EUR/USD

Analysis:

The European currency market has been dominated by a downward trend since the beginning of this year. As part of the last part (C), a counter correction has been forming since the end of September, which has not yet been completed.

Forecast:

A downward pullback is expected to be completed in the next session. In the second half of the day, the probability of a reversal and a return to the upward course increases, with the price rising to the resistance zone.

Potential reversal zones

Resistance:

- 1.1720/1.1750

Support:

- 1.1660/1.1630

Recommendations:

Today, short-term purchases from the support zone are possible on the market of the main euro pair. The lifting potential is demonstrated by the calculated resistance zone.

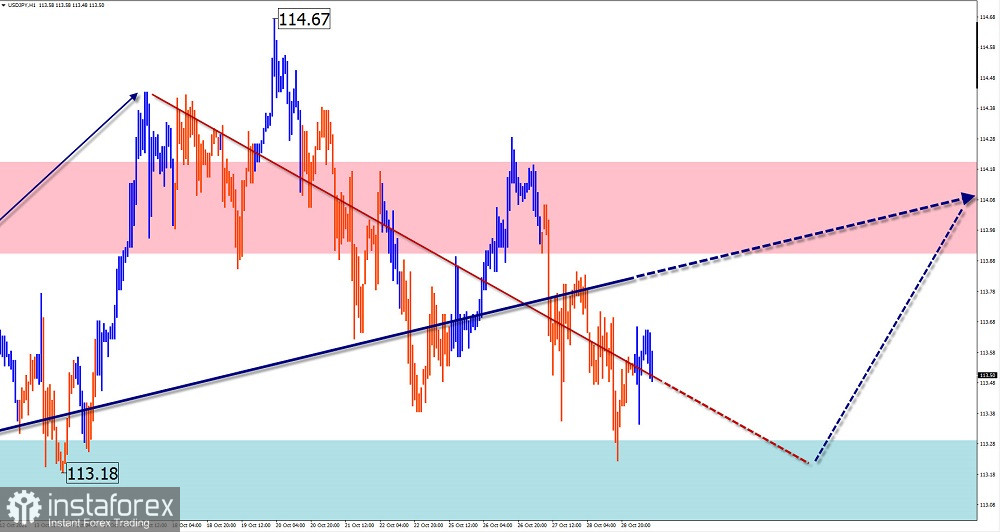

USD/JPY

Analysis:

The unfinished section of the dominant bullish trend of the Japanese yen chart has been counting down since September 22. The pair's quotes have reached the lower limit of a strong potential reversal zone. The pair's quotes have been forming in the lateral plane for the last two weeks, forming an intermediate pullback.

Forecast:

Today, the price is expected to move mainly horizontally, in the price corridor between the nearest oncoming zones.

Potential reversal zones

Resistance:

- 113.90/114.20

Support:

- 113.30/113.00

Recommendations:

Trading on the Japanese yen market today is possible only within the framework of individual trading sessions with a small lot. Purchases from the support zone are more promising.

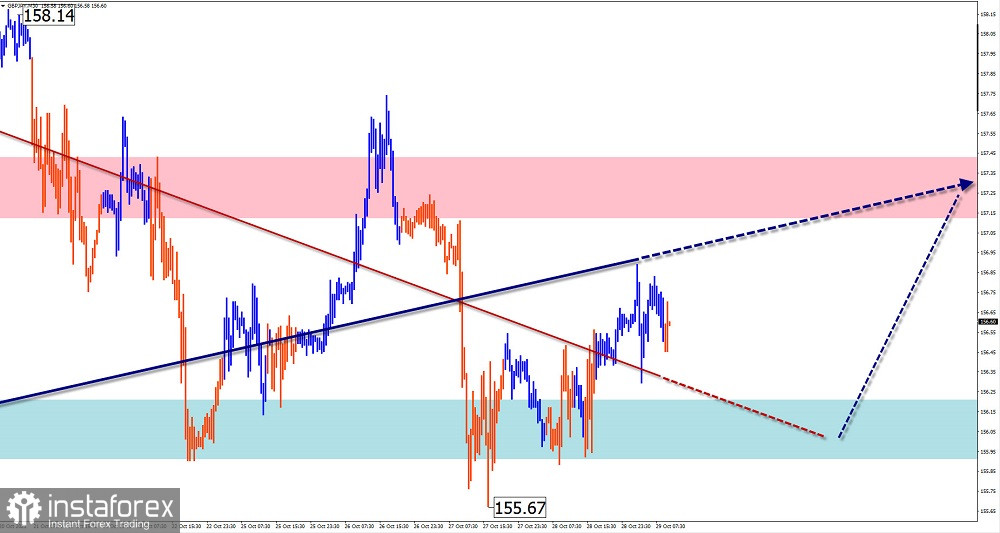

GBP/JPY

Analysis:

On the chart of the British pound/Japanese yen pair, the formation of an upward wave from March 18 continues. The pair's quotes pushed through the level of the strong resistance of a large TF. Over the past two weeks, the pair's quotes have been rolling back to the new support, creating conditions for a further upward spurt.

Forecast:

The general flat vector of movement is expected to continue today. Pressure on the support zone is likely in the next session. By the end of the day, the probability of an increase in volatility and a return to active price growth increases.

Potential reversal zones

Resistance:

- 157.10/157.40

Support:

- 156.20/155.90

Recommendations:

There are no conditions for sale on the pair's market today. It is recommended to monitor emerging signals for the purchase of the instrument in the settlement support area.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the movements of the instrument in time!