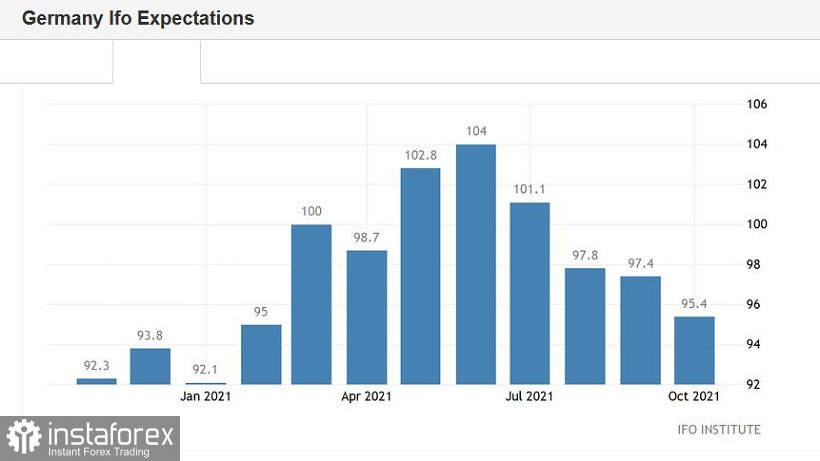

In other words, Biden's harsh comments did not provoke an increase in anti-risk sentiment in the markets, which is why the EUR/USD pair updated the local high at the start of trading on Monday. But during the European session yesterday, the euro weakened throughout the market, after the publication of IFO reports. The indicator of the business environment in Germany was in the "red zone", declining to 97.7 points (with a forecast decline to 98.2 points). This indicator has been consistently declining for the fourth month in a row, reflecting the pessimism of German entrepreneurs. The negative dynamics were also demonstrated by the indicator of economic expectations from the IFO. The indicator came out at 95.4 points, which is the weakest result since February of this year. It should be noted here that just on Friday, preliminary PMI indices for October were published, which also turned out to be quite weak. For example, the German index of business activity in the services sector came out at 52.4 points – this is the weakest result since April.

Such figures, which were published before the ECB's October meeting, disappointed buyers of EUR/USD. Meanwhile, the sellers of the pair received support from the current macroeconomic reports from the United States (in particular, the index of production activity of the Federal Reserve of Dallas rose to 14 points). On the other hand, dollar bulls were unable to interpret Jerome Powell's Friday speech in their favor. So, the Fed Chairman said that the US regulator "will raise rates if it sees serious risks of rising inflation expectations." But at the same time, he added that such a scenario is "unlikely" since the increase in inflation is temporary. He also noted that economic growth in the United States slowed sharply in the third quarter, due to the fact that the Delta strain "forced consumers to abandon eating out and generally reduced the consumer activity of Americans."

On another note, the main data on the growth of the US economy will be published this Thursday. According to preliminary forecasts, the volume of GDP in the third quarter increased by only 2.6% (in the second quarter, the American economy grew by 6.7%). Before this release, EUR/USD traders are in no hurry to invest in the US dollar.

Therefore, the pair will most likely trade in the above range of 1.1590-1.1650 in the coming days, alternately pushing off the borders of this range. If we talk about longer-term prospects, we believe that the priority is the downward direction, that is, to the levels of 1.1550 and 1.1500 (primarily due to the uncorrelation of the positions of the Fed and the ECB).