On Monday, the US and European stock markets continued to rise. The S&P 500 and the Dow set new records, helped by strong corporate income statements and better-than-forecast data on the US economy. The Conference Board's consumer confidence index rose by 4p in October against expectations of a sluggish result. In addition, inflation expectations in the 12-month perspective surged to 7%, which is the highest in 13 years.

Yields are still changing weakly. The 10-year UST was found near 1.6%, whose growth is likely to be supported by the dynamics of energy prices. The oil reserves in Cushing is expected to continue to decline, so special attention will be directed to the results of the OPEC+ meeting next week. A new wave of price growth is not excluded since the OPEC+ member countries do not intend to change anything in their strategy of the slow recovery of production levels.

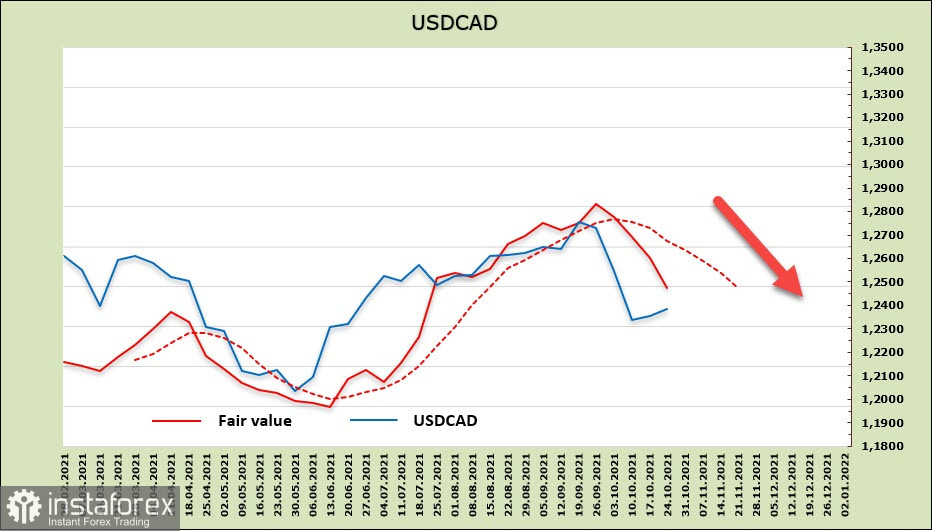

USD/CAD

Today, the Bank of Canada will hold a regular meeting on monetary policy. It is expected that the BoC will announce the end of the quantitative easing program and shift the focus to the strategy of reinvesting income, as well as the dynamics of inflation – the main factor that will determine the pace of normalization of monetary policy.

The dynamics of the USD/CAD pair after the meeting of the Bank of Canada will depend mainly on the tone of the accompanying statement, and primarily on the assessment of inflation growth rates. There are no questions about the pace of economic recovery. A report on business and consumer surveys published by the Bank of Canada last week showed that in both cases, confidence in demand growth expectations is growing, which means confidence in the rapid pace of economic recovery, that is, the Bank of Canada receives support from the economy for further normalization of monetary policy.

