EUR/USD – 1H.

The EUR/USD pair performed a reversal in favor of the US currency on Monday and began the process of falling. The quotes closed below the level of 1.1629, as well as under the upward trend corridor. Thus, the mood of traders has changed to "bearish" at this time. However, bear traders are in no hurry to continue selling the pair. Perhaps they need time since a meeting of the European Central Bank will be held in the European Union this Thursday. And this event is the key one this week. What can we expect from the ECB on October 28? Let me remind you that at the last meeting, Christine Lagarde announced that in the last months of this year, the volume of bond purchases under the PEPP program would be reduced.

I cannot say that these words provided strong support for the European currency. It seems that traders are watching the Fed and its decisions on the QE program more closely. However, both central banks are clearly in no hurry to curtail economic stimulus programs. Thus, I expect the same very soft rhetoric from Christine Lagarde this Thursday. It is unlikely that the ECB will announce an even greater reduction in QE, and it cannot make any other decisions now. Therefore, the ECB president will again talk about inflation, its slowdown in the future, and the "temporary nature" of strong price growth (although it is not so high in the European Union, judging by inflation reports). And traders will be forced to react to this soft rhetoric. Most likely, there will be no strong movements on Thursday. Yesterday, the pair moved quite actively, but at the same time, this movement looked very unexpected since there was no information background. If you pay attention to the movements over the past two weeks, it becomes clear that traders are still in no hurry to sell or buy the euro. Thus, even the entire information background of this week (it should also be noted the report on GDP in the United States and the report on inflation in the European Union) is unlikely to change the general state of things. Most likely, traders will still sluggishly trade the euro/dollar.

EUR/USD – 4H.

On the 4-hour chart, the quotes performed a fall to the corrective level of 100.0% (1.1606). However, there was no rebound or closure under it. Thus, it isn't easy to draw any conclusions at this time. Fixing quotes below the level of 1.1606 will allow us to count on a further fall of the pair in the direction of the corrective level of 127.2% (1.1404). If the pair remains above 1.1606, the growth process can be resumed toward the Fibo level of 76.4% (1.1782). Emerging divergences are not observed in any indicator today.

News calendar for the USA and the European Union:

On October 26, the calendars of economic events in the European Union and America were empty, except for the indicator of consumer confidence in the United States. Thus, there is no information background today. Traders' activity may remain low.

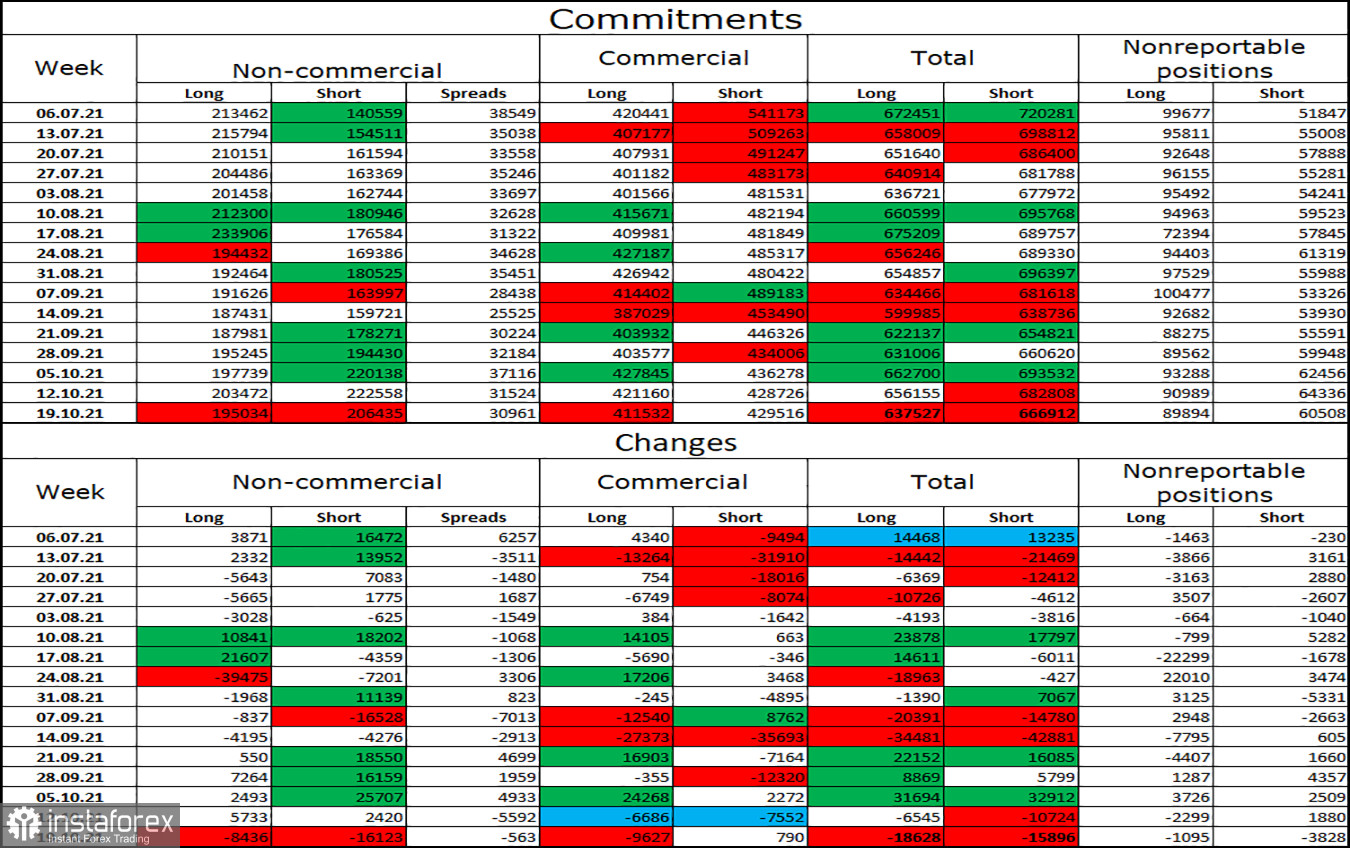

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders changed towards "bullish." Speculators closed 8,436 long contracts on the euro and 16,123 short contracts. Thus, the total number of long contracts in the hands of speculators decreased to 195 thousand, and the total number of short contracts - to 206 thousand. Over the past few months, the "Non-commercial" category of traders has tended to eliminate long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. In general, this process continues now, but the European currency has shown weak growth in the last two weeks. Thus, the current strengthening of the "bullish" mood may be a one-off.

EUR/USD forecast and recommendations to traders:

Traders are still not trading the pair too actively. I do not recommend buying the pair again yet, since there are no buy signals. I recommended selling the pair yesterday, as there was a closure under the descending corridor on the hourly chart, with a target of 1.1552. Now, these transactions can be kept open.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.