Bitcoin begins another trading week, stabilizing in a narrow range of $60,500-$63,500. At the same time, onchain activity and market activity continue to remain at record high levels. The cryptocurrency's hash rate also continues to recover and has returned to values prior to the "great migration" from China. However, the main reason for bitcoin's continued bullish rally is the worsening crisis of the fiat markets and the weakness of gold being a safe haven asset.

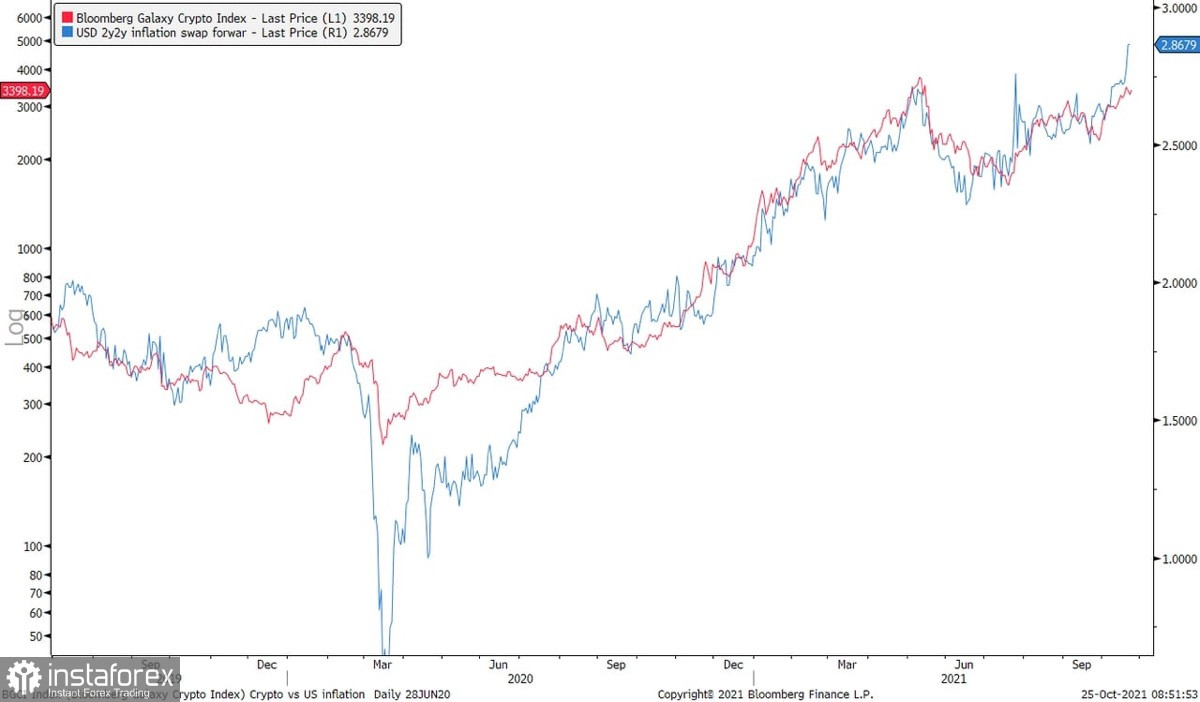

This simple conclusion was made by Goldman Sachs experts, conducting a study, according to which the growth of BTC price is directly related to the rate of inflation growth. This suggests that investors use bitcoin to protect their funds from the inflationary crisis triggered by supply disruptions due to coronavirus. A similar opinion was expressed by analysts at JPMorgan, examining the main factors for bitcoin reaching a new all-time record. According to experts, it was fear of inflation, but not the launch of the bitcoin ETF, which caused a bullish rally. Peter Peel, head of PayPal, is confident that the current price of the asset is a direct consequence of worsening inflationary processes around the world.

If we put aside the inflation problem for a while, we can note an important event for the leading digital asset. The growing correlation between BTC and the fiat currencies' depreciation suggests that bitcoin has become a major risk hedge instead of gold. The current rally in crypto is direct evidence of this, and the growing demand for bitcoin among customers of major US banks indicates the desire of investors to have more opportunities to operate with the asset. As the crisis worsens due to another wave of pandemics and the gradual acceptance of BTC as a traditional asset, the minimum growth expectation for bitcoin this year is $100,000. With the continued downward trend in financial market indices, as well as a consistently high flow of investment from all categories of investors, there is no doubt that the asset may reach $100,000 as early as November.

Meanwhile, bitcoin continues to hover within the narrow stabilization range after rebounding from the $57,000-$60,500 area. Over the past 24 hours, bitcoin gained by 2.5% and showed daily trading volumes of $36.3 billion, which is a good indicator for the current stage of the market. Despite all the fundamental positive factors, it is not yet supported by technical charts, on which the asset only enters the phase of consolidation and further accumulation. The main indicators of the cryptocurrency are moving sideways with no hints of an upward breakout. The MACD indicator maintains the current momentum and stays above zero. The RSI is moving along 60, indicating bullish market sentiment. The stochastic oscillator has formed several bullish crossovers in a short period of time, but all of them were formed by weak buyers, so it is impossible to develop a full medium-term upward movement. It is likely that it is in the waiting phase and accumulates volumes before the upcoming Taproot update. The first attempts to start a full-fledged movement to new highs may appear soon, but as of November 1, the market is not ready to support such bullish momentum due to the lack of proper support on the onchain metrics.