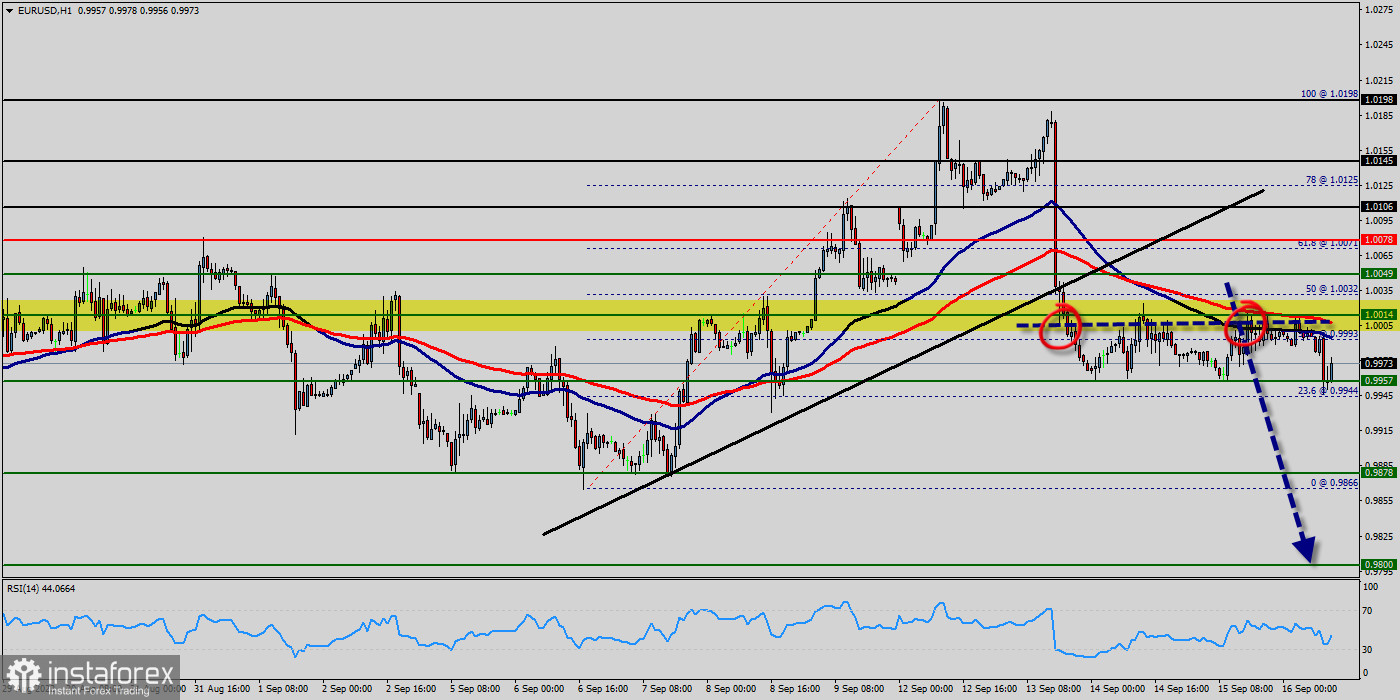

EUR/USD : The bias remains bearish in the nearest term testing 0.9957 or lower. Immediate support is seen around 0.9944. A clear break below that area could lead price to the neutral zone in the nearest term.

Price will test 0.9944, because in general, we remain bearish on Sept. 16th, 2022. The EUR/USD pair continues moving downwards from the level of 1.0014 this morning.

The EUR/USD pair was trading lower and closed the day in the yellow zone near the price of 1.0014. Today it was trading in a narrow range of 1 USD, staying close to European's closing price.

On the hourly chart, the GBP/USD pair is again trading below the MA (100) H1 moving average line (1.2074). The situation is similar on the one-hour chart.

Today, the first resistance level is currently seen at 1.0014, the price is moving in a bearish channel now. The market moved from its top at 1.0014 and continued to drop towards the bottom of 0.9957.

Today, on the one-hour chart, the current fall will remain within a framework of correction. If the trend breaks the double bottom level of 0.9944, the pair is likely to move downwards continuing the development of a bearish trend to the level of 0.9878 in order to test the weekly support 1.

So, the support stands at the level of 0.9878, while daily resistance is found at 1.0014. Therefore, the market is likely to show signs of a bearish trend around the spot of 1.0014.

Based on the foregoing, it is probably worth sticking to the south direction in trading, and while the EUR/USD pair remains below MA 100 H1, it may be necessary to look for entry points to sell for the formation of a correction.

However, if the pair fails to pass through the level of 1.0014 (first resistance), the market will indicate a bearish opportunity below the strong resistance level of 1.0014 (the level of 1.0032 coincides with tha ratio of 50% Fibonacci retracement, bottom price, last bullish wave).

Since there is nothing new in this market, it is not bullish yet. Sell deals are recommended below the level of 1.0014 with the first target at 0.9944 and continue towards 0.9878 so as to test the second support at the same time frame.

According to the previous events the price is expected to remain between 1.0014 and 0.9878 levels. Sell-deals are recommended below the price of 1.0014 with the first target seen at 0.9944. The movement is likely to resume to the point 0.9878.

The descending movement is likely to begin from the level 0.9878 with 0.9835 and 0.9800 seen as new targets in coing hours. This would suggest a bearish market because the RSI indicator is still in a negative area and does not show any trend-reversal signs.

The pair is expected to drop lower towards at least 0.9800 in order to test the second support (0.9800).

On the other hand, if the EUR/USD pair fails to break through the weekly pivot point level of 1.0032 today, the market will move upwards continuing the development of the bullish trend to the level 1.0198 (double top) for next week. For now, outlook will stay bearish as long as 1.0032 support turned resistance holds, even in case of another rise.