The US dollar strengthened after US government bond yields increased amid news that the Federal Reserve's preferred inflation indicator showed that prices continue to rise faster than the 2% target.

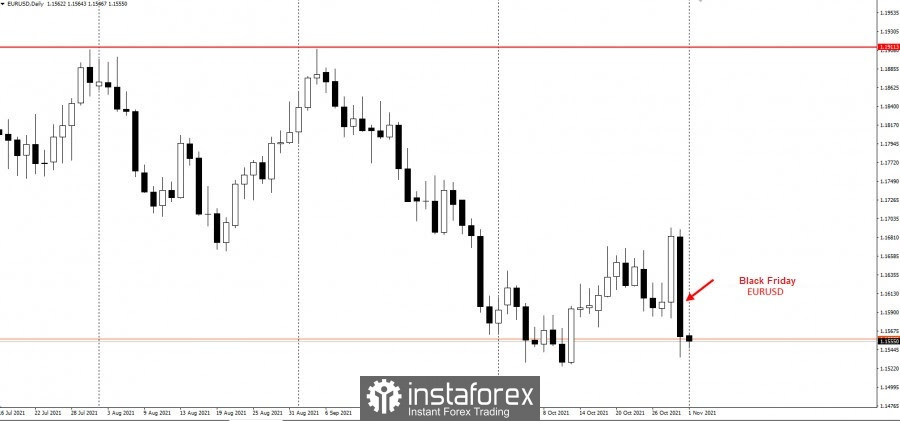

In turn, the euro, which is heavily pressured from the dollar index, declined by 1.05% against the US dollar.

Gold was losing 2700p at the moment:

Euro's decline contributed to the growth of the dollar index by 0.8%, reporting to 94,102 on Friday.

The volatility in the currency markets increased during the week due to the actions of the central bank and economic data. This week, the same thing may happen at policy meetings of the US Federal Reserve, the Bank of England, and the Reserve Bank of Australia.

According to Chief Market Strategist Marc Chandler, the source of instability is likely to be a discrepancy between what the market shows and what central banks declare. He also said that another reason for instability was the change in the position of the portfolio at the end of the month on that day of the week – Friday, that is, when markets are usually the least liquid.

U.S. Treasury yields rose after the government's index of core personal consumption expenditures – the Fed's preferred measure of inflation increased to 4.4% in September for the year. Inflation continues to rise, reaching a level not seen in the last 30 years.

Last Friday, European data showed that inflation in the 19 countries sharing the euro surged to 4.1% in October from 3.4% a month earlier, exceeding the consensus forecast of 3.7% and posing a political dilemma for the European Central Bank.

Germany's 10-year bond yields rose 8 basis points at the end of the previous week, which is the highest level since May 2019. The Southern European government bond yields also rose.

The lack of market opposition by ECB President Christine Lagarde during a press conference on Thursday regarding the increase in interest rates caused a negative reaction. Danske Bank's strategists predict that the euro will fall to $ 1.10 over the next 12 months.