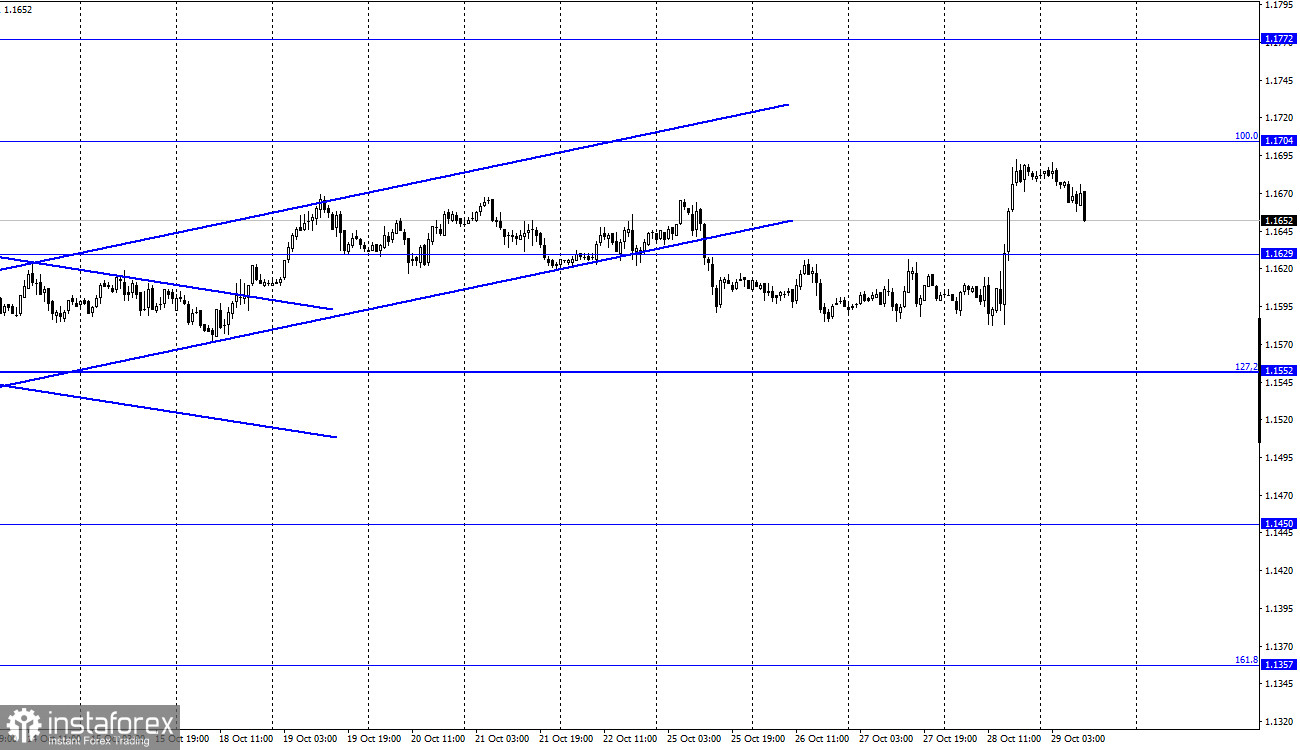

EUR/USD – 1H.

The EUR/USD pair performed a reversal in favor of the European currency on Thursday and began a strong growth, as a result of which it closed above the level of 1.1629. However, today, a reversal was made in favor of the US currency and the quotes began to fall in the direction of the same level of 1.1629. The rebound of quotes from it will work in favor of resuming growth in the direction of the corrective level of 100.0% (1.1704). Closing will increase the probability of a further fall in the direction of the next corrective level of 127.2% (1.1552). Yesterday, the information background for the pair was very strong. At about the same time, a report on GDP for the third quarter was released in America, and the results of the ECB meeting were summed up in the European Union. I believe that the first event was even more important than the second since the British pound also showed growth yesterday. Therefore, the reasons should be sought in America, not in Europe. However, at the same time, the pound rose weaker than the euro, so the ECB meeting also had an impact.

The report on the growth rate of the American economy turned out to be much worse than traders' expectations. Instead of 2.6% growth in the third quarter, the US economy showed only 2.0%. It was this report that could greatly disappoint bear traders who retreated from the market. At the same time, the ECB meeting could slightly affect the mood of bull traders. No important decisions were made at it, but Christine Lagarde said for the second time that the pace of buying bonds will decrease at the end of 2021. Thus, the ECB is already on the path of curtailing the stimulus program, unlike the Fed. Christine Lagarde also noted that high inflation may last much longer than the regulator had previously expected since supply problems and high growth rates of demand for goods ensure price growth. However, inflation is a problem now for many countries in the world. To repay it, a tightening of monetary policy is required. And the ECB and the Fed will start raising rates no earlier than next year. And before that happens, we need to completely abandon monetary stimulus.

EUR/USD – 4H.

On the 4-hour chart, the quotes closed above the corrective level of 100.0% (1.1606). Thus, the process of growth of euro currency quotes can be continued in the direction of the next Fibo level of 76.4% (1.1782). However, traders, with the exception of yesterday, are still not actively trading the pair. Thus, already today, it can make a return to the level of 100.0% (1.1606), near which it was during the week.

