The Bank of Canada (BoC) ended its quantitative easing program on Wednesday, but kept its key interest rate unchanged. This provoked Canada spot gold to have a double digit decline, last trading at CA$ 20.

The bank also announced that it is entering a reinvestment phase, so during this period, it will buy Canadian government bonds solely to replace maturing bonds.

With regards to rate hikes, it said it will consider it by mid-2022, mainly because the members believe that inflation will rise next year, but will return to 2% at the end of the year.

These statements pushed USD / CAD down by 1,000 pips.

The bank also projected the Canadian economy to grow 5% this year, increase 4.5% next year and rise 3.75% in 2023.

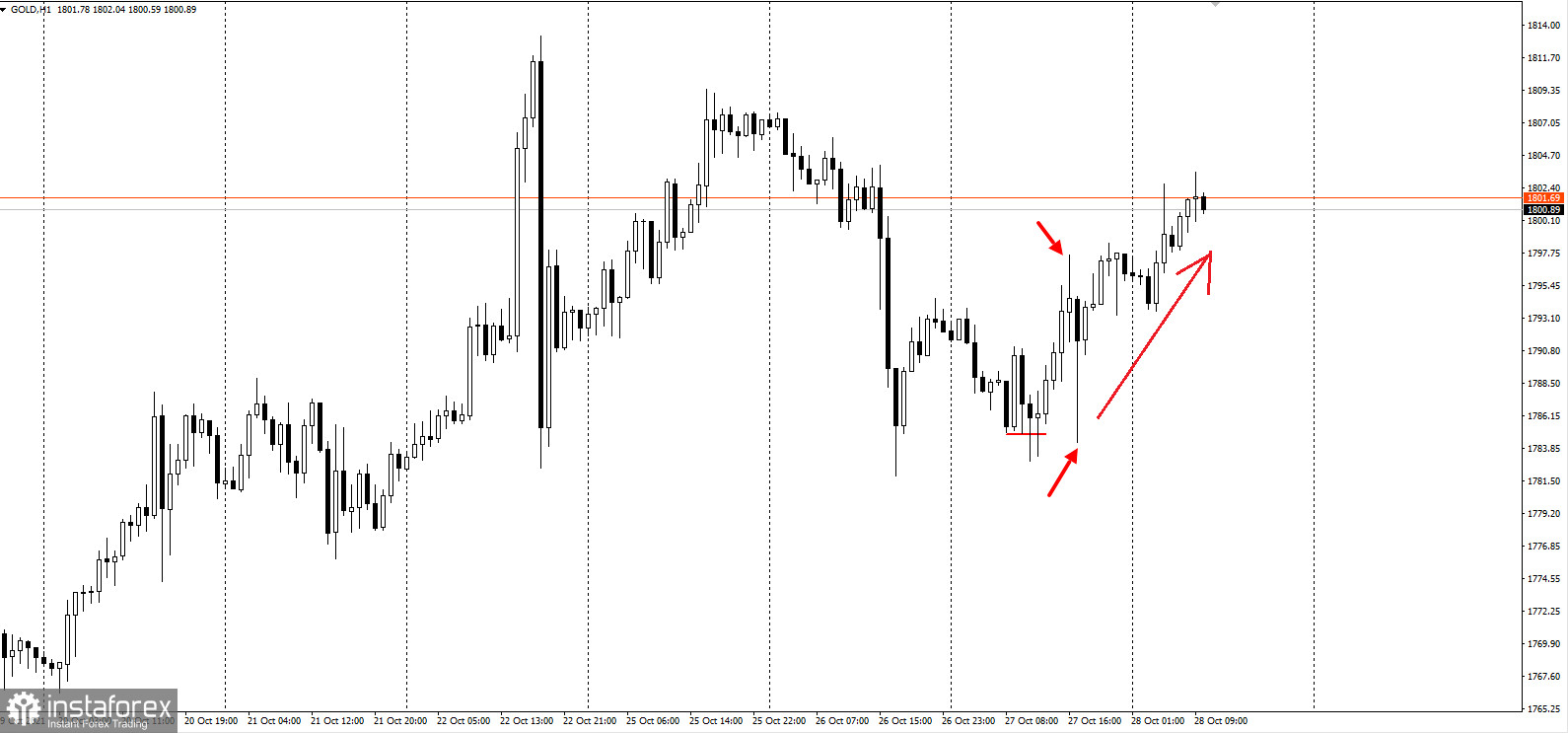

In terms of gold valued in US dollar, prices offset the crash seen in Canada spot gold, thanks to the data on the US manufacturing sector.

US durable goods orders reportedly fell 0.4% in September, after a revised 1.3% increase in August. This is better than expected because economists predicted a 1.1% decline in the index. Also, excluding transport, new orders rose 0.4%.

But some economists say this data does little to allay growing fears on stagflation. After all, the country is currently seeing a slowdown in economic activity and rising inflation.