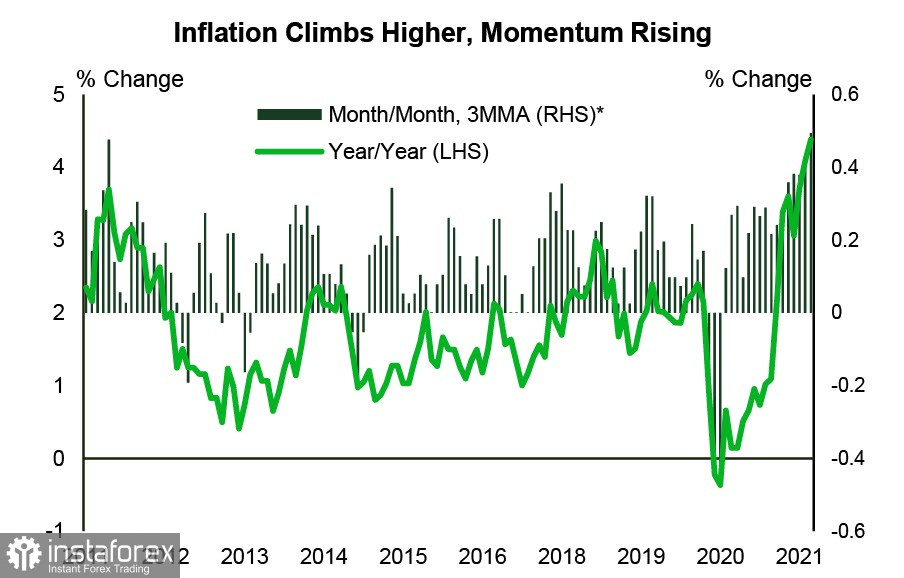

Inflation is another matter. The growth at the moment is 4.4% yoy, while the energy component is becoming less strong, that is, price growth is also observed for other components of the index.

The risk of stagflation is minimal since the labor market and demand in Canada remain stable, unlike in a number of other countries, which gives the Canadian dollar an additional reason for outstripping growth. And while the market assumes 3 rate increases (in total by 0.75%) by the summer of 2022, this gives the CAD an advantage in profitability over the USD, so attention will be on what risks the BoC will indicate in the accompanying statement. If the markets consider the risk concern not too obvious, then the CAD will have grounds for continued growth.

According to the CFTC report, the weekly change in CAD is also in the bullish direction. The net-short position immediately fell by 1.35 billion, to -884 million. The dynamics remain, and the calculated price is confidently directed downward.

The USD/CAD pair will resume its decline following a short consolidation. By the end of the week, a hike below the recent local low of 1.2284 is possible, with the next target being 1.2250.

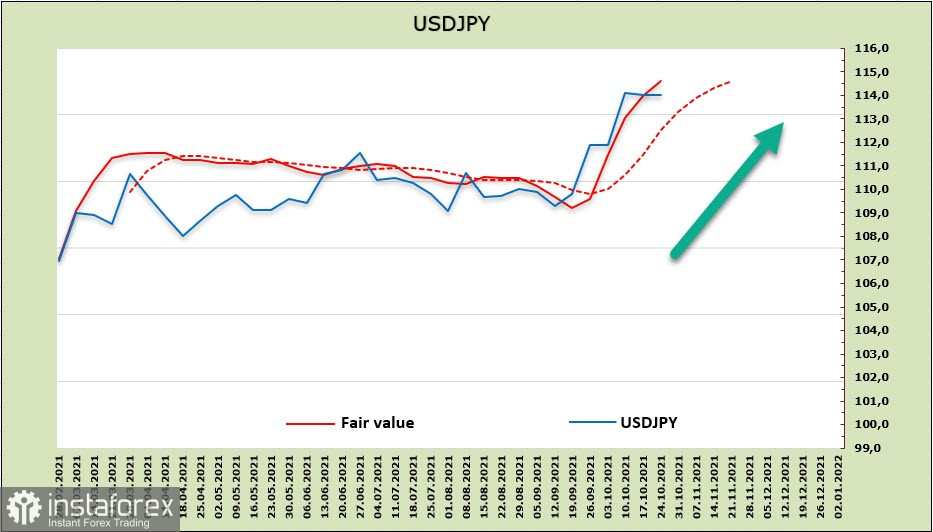

USD/JPY

On Thursday morning, October 28, the Bank of Japan will make a decision on monetary policy. No changes are expected because there are no grounds for that. The Bank of Japan's view on the economy at the moment is that the household sector (consumer spending) is relatively weak, while the corporate sector (capital spending) is relatively strong. The bank expects that the recovery in consumer spending is likely to be slow, so explosive growth is extremely unlikely.

The yen's net short position increased by 2.8 billion over the reporting week and reached -11.227 billion. A distinct bearish advantage, which cannot be questioned, will push the USD/JPY up, consolidating from time to time before a new surge.

The attempt to consolidate above the resistance zone of 114.50/70 was unsuccessful, but everything indicates that growth will resume after a short consolidation. The targets remain the same – 118.70 and 125 by the end of the year. A sharp increase in tension may prevent the implementation of this scenario, which will resume growth in protective assets.