News calendar for the USA and the European Union:

EU - consumer price index (09:00 UTC).

EU - change in GDP (09:00 UTC).

US - main index of personal consumption expenditures (12:30 UTC).

US - change in the level of spending of the population (12:30 UTC).

On October 29, the European Union will release reports on GDP for the third quarter and inflation for October. This data can greatly affect the mood of traders. There will be less important statistics in America, so all the attention is on European data.

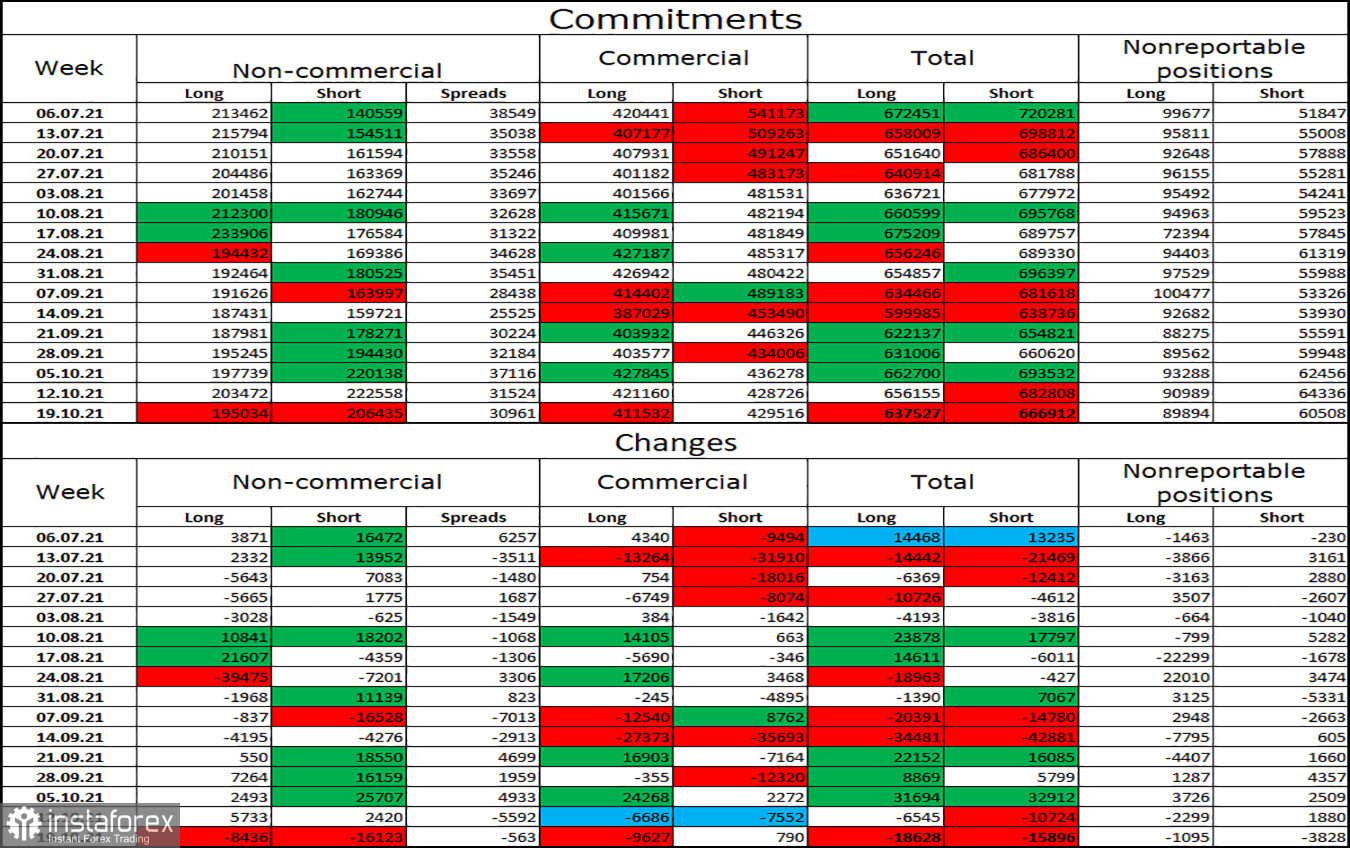

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders changed towards "bullish". Speculators closed 8,436 long contracts on the euro and 16,123 short contracts. Thus, the total number of long contracts in the hands of speculators decreased to 195 thousand, and the total number of short contracts to 206 thousand. Over the past few months, the "Non-commercial" category of traders has tended to get rid of long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. In general, this process continues now, but in the last two weeks, the European currency has shown weak growth.

EUR/USD forecast and recommendations to traders:

Traders are still not trading the pair too actively. I recommend buying a pair if there is a rebound from the level of 1.1629 on the hourly chart, with a target of 1.1704. I recommend selling the pair if a close is made under the level of 1.1629, with a target of 1.1587.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.