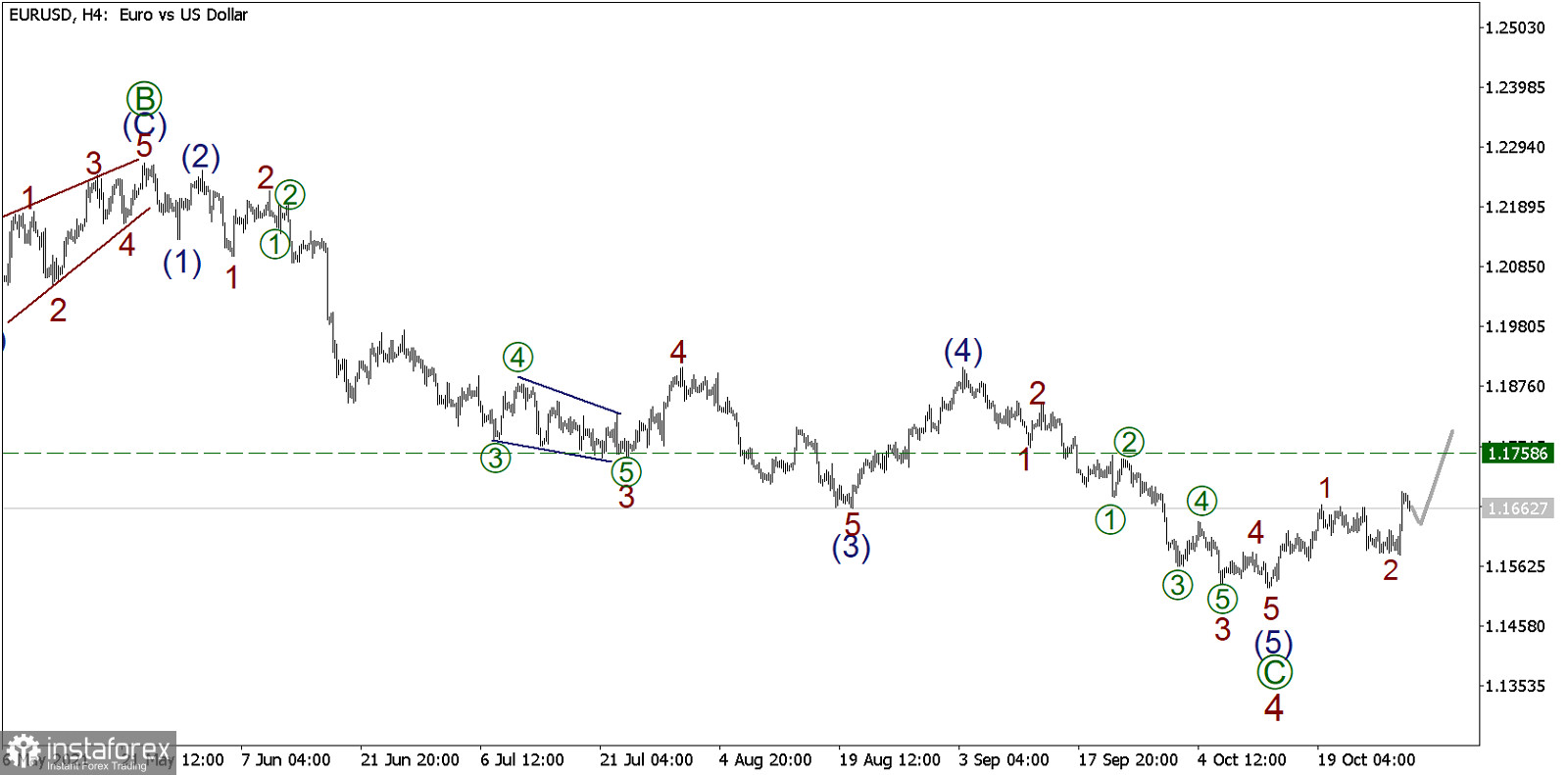

EUR/USD, H4 timeframe:

Let's continue to analyze the situation of the EUR/USD pair through Elliott's theory.

The current EUR/USD structure indicates that the formation of a long-term corrective wave 4 has been done recently.

Wave 4 took the form of a wave plane consisting of sub-waves [A]-[B]-[C]. In the final impulse [C], the sub-waves (1)-(2)-(3)-(4)-(5) can be observed. It should be noted that the price formed an incoming impulse 1 and a correction to this impulse 2 following the completion of all these waves. Right after the completion of wave 2, there was a sharp price growth in the initial part of the new impulse wave.

According to the current markup, wave 3 is currently developing, within which growth will continue in the near future.

Now, it is possible to open long positions from the current level with a target in the area of 1.175, and then a stop loss can be placed at the low of 2.

In terms of economic news background, the consumer price index will be published in the eurozone today. The publication of this news could help the price continue its rally as indicated on the chart.