On Wednesday, the US stock market (S&P 500) fell 0.51%, this morning the Japanese Nikkei 225 is losing 0.96%. Such volatility of indices near record highs puts pressure on the USD/JPY pair, which correlates to some extent with risk in the stock markets.

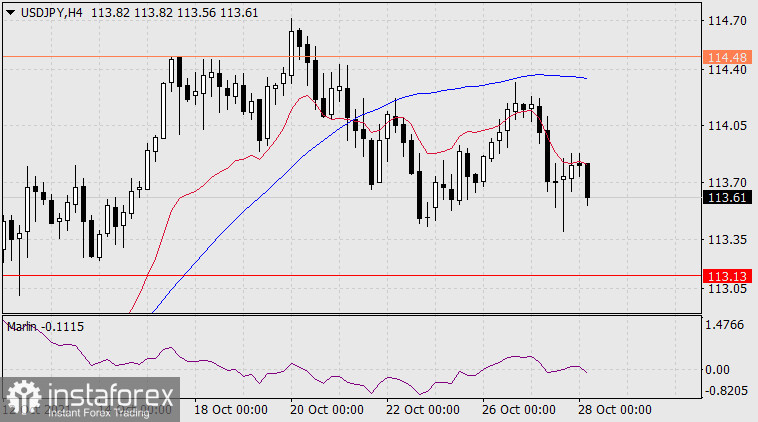

At the moment, we expect the price to decline to the closest line of the price channel of the higher timeframe in the region of 113.13. At this point, the signal line of the Marlin Oscillator will reach the zero line, and then two options are possible: if the growth in the stock market recovers, the USD/JPY pair will turn upward with the 115.80 target, or, having settled below it with the continued fall of the stock market, will develop a decline to the MACD line , to the area 111.44. We consider the growth of the USD/JPY pair as the main scenario, since there are no events on the market that can turn the stock indices into a deep correction. One of such events may turn out to be a strong drop in oil, so we are monitoring the quotes of this instrument as well.

On the four-hour chart, the price turned down with force from the balance indicator line, the Marlin Oscillator moved into negative territory. We are waiting for the price at the target level of 113.13.